Columns

Prospects of an improvement in external finances this year

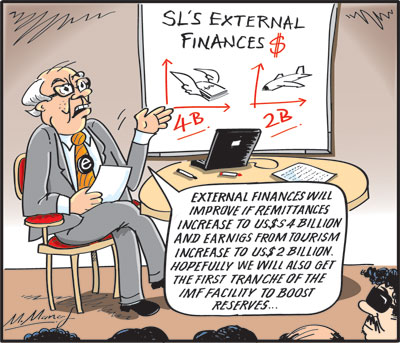

View(s):The Balance of Payments (BoP) is expected to improve this year owing to higher remittances and earn-ings from tourism.

Improvement

The BoP improved last year in spite of a trade deficit of US$ 5.18 billion due to increased remittances and earnings from tourism. A further improvement in the BoP is expected this year, despite a larger trade deficit, owing to higher remittances and earnings from tourism.

Balance of payments

The BoP that recorded a surplus of US$ 1.3 billion last year, is expected to increase to about US$ 2-2.5 billion this year. This is in spite of an expected increase in the trade deficit from US$ 5.2 billion in 2022 to about US$ 6.5 billion this year.

Trade deficit 2022

The trade deficit narrowed from US$ 8.1 billion in 2021 to US$ 5.2 billion in 2022: The lowest trade defi-cit since 2017. This was achieved by stringent import controls and increased exports of US$ 13 billion. Imports amounted to US$ 18 billion.

Import prices

The terms of trade deteriorated last year owing to higher prices for the country’s imports relative to export prices. The terms of trade are likely to deteriorate this year too owing to lower prices for our exports and higher import prices for our essential imports.

Improved BoP

An improvement in the BoP is expected this year too, despite a higher trade deficit, owing to higher remittances and earnings from tourism. However these increases are dependent on uncertain factors.

Tourism

Tourist arrivals are dependent on global developments and local conditions. There have been severe unforeseen setbacks to tourism in the recent past.

The latest expectations are that global recessionary conditions are likely to abate somewhat and that International travel would pick up. An improvement in the COVID-19 situation in China is likely to bene-fit the Island’s tourism significantly.

It is also imperative that conditions in the country do not deter tourists from coming. Even now there are travel advisories that are not favourable for tourism in the Island.

Earnings

Earnings of about US$ three billion from tourism would boost our external reserves. The Tourist Board expects a significant increase in tourist arrivals in the latter part of this year to exceed last year’s num-ber of tourists.

Remittances

In as far as remittances from abroad are concerned, the exchange rate matters. The inflow of remit-tances are much dependent on the margin between the official and unofficial exchange rates. If this differential is not much, remittances could reach US$ five billion, compared to last year’s US$ 2.7 bil-lion.

Recent months increased remittances of about US$ 400 million a month lends hope of achieving this target. The peak in remittances of US$ seven billion was IMF achieved a few years ago.

Remittances

The key factor in this optimistic scenario is the expectation of higher inflow in remittances this year. The expectation of the bankers is that remittances would reach US$ four billion this year. This is much below the peak remittances of US$ seven billion received in 2020, but much higher than last year’s US$ two billion.

Tourism

The other key expectation is from tourism. Earnings from tourism increased in the latter months of last year. Around 100 thousand tourists visited the country last year and earning from tourism are estimat-ed at US$ 1.5 billion. The expectation is that tourism would rake in about US$ three billion this year.

IMF expectations

Besides these expectations, there are indications that the country’s external reserves would be re-plenished by the first tranche of the International Monetary Fund’s (IMF) Extended Finance Facility (EFF) later this year.

The first tranche of the IMF’s EFF is expected to relieve the country’s severe shortage of foreign ex-change that has caused a dearth of essential imports of fuel, food, medicines and raw materials.

This has, on the one hand, caused severe hardships to people, and on the other hand, incapacitated the country’s agriculture, industries and services. This has also reduced the country’s foreign exports and increased unemployment and poverty.

Cautious optimism

Several of the factors that are expected to revive the economy have downside risks. The performance of the global economy would have an important bearing on the country’s exports. The earlier expecta-tion of a severe global recession has been modified with the Chinese economy growing at three per-cent last year. Western countries too are faring better with improvements in employment and in-comes. If recessionary conditions lessen the setback to our exports and tourism could be averted.

Summary and conclusion

The external finances are expected to improve this year owing to higher remittances from abroad and earnings from tourism. Consequently, a surplus in the balance of payments is likely, though the trade deficit would widen. The improvement in external finances is based on increased inward remittances and higher tourist earnings.

Remittances are expected to reach US$ four billion, while tourist earnings are expected to bring in about U$$ 2.5 billion. Consequently the higher trade deficit of about US$ five billion is expected to be wiped out to achieve a BoP surplus of about US$ two billion. In as far as the external finances of the country is concerned, there is some light at the end of the dark tunnel.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment