Columns

Are we resolving the economic crisis?

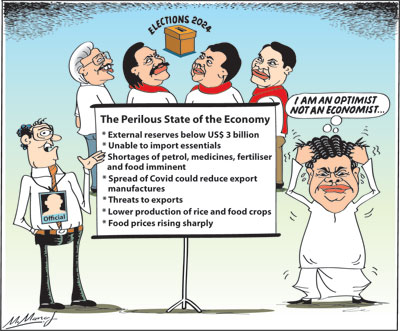

View(s): The island’s economic problems are gaining momentum. Farmers are protesting against the lack of fertiliser, loss of incomes and livelihoods. Food prices are rising far above those reflected in price indices. Many have lost their livelihoods and facing starvation. Scarcities of essential foods, fuel and pharmaceuticals are on the horizon.

The island’s economic problems are gaining momentum. Farmers are protesting against the lack of fertiliser, loss of incomes and livelihoods. Food prices are rising far above those reflected in price indices. Many have lost their livelihoods and facing starvation. Scarcities of essential foods, fuel and pharmaceuticals are on the horizon.

Political and social protests

Political and social issues too are in a state of controversy. Protests and strikes are widespread. Primary and secondary education are at a standstill. University education is in a crisis with the opposition to the Kotelawela Defence University bill. All state universities are dysfunctional.There are no signs of viable solutions to any of these.

External finances

Recently, the main focus has been on the perilous state of the external finances of the country; especially the low foreign reserves and the capacity to service the foreign debt obligations.

With the repayment of the international sovereign bond of US$ one billion on Tuesday, the reserves have fallen to a mere US$ three billion.

These low reserves imply difficulties in importing essentials like food, fuel and much needed raw materials for industry. Realising these constraints, the Government has indicated that it would remove some of the import restrictions.

These low reserves imply difficulties in importing essentials like food, fuel and much needed raw materials for industry. Realising these constraints, the Government has indicated that it would remove some of the import restrictions.

International Monetary Fund (IMF)

How would the Government resolve the country’s scarcities of foreign finances? The government is emphatic that it will resolve the foreign exchange crisis without assistance from the IMF.

Many economists and analysts have pointed out that the least cost and preferred solution would be to get IMF assistance to resolve the problem. However, the Government is adamant in not seeking such assistance as it does not want to comply with the conditions for such lending.

Government stand

Several Government spokesmen have reiterated and emphasised that the government will not turn to the IMF for a facility. This position has been clearly stated by the President’s Secretary Dr P. B. Jayasundera recently. He was categorical and clear that the Government will not seek IMF assistance. He said Sri Lanka has no immediate plan to seek financing from the International Monetary Fund (IMF).

No advantage

He saw no advantage in seeking IMF assistance as it would not enhance investment, increase tourism or improve the real sectors of the economy: Agriculture and industry.

Expectation

Dr Jayasundera placed his reliance on earning US$ 1.7 billion on IT services, accelerating foreign funded projects to expedite the inflow of foreign funds, remittances of US$ 7.8 billion and on expected currency swaps from India, Bangladesh and China this year.

Foreign borrowing

Dr Jayasundera was emphatic on not increasing foreign borrowing. Instead, the government is attempting to obtain currency swaps from friendly countries, India, Bangladesh and China. As exports have fared well in the first half, there is an expectation that exports will increase. However, import expenditure has increased in spite of controls and the trade deficit is widening.

Balance of payments

The balance of payments is expected to narrow owing to earnings from IT services of US$1.7 billion, remittances rising to more than last year’s US$ 7.1 billion to US$ 7.8 billion and a modest increase in tourist earnings of about US$ one to 1.5 billion.

Downside risks

The pertinent issue is whether these expectations would be realised as there are serious threats and downside risks. These include a fourth wave of COVID, withdrawal of the GSP plus concession and the shortfall in production of food crops and tea.

COVID

Medical advice in the country too have warned of the danger of the spread of a new variant in a fourth wave. So the current relaxations are fraught with dangerous consequences for manufacturing industry and exports.

Trade and balance of payments

With foreign reserves falling to US$ three billion at the end of July, the balance of trade and balance of payments outcomes are critical for the country’s external financial stability. What are the prospects of improvements in the trade balance and balance of payments in the second half of this year? Will the Government’s expectations be realised?

Widening trade deficit

The deterioration in the external reserves in the first half of this year was mainly due to the widening of the trade deficit in the first half of the year and repayments of foreign debt.

Trade deficit

In the first half of this year the trade deficit widened owing to increased import expenditure. On the other hand, exports fared well. They increased in the first half of the year. Indications are that import expenditure would increase in the second half owing to higher cost for food and fuel imports.

Normal conditions

Moreover, he expects a return to near normal conditions by end September with the expanded vaccination programme. This, in turn, would increase manufacture of exports and revive economic activities in his view. However, there is a higher probability of a spread of COVID in the coming months despite the increased vaccination.

COVID

The most uncertain factor in the current context is the extent of control of the COVID. Will the Government be able to contain COVID by September or will there be a new wave of it. A new wave of COVID would be a serious threat to the economy.

The Government’s current strategy to contain COVID and keep the economy moving is fraught with danger. While the increased availability of the different vaccines and the policy to vaccinate a high proportion of the population is an important move in the right direction, relaxing other controls to get the wheels of industry and commerce functioning is fraught with danger.

As the World Health Organisation (WHO) has repeatedly pointed out hasty relaxation of controls could lead to a resurgence of COVID, as several countries, such as Australia and the UK have learnt. They have had to re-impose travel restrictions and lockdowns. Such a spread of the delta variant in particular, due to reopening of the country to tourists and people neglecting health guidelines could be a severe setback to the economy and people’s livelihoods.

Summary and conclusion

There are no signs of resolving any of the crises facing the country. The undefined alternate economic policies of the government are about to succeed in bringing about a period of severe scarcities worse than in 1970-77.

The Government has decided to resolve the nation’s current crises in external finances by makeshift arrangement to borrow from countries or come to currency arrangements to tide over immediate difficulties.

They are expecting some favourable developments such as increased remittances, higher earnings from ICT services and US$ 780 million from the IMF SDR allocation. In spite of their not wanting to borrow at high cost by issuing International Sovereign Bonds (ISBs), indications are that they would do so.

The Government will however not seek the assistance of the IMF by coming to an extended fund facility as it does not want to accept the IMF conditions.

Nevertheless, such an IMF facility would be a long term accommodation in several instalments at low interest and would boost confidence in the economy and enable us to borrow on more favourable terms.

Final word

The wisdom of the Government’s approach to resolving the country’s economic woes would be seen in the fullness of time.

Leave a Reply

Post Comment