Columns

Replenishing low foreign reserves and strengthening external finances

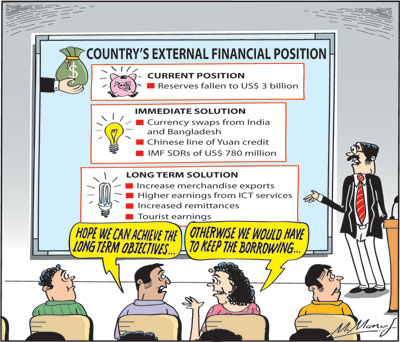

View(s):There is euphoria in the government after the loan repayment of US$ one billion on July 27, the due date for repayment. The country’s record of not defaulting on loan repayments has been maintained. Now, there is an air of confidence that the country’s external financial vulnerability would be resolved. How will the external reserves be replenished immediately and strengthened in the long term?

Replenishing reserves

Replenishing reserves

The Government is quite confident that the foreign reserves that have fallen to a mere US$ three billion would be replenished to a satisfactory level later this year. They are expected to grow owing to an inflow of currency swaps, an IMF grant and higher earnings from services in the coming months of the year.

However, analysts point out that the precarious level of reserves will continue during the rest of the year and aggravate in 2022, when further repayments of debt are due and import expenditure would increase.

Currency swaps

Currency swaps

The reserves are expected to be replenished by two currency swaps from India and Bangladesh, a “line of Yuan credit” of US$ 150 billion with China and a SDR allocation of about US$ 780 million that is expected from the International Monetary Fund (IMF).

The currency swaps are a temporary cushioning of the reserves and have to be repaid. The Chinese credit line is useful to import from China. The IMF allocation is a grant.

The currency swap of US$ 500 million from India and US$ 250 from Bangladesh are short term facilities that appear uncertain. The Chinese Yuan loan is only useful to purchase goods from China.

Useful palliatives

Currency swaps, loans and other financial arrangements are palliatives rather than solutions Nevertheless, these are useful means of tiding over the current foreign currency crisis though not a solution to the problem.

Solution

The reduction of the trade deficit by stringent import controls is inadequate. Increased merchandise export earnings and enhanced earnings from services are essential to reduce the island’s external financial vulnerability. Most of the expected funds are short term relief measures.

The plain truth is that the country has to earn foreign exchange by exports of goods and services in excess of funds spent on importing them. In brief, we must attempt to narrow the trade deficit and, if possible, achieve a balance of payments surplus as in 2019, when the trade deficit of US$ eight billion was offset by earnings from services and capital inflows.

In 2020, in spite of stringent import controls that reduced imports and narrowed the trade deficit to US$ six billion, the balance of payments was in deficit by as much as US$ 2.3 billion.

Higher earnings

Increased remittances, higher earnings from ICT services and an increase in tourist earnings in the fourth quarter of this year are expected to enhance the reserves to an adequate level. The icing on the cake is the finding of several “high value” gems. They have been valued at US$ 100 to US$ 200 million rather than in the billions. The gems, though very valuable to finders, are not of much value to the nation’s foreign reserves. Yet, in the dire situation we are in, like little drops of water, that fill the mighty ocean, they can add to our poor reserves. However, there are also reports that they are of low value. These inflows are expected to enhance the foreign reserves by the end of the year.

Past experience

The fact that the country has had only four or five years in which there was a trade surplus, is a clear indication of structural problems. The last trade surplus, albeit a small one, was 44 years ago in 1977 when it was achieved with stringent import controls, scarcities of essentials severe hardships to livelihoods and low economic growth.

Fundamental reason

The fundamental reason for the persistent trade deficits is the failure to increase exports while imports have increased substantially. Imports have been nearly twice export earnings in many years. Even in 2020 when the trade deficit was brought down to only US$ six billion, imports were US$16 billion compared to exports of only US$ ten billion.

Trade balance in 2021

What are the prospects for the trade balance this year?

This year’s trade deficit is likely to be much higher than last year’s US$ six billion owing to increased imports despite stringent import controls and a fairly good export performance in the first half of the year.

Exports

The Export Development Board (EDB) disclosed export earnings in the first half of the year to be US$ 5.6 billion. It has projected merchandise exports to reach US$ 12 billion. Despite this, the trade deficit is expected to widen owing to much higher import expenditure.

Sri Lanka’s merchandise exports of US$ 5.56 billion in the first half of this year was an increase of 27.5 percent over the first half of 2020 of US$ 4.36 billion. This improvement was achieved, despite the severe third wave of COVID-19, many restrictions and obstacles. The manufactured exports were responding to the gradual revival of international demand.

Imports

Paradoxically, the adverse impact on the balance of trade this year has been the increasing import expenditure in spite of restrictions on imports. The second half of this year is likely to witness a widening of the trade deficit owing to increasing import expenditure on food, fuel essential raw materials and reduced agricultural exports. Restrictions on fertiliser imports to counteract this, would aggravated the balance of trade by shortfalls in food production.

Balance of payments

In this context of a widening trade deficit, the earnings from services is of paramount importance, as in previous years. The pertinent question is whether worker’s remittances, earnings from ICT services and net capital inflows would exceed the trade deficit to yield a balance of payments surplus.

Summary

The foreign reserves of US$ three billion at the end of last month is a dangerously low level as import requirements for the rest of the year are high. The expected currency swaps and IMF grant may help the country tide over the immediate difficulties. They are necessary palliatives in the current situation but not a solution to the fundamental disequilibrium in external finances.

Conclusion

The only viable solution to the external finances of the country is the reduction of the trade deficit by increased exports and achieving a balance of payments surplus through enhanced earnings from services.

Leave a Reply

Post Comment