Columns

Are there prospects of an improvement in the deepening crisis in external finances?

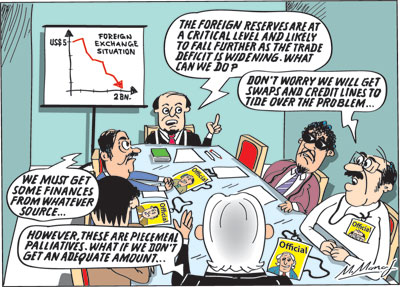

View(s): Foreign currency reserves have fallen to a dangerously low level of only US$ two billion at the end of September. Is there a prospect of an improvement in the external finances of the country in the coming months?

Foreign currency reserves have fallen to a dangerously low level of only US$ two billion at the end of September. Is there a prospect of an improvement in the external finances of the country in the coming months?

Deepening crisis

External currency reserves that were US$ 5.2 billion at the beginning of the year has been declining to only US$ 3.6 billion at the end of June, US$ 2.5 billion at the end August and dip to a perilously low US$ two billion at the end of September.

The depletion of the foreign reserves from US$ 3.5 billion at the end of June to US$ two billion in September was in spite of an infusion of US$ 870 million from the International Monetary Fund’s (IMF) SDR allocation and a currency swap of US$ 250 million from Bangladesh in August.

The external reserves of only US$ two billion are a net negative position as the forthcoming debt repayments are higher. Only foreign financial assistance can retrieve the country’s precarious external financial predicament.

Foreign assistance

An improvement in the reserves could be expected only by foreign assistance in the form of currency swaps, credit lines, aid inflows or other forms of foreign assistance. The Central Bank is optimistic in expecting such assistance, especially a line of credit from Oman to purchase petrol and currency swaps. On the other hand, the Central Bank of Sri Lanka and the Government has ruled out seeking IMF assistance.

Trade performance

This declining trend in the external reserves was mainly due to the repayment of debt and the widening trade deficit. The trade deficit has expanded despite import and foreign exchange restrictions and a good export performance. Import expenditure has been increasing owing to the escalating international oil prices to over US$ 80 per barrel and higher expenditure on essential food imports whose prices have also been increasing.

In contrast, exports have been faring well. Export earnings reached US$ 7.9 billion by end August: An increase of 22.6 per cent compared to the same period in 2021. In the four months since June, export earnings have been about US$ one billion a month. While export earnings in the first eight months have exceeded last year’s earnings in the same period by 23 per cent, import expenditure has increased by nearly 31 per cent.

Widening trade deficit

The implication of this pattern in trade is that the trade deficit will continue to increase as imports of fuel, food and other essentials would increase in the coming months. The widening trade deficit is likely to continue and even expand further. The reserves could be replenished only by the infusion of foreign funds in one form or another.

Expanding trade deficit

Despite stringent import controls, the trade deficit has expanded in the first ten months of this year. In the first eight months the trade deficit had reached US$ 5.5 billion. Based on this trend, the projected trade deficit is about US$ eight to nine billion for 2021.

Balance of payments

Balance of payments

With remittances showing a decline in recent months, tourist earnings small and net capital outflows, the balance of payments is likely to have a deficit of US$ three to four billion. In the first eight months of this year, the BOP deficit was US$ 2.4 billion. Only foreign assistance could relieve the situation.

Imports and exports

The trade performance this year is significant because the widening trade deficit was brought about by imports increasing despite increasing import controls. This clearly demonstrates that the country’s trade imbalance cannot be resolved by import controls. The country’s future lies in a liberalised trade regime that expands the country’s exports.

Growth in exports

Despite constraints posed by COVID and import restrictions that disrupted raw material availability, exports increased by 23 per cent to US$ 7.9 billion in the first eight months of the year. Both agricultural and manufactured exports increased. Moreover, exports exceeded US$ one billion in June, July and August, leading to expectations of achieving and even exceeding the export target of US$ 12 billion for 2021. Exports may reach US$ 13 billion.

Prospects

Nevertheless, the external financial crisis may worsen as the trade balance is widening and the prospect of non-debt inflows of capital, such as tourist earnings, foreign direct investment and aid are small. Remittances too have been slowing down owing to the wide divergence in the official exchange rate and the informal market rate. Therefore foreign assistance is imperative.

Foreign assistance

From whom will such assistance come? Foreign assistance from whatever source in whatever form is of immediate importance to tide over this crisis. The Central Bank of Sri Lanka is confident of overcoming the crisis with several forms of foreign assistance it expects soon. These would in currency swaps and trade credit.

Summing up

In spite of stringent import restrictions, the trade deficit has widened and the balance of payments deficit has increased. The rupee has depreciated and reserves depleted to a dangerously low level. Foreign financial assistance is crucial to overcome the crisis.

Best solution

Most economists and financial analysts have pointed out that the wisest and least cost solution to the country’s external financial crisis is to seek the assistance of the International Monetary Fund (IMF). Its advantages are the long term repayment of the loan; low interest rate and the confidence boost the country would get in the international financial market.

Conditions

The likely conditions that the IMF would lay down would be a market determined exchange rate, the liberalisation of imports and a consistent interest rate policy. It would require the reduction of the fiscal deficit over a period of time by pruning certain expenditure and by enhancing revenue. The pruning of expenditure would require the reform of loss making state enterprises and curtailment of some state expenditure. These may be politically unpopular policies but economically sound and needed policies for economic recovery.

In conclusion

Although the Government and the Central Bank have consistently said they would not go for IMF assistance, they may now realise that there is no better alternative.

Final word

The Central Bank is surely as capable of justifying such a U-turn in policy as it has defended its opposite position with eloquent rhetoric.

Leave a Reply

Post Comment