Columns

Objectives and expectations of the Budget for 2023

View(s):The contours of the 2023 Budget to be presented to Parliament tomorrow are well known. Few surprises are expected as the main tax measures have already been presented to Parliament.

Nevertheless, many low income earners hope there will be modifications in taxation to reduce the tax burdens they cope with.

There is a likelihood that President Wickremesinghe would announce some relief measures in re-sponse to the widespread criticism, in Parliament and outside, that the personal taxation proposals were too harsh on lower income earners whose real incomes have been severely eroded by high inflation.

There is a likelihood that President Wickremesinghe would announce some relief measures in re-sponse to the widespread criticism, in Parliament and outside, that the personal taxation proposals were too harsh on lower income earners whose real incomes have been severely eroded by high inflation.

Hopefully, some of the tax measures that fall on lower income employees will be reduced and effective and enforceable progressive taxes will be proposed.

Main objective

The main objective of the Budget is to reduce the fiscal deficit from the current high level of 13 percent or more of GDP to around eight percent next year. This is expected to be achieved by a significant increase in revenue collection rather than the curtailment of Government expenditure.

Fiscal consolidation

This year’s reduction in the fiscal deficit is the beginning of a process of fiscal consolidation that is expected to progressively reduce the fiscal deficit to five percent of GDP in 2025.

Expenditure

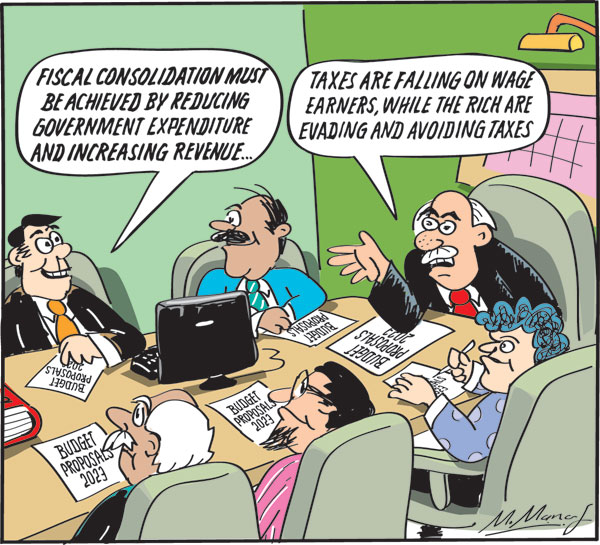

Fiscal consolidation has to be achieved by a three-pronged strategy of increasing revenue, reducing unproductive expenditure and austerity measures. Admittedly, curtailing Government expenditure is difficult owing to the high proportion of committed expenditure on salaries, wages, debt servicing and defence. However, fiscal consolidation cannot be achieved without the pruning of Government expenditure through public sector reforms.

Unlikely

A substantial decrease in Government expenditure that is vital to reduce the Budget deficit is most unlikely. In fact, the expenditure estimates indicate an increase in expenditure in 2023, over that of 2022.

Expenditure reductions can only be expected with reforms of loss-making state owned enterprises and the reduction of extensive prerequisites or perks of ministers, Parliamentarians and state sector officials. This is doubtful owing to vested political interests.

Taxation

The means by which Government revenue is increased must be equitable, effective and enforceable. The taxation measures would also be more acceptable, if measures are adopted to prune down non-essential, unproductive and wasteful public expenditure. As yet, there are no signs of such austerity measures. In fact, there has been some wasteful expenditure recently.

Equity

One of the most contentious issues with the new tax proposals is the reduction in the threshold for personal taxation to Rs. 1.2 million a year. An income of Rs. 100,000 per month is barely adequate for living with prices soaring. It would have been more equitable had the threshold been increased to Rs. 2.4 million a year and the rate of ten percent applied to the first slab. Corporate taxes must be such that they are not disincentives to production, especially export industries and export services.

Compliance

Another pertinent issue is that many income earners eligible for taxation, especially some higher income earners, do not pay taxes on a high proportion of their income or avoid paying taxes altogether. It is well known that some of the highest income earners do not declare their actual incomes. They declare a fraction of their earnings or none at all. Professionals such as lawyers, doctors and tuition masters are among them. This is clear from the fact that the number of tax files in the Inland Revenue Department is only around 300,000. Past efforts to bring in tax evaders have not been met with much success.

Tax avoidance

An equitable and effective tax system must recognise that tax avoidance and tax evasion are wide-spread and coaxing tax evaders and tax avoiders to declare their actual incomes is not feasible in the short run. There is a proposal to increase tax compliance but this will take time to implement and its efficacy is uncertain. This is why we have argued in previous columns for an expenditure based taxa-tion system.

Expenditure taxes

An expenditure-based tax system would place high taxes on items of conspicuous spending, such as motor cars and large vehicles, stamp duties on property registration, high property taxes and high cost items or luxury items. Such taxes are difficult to avoid, easy to collect and equitable as they fall on the rich and the super-rich. Why have successive governments not resorted to such taxation?

In conclusion

Increased taxation is vitally important to raise Government revenue that is one of the lowest in the world at about eight percent of GDP. The goal of increasing it to 14.5 percent by 2025 must be achieved through higher taxes that fall on the affluent, the rich and the super-rich that evade and avoid taxes. This can be achieved only by a system of expenditure taxes.

The Government must also reduce its expenditure to bring the fiscal deficit down. However, this is impractical owing to a high proportion of committed Government expenditure on salaries, pensions and interest payments and vested political interests.

Final questions

Will tomorrow’s Budget be equitable, enforceable and effective in its objective of fiscal consolidation? Will it achieve its main objective of reducing the fiscal deficit by more equitable taxation? Will there be a reduction in wasteful and unproductive Government expenditure?

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment