Columns

- Triumph for President, but bumpy road ahead in programmes to be implemented, mainly battle against corruption

- Will Ranil be candidate for presidential poll next year, as SLPP split over Namal’s candidature?

- Local council elections not likely to be held this year; but campaign continues at village level

By Our Political Editor

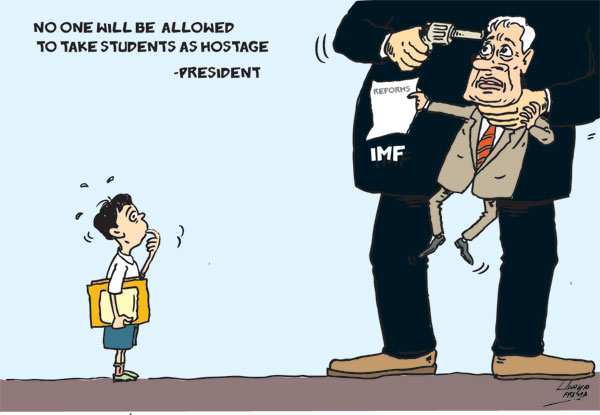

There were both domestic and external challenges he had to face until the IMF’s Executive Board approval last Monday. Bilateral creditors had to be managed. Domestically a string of strikes and protests threatened political stability. The Janatha Vimukthi Peramuna (JVP)-led National People’s Power (NPP), touted as a potential winner if the local council elections were held, in an early campaign targeted Wickremesinghe.

The party not only cast doubts on the likelihood of the IMF approving the bailout package but also said this was an occasion to prove that President Wickremesinghe had little support of the international community. In both instances, the NPP was proved wrong. But the non-conduct of the local council elections saved the NPP’s credibility somewhat. Sections of the people did not believe the front was serious. They believed that like in the days of yahapalanaya (the good governance government days), there was still some nexus.

Most glaring was the main opposition in the country, the Samagi Jana Balavegaya (SJB). Dr Harsha de Silva, who styles himself as the economic wizard among them, congratulated President Wickremesinghe for his feat. Only the days before, he was at the Sinhalese Sports Club where the 144th Royal College–S. Thomas’ cricket big match was underway. He used the charm offensive. When Namal Rajapaksa MP walked in, he hugged and kissed him. “Politics apart,” he exhorted, “this is a big match, and we are all there for it.” He had his photographs in both print and television outlets with his zealous public relations drive. The other SJBer who also vies for the top economist slot, Eran Wickremeratne, however, held a different view. He told a news conference last Tuesday, “Some are of the opinion that all problems we have will vanish into thin air just because we have been okayed for the IMF loan. That is a fallacy. The IMF loan is akin to asking us to get our necks into the noose first so that they would feed us thereafter.”

Like on all major issues, the fact that the SJB had a cocktail of views is one thing. However, what makes the issue worse is the studied silence of its leader. He was otherwise preoccupied. At a public rally in Kolonnawa, Sajith Premadasa was waxing eloquent about missing out on the vocation that he loved most, becoming an airline pilot. One need hardly say that other than politics, piloting an aircraft is a much more specialized task where the lives of passengers lie in skilled hands. The question that begs answer is why Premadasa did not think it fit to address a news conference and explain the SJB’s position. Nor did the SJB think it suitable to issue a statement.

That brings us to the ruling Sri Lanka Podujana Peramuna (SLPP) where President Wickremesinghe has won quite a few hearts and minds as their leader. For most parliamentarians there, the biggest asset since Wickremesinghe assumed Presidency on July 20, last year, was the bolstering of their personal security. They were able to move around freely. Only days earlier the homes of some 70 parliamentarians had been badly damaged and fear of further attacks by protestors confined them to hideouts. The economic environment was then gloomy and uncertain. Former President Gotabaya Rajapaksa fled the country in fear and later resigned amidst accusations of gross mishandling of the economy. Fuel was in acute short supply leading to queues that were several kilometres long. Cooking gas was not available forcing consumers to queue outside outlets with empty cylinders. Electricity cuts were the order of the day. Under President Wickremesinghe’s leadership they became things of the past.

The IMF bailout has further bolstered the government parliamentarians. It raised hopes of successful electoral prospects. However, it must be borne in mind that that many more challenges are ahead for President Wickremesinghe, and he cannot walk back from them. He is determined to forge ahead. He told Parliament on Tuesday that he had previously requested the support of the opposition in rebuilding the economy but did not receive it. He had made similar requests during the opening of Parliament and Budget debates, but to no avail. Despite his efforts, opposition parties refused to extend their support citing various reasons. The President acknowledged that the current situation was difficult but assured that the sacrifices made now would lead to benefits soon. He later told a news conference on Thursday that he would wish to have parliamentary approval for the measures he would adopt though such a step is not required — a hint that more tough measures are to come.

An interesting point on the IMF decision was revealed by Palki Sharma of India’s WION television. She said in a Twitter message: $15.6 billion IMF loan for Ukraine. The IMF has never loaned money to a country at war. Until last week, Ukraine was not eligible. Then a rule was tweaked. Took one year to clear $ 3 billion for Sri Lanka but Ukraine has Western allies and white citizens & the US can clearly override all rule books.

Like in every coalition, there have been factions or sharper differences in the SLPP government led by President Wickremesinghe. The first ripples began to appear from the 75th Independence Day ceremonies. The SLPP top leaders including former President Mahinda Rajapaksa, son MP Namal Rajapaksa, brother Chamal Rajapaksa and other prominent members kept away. In Parliament,

MPs from other political parties that backed the government splintered. Through all this, the President was resilient and did not react. Then came SLPP founder Basil Rajapaksa’s appeal to him to include a set of his party’s nominees, said to be around five, to the Cabinet of Ministers. It was known that some of them were tainted with corruption. He did not yield. Just days earlier, Anuradhapura District SLPP parliamentarian S.M. Chandrasena declared that a reshuffle would be underway soon. The reason – funny enough he (Chandrasena) had reportedly been overlooked. So it was being done to accommodate him. The remarks turned out to be nothing less than a joke. A highly placed source said there would be no such reshuffle.

The SLPP is once again flexing its muscles. The party wants to conduct a May Day rally with the largest turnout this year. This was discussed at an SLPP parliamentary group meeting held at the Wijerama Road residence of their leader, Mahinda Rajapaksa. Now, detailed preparations are underway. As reported earlier, the only non-parliamentarian to take part in that event was Basil Rajapaksa. He is spearheading the move.

A long-term focus of such a well-attended rally is to prepare the SLPP for the next presidential and parliamentary elections. As reported earlier, President Wickremesinghe has indicated that he proposed to hold the presidential election next year followed by the parliamentary polls. Though it is speculation, such a prospect raises the question of who the SLPP presidential candidate would be. Existing laws prevent SLPP leader Mahinda Rajapaksa from contesting. Those closely associated with the family are pushing for the candidature of Namal Rajapaksa but others in the party say he is still not ready and inexperienced. They believe that he will not have the countrywide backing and will require more experience. Would that pave the way for Wickremesinghe to take on formidable opposition candidates like Sajith Premadasa (SJB) and Anura Kumara Dissanayake (NPP)? Thus, clinching the IMF deal has thrust the UNP leader on a higher pedestal though his own party is in shambles in most parts of the country.

Other than the political ramifications, there is also another very significant aspect to the IMF endorsement of part of the Extended Fund Facility (EFF). The IMF in its statement released on Monday, March 20, acknowledging its Executive Board approval, amongst various other important points, highlighted as part of what is expected from Sri Lanka “the ongoing efforts to tackle corruption should continue, including revamping anti-corruption legislation. A more comprehensive anti-corruption reform agenda should be guided by the ongoing IMF governance diagnostic mission that assesses Sri Lanka’s anti-corruption and governance framework. The authorities should step up growth-enhancing structural reforms with technical assistance support from development partners.”

In September 2022, in her comprehensive report to the United Nations Human Rights Council the then High Commissioner wrote that she encouraged the international community to support Sri Lanka in its recovery, but also in addressing the underlying causes of the crisis, including impunity for human rights violations and economic crimes.

The two statements by two international institutions with different remits and dynamics, yet making similar points that one of the main causes of the current economic situation of Sri Lanka is rampant corruption and the almost impossibility to recover from this unless Sri Lanka addresses this root cause.

Last year, protestors came to the streets and one of their main demands was to investigate and charge the politicians who stole state money that brought Sri Lanka to its knees. However, to date, nothing tangible has been done to even begin to investigate these claims of the past and some present leaders having stolen billions of dollars from the State.

Against this backdrop, in the Executive Summary of a report dated March 6, 2023 jointly approved by Anne-Marie Gulde – Deputy Director, Asia and Pacific Department and Bikas Joshi – Division Chief, Lending Policy Division, Strategy Policy and Review Department of the IMF, they highlighted the following as IMF Program Risks; Risks to programme implementation are exceptionally high, given the complex debt restructuring process, unfavourable external environment, elevated risks of persistently high inflation, and challenging political and social situation. Given Sri Lanka’s weak track record of reform implementation, the program runs significant risks of slippages regarding fiscal consolidation, revenue mobilization, and reserves build up. A deeper crisis induced by a further economic fallout, the weakened banking sector, exchange rate pressure, and loss of market confidence could also complicate program implementation. In this regard, contingency plans are crucial and policies should remain agile to adjust to the evolving circumstances.

Independently, “there’s potential for disruptions after the initial board approval as authorities may find it challenging to stay on track with the IMF program amid a weakening economy” said, Seah Wang Ting, country risk analyst at Fitch Solutions, according to Bloomberg. These comments and observations indicate that Sri Lanka is still expected to be on a bumpy road ahead at least for the foreseeable future.

President Wickremesinghe has declared that new anti-corruption laws approved by the Cabinet of Ministers would be the toughest in South Asia. He has said they would be introduced in Parliament soon. A government source said that the new laws together with a new counter-terrorism bill would come before Parliament later next month. Introduction of new laws is one thing. However, if the existing institutional machinery remains, no purpose will be served. This is particularly with the existing Criminal Investigation Department (CID) and the Commission to Probe Bribery or Corruption – both of which have been ineffective.

Local council polls

unlikely this year

It is becoming increasingly clear that the local council elections will not take place this year. Procedurally, the Election Commission will convene next week to decide on the new dates for the postal voting and the date for the conduct of the local council elections, a senior official of the Election Secretariat said. He said at Thursday’s meeting with the political party secretaries and representatives, they were informed that since the funds were not received for the conduct of the elections and therefore, they had been forced to look for new dates.

“The next option left to us would be to go back to courts and inform it about the failure of the Treasury to release the required funds for the elections,” he said.

He pointed out that during the meeting with Party Secretaries or other representatives, several proposals came up. “Among them were that a new date should be announced only after all arrangements to conduct the poll are ready, that the elections should not be postponed and that the future date should be decided following consultations with the President, Parliament and other stakeholders”.

SLPP General Secretary Sagara Kariyawasam said that at present the party did not have plans to conduct public meetings and would await a fresh announcement about the new dates. SJB General Secretary, Ranjith Madduma Bandara, however, said the party would carry out its campaigns at the village level in limited ways and go on to build party activities. The JVP backed-NPP’s Executive committee member Wasantha Samarasinghe, said they would concentrate on village-level meetings for the next few days until a date was announced.

The decision of the IMF board to grant part of the EFF to Sri Lanka will not only have its impact economically but also substantially in the country’s political spectrum.

| Is the IUSF claim true or false? Wasantha Mudalige, Convenor of the Inter University Students Federation (IUSF) has written to the Sunday Times about what he calls “false reportage” in the political commentary in last week’s issue. The IUSF, he says, conducted “a few discussions with the Jaffna University Students Union as well as University lecturers and civil society activists in Jaffna regarding the PTA (Prevention of Terrorism Act) and other socio-political grievances faced by the people of the North and the East…..As per your report, there were “no conditions” handed over to the IUSF by any participant at the meeting…. We are deeply disturbed that a responsible media institution such as the Sunday Times, is involved in deliberate dissemination of false information to the general public…..” Is the IUSF claim true or false? The answer lies in a letter to the Sunday Times on the same subject from another player Kumanan Kanapathipillai, who is a translator. Here are highlights of his letter: “…….Under the sub-heading ‘A nexus between student bodies in Colombo and Jaffna’ the column lists the set of demands handed over by the Jaffna University Students Union (JUSU) to visiting Inter-University Students Federation (IUSF) leader Wasantha Mudalige in a discussion held at the Jaffna University premises on the 12th of March. It is commendable that the Sunday Times had published seven of the eleven demands with a few changes, whereas mainstream media houses in Colombo seem to have totally overlooked this significant development. However, it is regrettable that the list of demands had been incorrectly attributed to a tweet by “Jaffna University student leader Kannan”. I can assure you that the JUSU (Jaffna University Students Union) has no student leader named Kannan. The list of demands was tweeted by me at 10:30 AM on March 12, 2023 in a thread under the handle @kumanan93, which I have been using since November 2014. The full list of demands can be found in the link below. https://twitter.com/kumanan93/status/1634864499143622657 Wasantha Mudalige was given the list of demands by JUSU led by its President Alagarasa Vijayakumar in Tamil. The English translation published on twitter and the Sunday Times political column was done by me. You would appreciate that attributing it to a non-existent student leader ‘Kannan’ in a widely read outlet deprives me from being acknowledged as the journalist who first reported it in English. IUSF Convener Wasantha Mudalige and his colleagues visiting Jaffna from Sri Lanka’s south was translated from Tamil to English and tweeted by Journalist Kanapathipillai Kumanan. It would also be helpful for readers to put the record straight by clarifying the origins of these demands. The reference to Kannan as “student leader” – The error is regretted.

| ||

| Never waste a crisis: Govt. hopes to restore macroeconomic stability = Sri Lanka economy: Top experts’ report tabled in parliament; outlines the path ahead

rishnamoorthy Subramaniam is Executive Director for Sri Lanka and Chandranath Amerasekera, is the Alternative Executive Director for Their report on Sri Lanka’s economy is among the documents tabled in Parliament by President Ranil Wickremesinghe last Tuesday. They were part of the communications with the International Monetary Fund (IMF). Here are edited excerpts: Our authorities extend their sincere gratitude to all nations – particularly to India for leading the way – for providing the necessary financing assurances and required support, thereby enabling staff to submit Sri Lanka’s request for a 48-month Extended Arrangement under the Extended Fund Facility (EFF), with access to Fund resources of approximately US$ 3 billion (395 percent of quota), to the Executive Board for its consideration. The authorities express hope that the implementation of the economic program supported by the EFF will bring about much-needed stability to the Sri Lankan economy, paving the way for longer-term sustained and inclusive growth in Sri Lanka. In 2022, Sri Lanka experienced the worst socio-economic and political crisis in its post-independent history. Although fiscal and monetary policy stimuli helped a rebound of the economy from time to time over the past few years, events that unfolded since 2018, including the constitutional crisis in 2018, the Easter Sunday terrorist attacks in 2019, and the COVID-19 pandemic thereafter, considerably weakened the Sri Lankan economy. The situation was exacerbated by grave policy missteps that included unsustainable direct and indirect tax cuts, continued monetary financing of fiscal deficits at suppressed interest rates, a prolonged period of low-interest rates that caused excessive monetary expansion and balance of payments pressures, flawed pricing policies for petroleum products, electricity and other public utilities, an ill-timed ban on chemical fertilizer, and the defense of the exchange rate at the expense of the country’s foreign exchange reserves. Sri Lanka had lost access to the conventional international financial markets with the onset of the pandemic, and had exhausted all fiscal, monetary, external sector and financial sector buffers by early 2022. Rising inflation and shortages of essentials, including basic food items, pharmaceutical supplies, cooking gas and domestic petroleum products, together with long power cuts, resulted in a collapse of business confidence, severely affected the ongoing recovery in tourism, and most importantly, triggered widespread public protests of an unprecedented scale that resulted in a change of key positions of the government over the next few months. The government expressed its desire for close IMF engagement and made a request for a Fund-supported stabilization program. The government also announced a debt service standstill in April 2022, as almost all usable foreign exchange reserves of the country had been exhausted. The government commenced introducing necessary stabilization measures broadly in line with the recommendations of the 2021 Article IV consultations and introduced additional measures to address the shortages of essentials with the assistance of friendly nations. In this regard, the authorities extend their special thanks to India for stepping in during the country’s hour-of-need and providing emergency financing through multiple channels, at a time of extreme uncertainties surrounding the recovery of such financing – a rare act of kindness by any standard. The government also embarked on discussions with creditors to seek support for an IMF-backed program to regain debt sustainability and restore macroeconomic stability. Following intense negotiations, the authorities reached a Staff-Level Agreement (SLA) with the Fund on September 1, 2022, and while meeting the prerequisites needed for program approval. The delay in obtaining the approval for the EFF and the unpopular, yet essential, reform measures have caused some tensions in Sri Lanka in the past few weeks. However, our authorities, with a deep sense of conviction and ownership, reiterate their resolve to carry out the necessary reforms and take steps to institutionalize reforms in order to prevent any return to populist and unsustainable policies that would be detrimental to the country’s progress in the long run. The Sri Lankan economy contracted by an unprecedented 7.8 percent in 2022, reflecting the magnitude of the crisis it faced during the year. All three sectors of the economy, namely, Agriculture, Industry, and Services, were severely affected in 2022, and the impact of corrective policy measures is also having a dampening effect on economic activity in the near term. While the recovery in some agricultural subsectors, the rebound in tourism and the gradual return of business confidence are expected to aid