Columns

Hopes, economic expectations and fears in the New Year

View(s):With the dawn of a new year the hopes and expectations are that it will be one of economic recovery and growth. Many people are hoping and expecting these things as the country will be celebrating 75 years of Independence next month.

Economic prospects

Regrettably, the economic prospects for the New Year are bleak. This is especially due to the recessionary global economic conditions which will heavily impact the Sri Lankan economy. The New Year was expected to be a year when there would be an easing of the economic difficulties faced in the last few years.

However, the trend of negative economic growth, as in the last few years, will continue. Unemployment, poverty, hungry, malnutrition and starvation will increase. Only foreign assistance can alleviate poverty and hunger.

Silver linings

Hopefully a few silver linings will materialise in the economy. These are: Expectations of higher inward remittances, increased tourist earnings and increased food production. However, the initial expectations from tourism may not be realised owing to the global recessionary conditions that could affect tourist arrivals later this year.

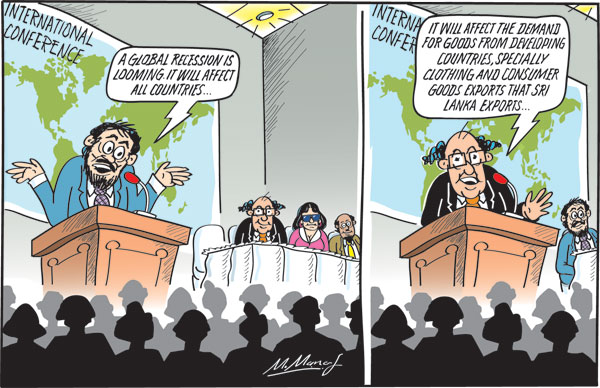

Global recession

The global recessionary conditions will severely impact the country’s manufactured exports, especially garments, the country’s main export.

The impact on garment exports is already clear. Apparel exports that increased in the first nine months of last year, have fallen since then due to the depressed demand in western countries.

In October and November exports of clothing fell. Export orders for our apparels are shrinking in our western markets. Already there has been a layoff of workers in garment factories, adding to the severity of increasing unemployment.

Other economies

In a world of global supply chains, most countries will be adversely affected. Our economic conditions could aggravate further by growing difficulties in regional economies as well. China, which assisted the country in several ways recently, may be constrained. Similarly, the Indian economy may have a setback that reduces its capacity to assist us. These factors would affect the expected tourism revival.

Foreign investment

The expectation of foreign investment of US$ 2 billion is most unlikely as the current foreign currency restrictions and investment climate is not conducive for investment. Only by the sale of assets to foreigners can foreign investment be expected.

Extended Finance Facility (EFF)

The Government was heavily depending on obtaining an EFF of US$ 2.9 billion over the next four years, for its economic recovery and reform programme. However, the inability to fulfil the condition of foreign debt sustainability has postponed the prospect of receiving it.

The prospect of reaching an agreement for debt sustainability with the Chinese is highly unlikely. Its uncertainty requires an alternate strategy to mitigate difficulties. Geopolitics may ultimately determine the resolution of this issue.

Hobson’s choice

In this rather bleak international environment, the only prospect is to reduce hardships by strengthening the domestic economy and finding ways and means of alleviating the peoples’ severe hardships.

Food crops

The revival of food crop production is a priority. Unfortunately, the Maha paddy crop to be harvested before the national New Year is expected to be 30 to 40 percent lower. It is vital to ensure that required inputs are available in time to ensure a maximum Yala harvest. The uncertain and vital factor is the rainfall in the coming months that is important for cultivation and the generation of hydroelectricity. If the threatened power cuts of ten to 12 hours occur, the plight of people will be compounded.

Markets

The recessionary conditions in our western markets are a serious threat to the economy this year. This adds a further reason for the development of agriculture that was discussed in the December 18th column.

Foreign assistance

Foreign assistance must be sought and efficiently distributed to tide over the impending crisis.

Essential imports

In spite of severe constraints on foreign currency for imports, the release of foreign currency for imports must be used to obtain imported raw materials for increased production. Foreign assistance must be channelled to obtain fertiliser and agrochemicals that are essential for increasing the production of food crops and tea. Timely availability of inputs for agriculture at affordable prices is vital to resurrect agriculture. Furthermore, the administrative capacity to distribute fertiliser country-wide has to be strengthened.

Unless we find the ways and means to overcome input constraints in our productive sectors, the much needed economic revival will be a mirage. Strengthening the fundamentals of the economy is vital to stabilise the economy, before a take-off to a higher trajectory of growth of seven to eight percent, can be expected.

Concluding reflection

At the dawn of the New Year, we must hope that the bleak prospects discussed will not materialise. The end of the war in Europe and the tapering down of global recessionary conditions could be vital for the country’s economic recovery.

Final word

Finally, let us hope the bleak economic picture portrayed here is proven wrong.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment