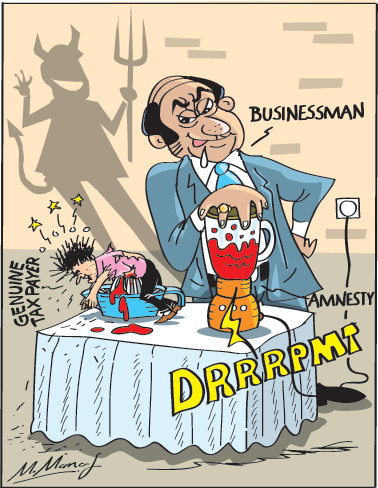

Tax Amnesty: Saving grace or the devil in disguise?

The Finance Act Bill which is to undergo amendments to 12 of its clauses on a Supreme Court order issued last week consists of two parts namely ‘imposing Tax on voluntary disclosure’ and ‘provisions to write off tax arrears under certain laws’. Even though it isn’t explicitly mentioned, in effect it is a Tax Amnesty.

The Finance Act Bill which is to undergo amendments to 12 of its clauses on a Supreme Court order issued last week consists of two parts namely ‘imposing Tax on voluntary disclosure’ and ‘provisions to write off tax arrears under certain laws’. Even though it isn’t explicitly mentioned, in effect it is a Tax Amnesty.

The Supreme Court has suggested certain amendments to the proposed Finance Bill which seeks to grant tax amenities and indemnify persons who voluntarily disclose taxable supply, income, or assets, against liability from investigation, prosecution, and penalties.

Is the Tax Amnesty truly a free pass with no strings attached?

Insurance schemes are generally advertised to be your saving grace covering anything and everything until you go to make a claim and realise the hidden shackles mentioned in the fine print. Similarly, an Amnesty is perceived as a free pass with no strings attached; is that the case here? Will the legislation say the same?

This Amnesty gives immunity only in the Value Added Tax (VAT) and Income Tax (IT) laws but not in the eyes of the other laws, so the information declared here can be used against you. Further, if any evaded income is already in dispute with the Department of Inland Revenue (IRD) within the VAT and IT space, then that cannot be declared under the Amnesty. So, determining if the income declared is disputed or not can be contentious and never-ending.

There is a potential concern with confidentiality as the information may get shared within the IRD especially with any file officer and one can be subjected to queries and probes for future periods and taxes which are not covered by the Amnesty.

The Amnesty may be perceived as a free pass with no strings attached and the Government may have intended for it to be a free pass with no strings attached, but the plain reading of the proposed Finance Act states that acceptance and refusal is in the hand of the IRD Commissioner General. As the Bill stands there are strings attached and you may face repercussions in the event the declaration is not accepted, unless otherwise the tax administration is influenced to be generous and to look with one eye closed. This generosity can be discriminatory.

You need to make a considered decision. If not, before you know it, you can go down a very slippery slope.

Are you admitting to being a criminal by making a declaration for Amnesty?

You may be confidentially exposing your criminality with the expectation that you will be granted exoneration. However, the question to be asked is, are you prepared to take the risk of exposing your criminality for a second chance and clear slate, even if the laws aren’t going to be deterrent in the future.

Do Tax Amnesties really work?

Over 25 countries have had a Tax Amnesty at some point in their history, but only a handful was successful. The success was mainly due to the following reasons: (i) Stringent and punitive measures of tax administration after the end of a Tax Amnesty, such as increased enforcement, penalties, increased audits, and/or prosecution; (ii) Fear of no more amnesties; (iii) The Tax Amnesties are targeted and specific, and; (iv) Unconditional immunity.

One of the most successful and record-breaking Tax Amnesties was introduced in Indonesia in 2016. The three main features that made it a success were (i) very favourable tax rates for repatriated assets; (ii) the origins of the funds were not to be declared; and (iii) full immunity from prosecution was granted. The programme was appealing to the Indonesians as the Government had access to information on funds held by the citizens in other countries especially Singapore, through the voluntary information sharing scheme under the Common Reporting Standard. This information gave the ability to the authorities to impose penal provisions which could adversely affect the citizens.

Ireland was another country with a successful Tax Amnesty even though the authorities didn’t have information on the undisclosed funds like the Indonesian authorities. However, their major success was due to the emphasis on much greater enforcement of the penal provisions on future tax evaders and the emphasis that it would be the first and last Amnesty in the country. The citizens believed this and that led to a much greater buy-in than expected.

Compliant Taxpayers, do you feel betrayed?

Compliant taxpayers can feel that they have got the short end of the stick as the non-compliant folks are allowed to get away with not even a slap on the wrist with just 1 percent tax on the declaration of undisclosed amounts.

Also, some taxpayers are questioned and probed for the smallest issues whilst others go scot-free. This is where we should consider the principle of Ad hominem. Following which it is fair to classify persons in order to give tax exemptions/benefits to a particular industry or sector as part of fiscal policy, but it is not permissible to give immunity and/or impunity for targeted persons when it comes to the penal provisions. Hence, the Amnesty contradicts this principle.

Way forward

We are amongst the countries with the lowest tax revenue collected to GDP ratio. For effective and sufficient collection of tax revenue, you need proper policy, administration and enforcement.

A Tax Amnesty can be a solution to bridge the gap in the revenue shortfall, but it has to have all the features required to make it successful.

Reforms are required to have a long-lasting solution. This is a complex and cumbersome process but it will be critical for the long-term revival of the country. The RAMIS system used by the IRD was the silver bullet that the Government introduced to automate the processes to remove discrepancies, corruption, and human biases. During my time at Goldman Sachs, I realised that no one person in the organisation was given absolute control as it leads to absolute abuse.

RAMIS was the Government’s solution to the same problem. However, the full implementation of RAMIS including random rotation and allocation of files has been subverted. RAMIS should be fully implemented, and a similar system should be implemented in the Customs framework to reduce the corruption and discretionary powers of the authorities and to deter the citizens from misstating the value of goods. The misstatement of the value of goods leads to the growth of the unofficial market resulting in a significant loss of tax revenue. Another reform could be creating a scheme of social recognition of peers in the public eye which can improve voluntary compliance, as it will create an environment where high compliance is given higher social standing and appear more socially responsible.

Why a Tax Amnesty? Why now?

A Tax Amnesty is generally introduced with the aim of increasing the short-term government revenue, and /or increasing the future tax base.

It is difficult to perceive the true intention of the Amnesty. If it is to get foreign funds, then it hasn’t worked historically, as seen by the similar provisions in the Foreign Exchange Act introduced in 2017, which saw only around 10 instances in which funds of less than US$1 million each was remitted into the country. If the intention was to bridge the short-term budget deficit, it isn’t going to be successful as there isn’t a sizeable amount of revenue that can be declared to bridge the gap. Even if Rs. 1 trillion of undisclosed money is declared, the tax collected will be only Rs. 10 billion, which is not substantial by any means. The only plausible intention might be to increase the future tax base.

(The writer can be reached at Losini.Gajendran@gmail.com)