Columns

Widening trade deficit weakening balance of payments and eroding external reserves

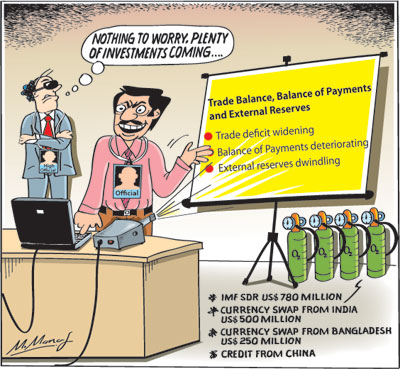

View(s): The widening trade deficit in the first half of this year and a likely increase in import expenditure in the second half are weakening the balance of payments and eroding the country’s perilously low foreign reserves.

The widening trade deficit in the first half of this year and a likely increase in import expenditure in the second half are weakening the balance of payments and eroding the country’s perilously low foreign reserves.

Impact on people

The balance of payments statistics have come to bite the ordinary man. They are determining the supply, availability and cost of basic necessities for living. No longer are the balance of payments statistics only for analysis by economists and commentators. They are impacting on basic living conditions of the people. Their basic needs of food and essentials are being threatened.

Soaring prices and shortages

The soaring prices and shortages of food are creating severe hardships. These difficulties are related to the shortages of foreign exchange, the depreciation of the rupee and the perilously low foreign reserves.

Trade deficit

Trade deficit

According to the Central Bank’s external trade data, the trade deficit widened to US$ 4.3 billion in the first half of this year. Imports increased by 36 percent to widen the trade deficit by 30 per cent compared to the trade deficit of US$ 3.3 billion during the first half of last year. This trade deficit was higher than the trade deficit of US$ 3.3 billion in the first half of 2020 and even the trade deficit of US$ 3.6 billion in the first half of 2019.

The trade deficit is projected to rise to US$ ten billion at the end of this year, in spite of a favourable export performance, owing to increased imports.

A large trade deficit will make a serious dent in the balance of payments and strain the low foreign currency reserves.

Import controls

Despite import controls and high import tariffs, the trade deficit is widening and weakening the balance of payments and eroding the external reserves to critical proportions. Consequently, the capacity of the country to import basic necessities is seriously impaired.

High tariffs

Last week the Government re-imposed higher import duties on basic food items that would increase their prices and the cost of living of people. The intent of these increased tariffs may have been to stem imports, reduce import expenditure and increase government revenue that has fallen to very low levels. The fiscal deficit has risen to an unprecedented 14 per cent of GDP.

Foreign currency reserves

The reserves that were US$ four billion at the end of June had depleted to about US$ three billion at the end of July. They have fallen to US$ 2.7 billion in mid-August and are expected to fall to a perilously low US$ 2.5 billion at the end of August.

Balance of payments

The outcome in the balance of payments is a determining factor for the country’s external finances and import capacity. Given the current low level of reserves, a balance of payments surplus is vital to strengthen the external reserves of the country. To achieve such a surplus, it is crucial that the trade deficit is low and earnings from services increase to more than offset the trade deficit. Will the country achieve such a balance of payments outcome?

Bleak prospects

The trade performance in the first half of this year, discussed earlier, is indicative of a bleak prospect in the trade balance this year. Import expenditure will increase owing to essential needs and increasing international prices. Nevertheless, there is a silver lining: a robust growth in exports.

Silver lining

There was a robust growth in exports in the first half of the year, when merchandise exports reached US$ 5.7 billion. Furthermore, in both June and July exports were about US$ one billion. The Export Development Board (EDB) expects exports to reach US$ 12 billion this year. If this expectation is realised, then the trade deficit would be contained somewhat.

Downside risks

However, there are critical uncertainties and downside risks in export earnings in the remaining months of the year. The current rapid spread of COVID is a serious threat to export production. The progress in containing the covid is an important determinant of the trade balance. If the fourth wave necessitates restrictions on travel and lockdowns, the wheels of industry and commerce will turn more slowly and the export potential of the country hampered.

We must also hope that the threat of the EU withdrawing the GSP plus concession would not take place. A conciliatory approach at the forthcoming UNHRC sessions is vital to ensure this. The suspension of the GSP plus concession could reduce export earnings, especially of apparel, other manufactures and sea food exports.

Import prices

Another factor is the terms of trade. If import prices rise more than export prices, then it would impact adversely on the trade balance.

The increase in prices of food and fuel could increase the import bill significantly. At the time of writing international oil prices have exceeded US$ 75 per barrel and are likely to increase further. Food prices too are on the rise.

Food imports

The reduction in output of rice in Yala this year and in Maha 2021-22 would be a further blow to the trade balance. While estate tea production is likely to be unaffected this year, smallholder tea production that accounts for about 75 per cent of the country’s tea exports is being severely threatened. This would reduce export earnings.

Summary

The perilous state of the external reserves has come to bite the ordinary man. They are impacting on basic living conditions and the livelihoods of the vast majority of people. There are shortages of gas, milk powder, sugar and fears of scarcities of essentials, including petrol and medicines. Prices of other essentials, including rice, are soaring.

Reminiscences of the hard times of 1970-77 are haunting those who are old enough to have experienced those years of severe hardships, when bread, medicines milk powder, sugar and even rice were not available.

The deterioration of the trade balance in the first half of the year and the prospect of it widening further during the rest of the year are serious concerns.

Conclusion

Foreign currency reserves that have dipped to a critically low US$ 2.8 billion at the end of July is expected to be replenished by an IMF grant of US$ 780 million and currency swaps from India and Bangladesh of US$ 750 million that are dragging on.

The Government is expecting foreign investments like manna from heaven, when there has been a net outflow of capital in the first half of the year. Are we waiting for Godot?

Leave a Reply

Post Comment