News

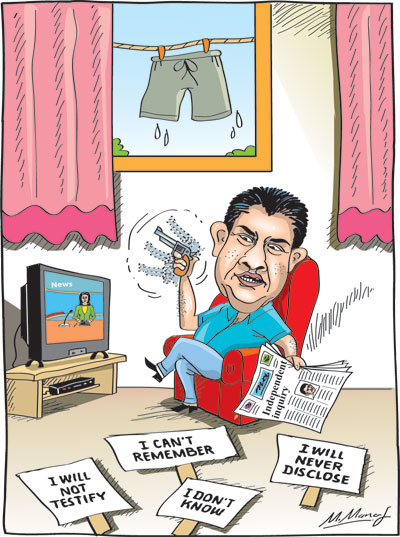

Case of conflict of interest: The Governor’s connection

View(s):- Independent forensic audit report tabled in Parliament now with the Attorney General

- Another independent audit report exposes EPF’s questionable trading activities on the Colombo Stock Exchange, leading to hefty losses

Ajith Nivard Cabraal, 67-year-old accountant and politician, has taken over Central Bank of Sri Lanka (CBSL) as Governor for a second time. Among his first administrative actions was to replace the CBSL employees in his office with personal staff. He also told employees that he held his position this time with added powers–those of a Cabinet minister.

Mr Cabraal’s appointment is concerning, not least in view of information revealed in several forensic audits commissioned by the CBSL. Among them is the report into the issuance of Treasury Bonds from January 2002-February 2015 by the Public Debt Department (PDD), which the Sunday Times revisited this week. It gives insight into, not only into how former Governor Arjuna Mahendran’s conduct was tainted by conflict of interest, but how Mr Cabraal had close family members in institutions that did repeatedly profited from dealings under CBSL purview while he was heading it.

These relationships spread like tentacles, forcing the auditors to draw a family tree to untangle them. Below are relevant excerpts from the report, published in the public interest in view of the President’s latest appointment to the position of Governor CBSL. The audit was carried out by BDO India, part of an international network of public accounting, tax, consulting and business advisory firms.

Family ties and blatant conflicts of interest

Mr Cabraal was CBSL Governor and Chairman of the Monetary Board (MB) from July 2006 till January 2015. He also functioned as an Alternate Governor of the International Monetary Fund (IMF). According to information in the Presidential Commission of Inquiry on the issuance of Treasury Bonds and from public domain searches, it was noted that relatives of Mr Cabraal held influential positions in primary dealers and/or related companies of primary dealers during his tenure as Governor.

“As per the Presidential Commission of Inquiry (PCOI) report, electronic media and annual reports of various primary dealers and banks supervised by the CBSL, former Governor Mr. Ajith Nivard Cabraal, while holding office from July 2006 to February 2015, had several of his close relatives appointed to the chief positions in banks under the purview of CBSL,” the forensic audit states.

This is a red flag, it points out. Such relationships could lead to debate regardless of financial interest. Further, Sri Lanka’s Establishments Code states: “An officer shall not do anything which will bring his private interest into conflict with the public duty or which compromises his office. He should always so conduct himself as to avoid giving rise to any appearance of such conflict or of being so compromised.”

Mr Cabraal took over as CBSL Governor in July 2006. Until November 2005, he headed a management consulting company called Cabraal Consulting Group, specializing in corporate governance, strategic planning and turnarounds. He resigned from all his private positions to work full-time for CBSL.

A sister, was a Director of the holding company of PTL, Perpetual Capital Holdings (Pvt) Ltd, from December 2013-March 2015. She was a Director of HNB Assurance (fully owned subsidiary of HNB) from 2013-2017 and a Director of Commercial Bank from February 2009-May 2010. She was a Director of Ceylon Asset Management Company from 2000-20018. She was Chairperson of Housing Development Finance Corporation Bank of Sri Lanka (HDFC) from May 2010-January 2015.

The audit points out that Arjun Aloysius, the son-in-law of former Governor Arjuna Mahendran, was also a Director of HDFC Bank from May 2011. The sister shared key managerial positions at Perpetual Capital along with Mr Aloysius. Also, both HNB Assurance and Ceylon Asset Management were subsidiary/holding companies of primary dealers–namely, Perpetual Treasuries Ltd, HNB and Bank of Ceylon.

Perpetual Treasuries was first incorporated as a private limited liability company in October 2012. It applied for a CBSL primary dealership licence in the same month. It was rejected but submitted in May 2013 and approved in principle. In December 2013, Cabraal’s sister was made a director of PTL’s holding company.

The then Governor’s wife, was a Director of Sri Lanka Insurance Corporation from 2010-2015 and the list goes on and on.

All the appointments to the Board of DFCC of his relatives were during the period of Mr Cabraal was the Governor of CBSL.

Treasury Bonds

Treasury Bonds are medium and long term debt instruments issued by the Sri Lanka Government to raise domestic public debt for budgetary purposes. The CBSL generally issues them through auction (where bids are received from primary dealers through competitive multiple price bidding after publication of a notice) or direct placement (where Treasury Bonds are issued to a single buyer or limited number of buyers without a public offering).

In reviewing direct placements, the audit found a large number were issued to Acuity Securities Ltd (formerly HNB Securities). Eighty percent of these are in 2013-14 at a higher rate due to which CBSL lost around Rs 60mn. Acuity was promoted at an equally owned joint venture between DFCC and HNB. In 2014, Mr Cabraal’s brother-in-law Ravindra Balakantha Thambiah was a director of DFCC. Amal Cabraal, his brother, joined HNB as a director in April 2014.

The audit noted a significant increase in the value of placements made to the Commercial Bank of Ceylon –from Rs 3.55bn in 2008 to Rs 25.11bn in 2009.

The increase in issuance of Treasury Bonds through direct placements to identified primary dealers at higher yield rates and resultant losses coincided with the presence of identified persons at these entities. But BDO India states documentary and digital evidence reviewed did not suggest this. At the same time, the quantity, quality and range of information available to it had been greatly limited. For instance, CBSL did not have a voice record system at the PDD and “significant limitations existed on the availability of ESI [electronically stored information] in terms of email files and email deletions”.

EPF investments and hefty losses

The Sunday Times also went through an audit carried out by KPMG India regarding EPF investments. The mandate was set by the PCOI statement that: “It is in the public domain that during the period prior to 2015 (prior to the PCOI mandate), especially during 2010 and 2011, the EPF, which comes under the direct control of the Monetary Board of the CBSL, is said to have been involved in questionable trading activities on the Colombo Stock Exchange.”

It said: “There were allegations made in the public domain that the EPF engaged in large scale transactions in shares in companies such as Piramal Glass Ceylon PLC, Galadari Hotels (Lanka) PLC, Laugfs Gas PLC, Ceylon Grain Elevators PCL, Brown and Company PLC during this period and that some of these transactions raised the inference of ‘Pumping and Dumping’ and ‘market manipulation’. There were allegations that the EPF knowing acquired shares which resulted in the EPF incurring substantial losses.”

KPMG investigated investments of EPF in equities and shares from 1998 to December 2017. It said that some key IT and other non-financial controls were missing.

With reference to Mr Cabraal, the report describes the case of Ceylon Grain Elevators where EPF made heavy losses. A large proportion (91.80%) out of the total investment of Rs 1,051mn amounting to Rs 965mn in shares of CGE was made through “crossing” transactions on two dates: March 4, 2011, and March 15, 2011. Both the transactions were not in the EPF’s Investment Committee (IC) weekly plan and were subsequently ratified.

The major counterparty to these transactions (approx 95 percent of the purchase) was Perpetual Capital Private Ltd (PCPL). The transaction was executed by Mr M S M Husam (dealer). He told auditor he did not remember the event and that the Superintendent at the time could have asked him to execute the transactions. EPF incurred an impairment loss of Rs 651.91mn on the investment in CGE and earned a dividend of Rs 25.02mn

PCPL was counterparty for 4.75mn shares. Out of the 4.75mn shares, PCPL would have earned a potential profit in the range of Rs 236.05mn to Rs 302.56mn for 1.99mn shares, the audit states. Additionally, PCPL was counterparty for 2.76mn shares and its acquisition cost is unknown, hence the profit/loss impact cannot be computed.

The Superintendent at the time of the investment told auditors that, “The Governor explained and convinced that this is a viable project considering prospect and poultry sector was flourishing.” A former Additional Superintendent during the time informed that: This investment was a management decision whereas a former Deputy Governor at the time said he “would never (approve) the investment in Ceylon Grain Elevators due to it prevalent high price.”