economic recovery, the economy is projected to contract by around 3 percent in 2023. In 2025, the authorities plan to revamp the property tax system and introduce a wealth transfer tax. The above measures are expected to make Sri Lanka’s tax system more progressive, and gradually shift the focus of taxation from indirect to direct sources. The government has also embarked on revenue administration reforms to strengthen tax compliance, keeping in mind the relatively large size of the informal sector of the country. In order to enhance fiscal transparency, the government will document all tax expenditures provided under the Strategic Development Projects Act and the Board of Investment Act. Expenditure rationalization is not expected to compromise spending on health, education, and social protection. The crisis has increased the incidence of poverty and reversed the gains achieved in recent decades. The poorest of the poor are the most affected by the crisis, and there is evidence that many others are falling into poverty because of reduced real incomes and loss of livelihoods. The ongoing social safety net reforms are expected to improve coverage and targeting, thereby supporting the poor and the vulnerable, particularly during the ongoing adjustment phase. Measures are being introduced to mitigate fiscal risks arising from state-owned business enterprises (SOBEs) and to reform the SOBE sector. Fuel and electricity prices have been adjusted in line with international market prices, and regular formula-based price revision mechanisms have been introduced. Such measures are expected to depoliticize pricing of energy and other public utilities, while eliminating the spillover effects of mispricing on the fiscal and financial sectors. A comprehensive strategy to reform the key SOBEs is expected to be introduced by mid-2023. The government expects to strengthen the framework for SOBE borrowing by limiting such borrowing to commercially viable activities and preventing foreign currency borrowing by non-financial SOBEs without adequate sources of foreign currency revenue. The government will transparently remunerate any subsidies and quasi-fiscal activities of SOBEs through government transfers. A new Public Financial Management (PFM) law is expected to be in place from 2024, thereby introducing binding fiscal rules, including a legally binding government debt ceiling. The PFM law is also expected to establish the legal definitions for public debt and government deficit, clarify the budget formulation process, specify the responsibilities of the Ministry of Finance and spending units, establish information and accountability requirements, and introduce stricter guidelines on issuing treasury guarantees. Inflation, Monetary Developments and Monetary Policy Inflation (Colombo Consumer Price Index (CCPI) based, year-on-year) accelerated from 5.7 percent in September 2021 to 69.8 percent in September 2022, i.e., over a space of merely one year. Causes for this acceleration included the depreciation of the Sri Lanka rupee, disruptions to domestic food production, global fuel and food price shocks, price revisions of domestic fuel, electricity, and cooking gas supplies along with the associated increases in other prices, and unsustainable monetary financing of the fiscal deficits that de-anchored inflation expectations. Inflation has decelerated thereafter in response to policy tightening, measuring 50.6 percent in February 2023. A sharper deceleration is projected over the next few months. Monthly inflation has hovered within a range of – 0.7 percent and 0.5 percent over the past five months, indicating that high year-on-year inflation recorded at present is due to legacy effects than due to ongoing inflationary pressures. The policy interest rate corridor of the Central Bank of Sri Lanka (CBSL) was increased from 5.00-6.00 percent at end 2021 to 15.50-16.50 percent by March 2023, with a decisive seven percentage-point hike in April 2022. The latest monetary policy adjustment in March 2023 was carried out after much deliberation between the Fund staff and the CBSL. The CBSL remains committed to a data-driven monetary policymaking process and is confident of bringing down inflation to single digit levels by end 2023, and subsequently to the target range of 4-6 percent by 2024. The enactment of the new Central Bank bill will also assist in firmly anchoring inflation expectations by prohibiting monetary financing, introducing institutional reforms that would enhance the independence of the CBSL, institutionalizing the flexible inflation targeting monetary policy framework with exchange rate flexibility, and increasing accountability of the CBSL in relation to price stability. The sharp depreciation of the Sri Lanka Rupee in early 2022, the tight monetary policy stance, decline in real incomes and purchasing power, and tighter controls on imports resulted in a narrower trade deficit of US$ 5.2 billion in 2022. Worker remittances are on an upward trend while tourist arrivals have also begun to show signs of sustained recovery. The stability of the foreign exchange market also benefitted from the debt service standstill that is in place and the capital flow measures (CFM), as well as the quota system for fuel distribution. With positive sentiments in the domestic foreign exchange market rising, the CBSL eliminated the guidance given to the market on the exchange rate and allowed the exchange rate to be determined by market forces. Thus far in 2023, the CBSL has been able to purchase over US$ 950 million on a net basis towards building up reserves, while the Sri Lanka Rupee has appreciated by around 11 percent against the US$ during this period, reflecting improving market sentiments in anticipation of the Executive Board approval of the EFF. The CBSL remains committed to a flexible exchange rate policy that is consistent with the flexible inflation targeting framework, and to building up reserves through regular intervention in the domestic foreign exchange market as envisaged in the program. The authorities have also requested temporary approval of the remaining exchange restrictions and multiple currency practices until a sustainable outcome in the foreign exchange market is achieved. The government is appreciative of the specific and credible financing assurances from India, the Paris Club, Hungary, and China, as well as the consent of other official bilateral creditors to Fund financing to Sri Lanka notwithstanding the arrears. The authorities also appreciate the cooperation of external commercial creditors in this regard. The government reiterates its commitment to a debt resolution consistent with the IMF program parameters and stands ready to use additional safeguard mechanisms to ensure comparable treatment, as appropriate. In this regard, the authorities have issued a Presidential letter addressed to all bilateral official creditors a) assuring transparency on any debt treatment terms that are agreed with any creditor or group of creditors, before being formalized, b) committing not to resume debt service to any creditor unless that creditor agrees on a comprehensive debt treatment in line with IMF-supported program parameters and the comparability of treatment principle, and c) reiterating commitment to a comparable treatment of all external creditors, with a view to ensuring all-round equitable burden sharing for all restructured debts. An announcement on the coverage and parameters of debt operations is expected to be made before end-April 2023. Concluding remarks The Sri Lankan government recognizes that the approval of the EFF alone is insufficient to resolve the issues the country is currently facing. While the delay in seeking Fund assistance is regretted, due to various reasons, it has taken a period of 12 months, as well as extraordinary efforts from all stakeholders, to design an appropriate stabilization program, complete the prerequisites, coordinate with creditors, and secure the necessary financing assurances, before reaching the current stage of Executive Board approval. The government hopes that the next steps in finalizing debt treatment would be faster, as further delays could lengthen the Sri Lanka’s economic recovery process. The government has benefitted from the close engagement with the Fund during the past year, particularly through policy discussions and technical assistance in the areas of fiscal reforms, financial sector reforms, and institutional reforms through necessary legislative changes. The government also expects that the approval of the EFF will lead to notable catalytic effects to mobilize support from the World Bank, ADB and other bilateral and multilateral development partners, as well as to rebuild confidence in the economy as the reform program progresses. The government is aware of the serious downside risks that the economy is facing and is determined to decisively address these under the IMF-supported economic program. Recognizing the fact that a major reason for the country’s lack of continued progress is the deficiency in implementing the identified essential reforms, our authorities express their willingness to learn from countries that have faced similar crises and recovered through the timely implementation of successful reform programs. In essence, in the spirit of the motto “never waste a crisis,” our authorities are determined to use the current crisis and the IMF-supported reform program as an opportunity to durably address Sri Lanka’s institutional weaknesses and ensure macroeconomic stability and sustainability, going forward. Following the Executive Board approval, our authorities also propose to present the IMF-supported economic program to Parliament for discussion and to mobilize the necessary consensus for the successful implementation of the program. |

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

IMF bailout will shape not only economic but political affairs also

View(s):