Budgeting in troubled waters

View(s):

File picture of currency notes printed in Sri Lanka.

In an economic recession, governments act differently. The proponents of a bigger role expected from the government will have a comfortable time to be convinced in what they believe in. Equally important is that the opponents of such a strategy will have a hard time to get their points across with conviction. These opposing views have much to do with a decades-old debate between two economic camps. Nevertheless, the “time” that we live in is a necessary condition to understand the debate too.

I thought of getting into a discussion today on the government budget which is an important element of the above debate. It is not to discuss about the Budget 2021 of the Sri Lankan government, which is indeed the most challenging budget the country has ever had throughout its history. However, in its overall appearance, it is no different from the budgetary outlooks all over the world – that is “budgeting in troubled waters”. If the Sri Lankan case is different, it is because the economy was hit not only by the COVID-led economic recession but also by the years’ of poor economic performance before the COVID pandemic problem, which is not a common feature of many countries in the region.

Troubled waters

It is an economic recession all over the world. Producers have lost a significant part of their market; their backward supply chains have been broken so that the supply of inputs – both primary inputs and intermediate inputs, has got disrupted. Their forward supply chains have been broken too and their sales have got disrupted too. Consequently, people lost jobs and livelihoods and their incomes got affected too resulting in less-spending. They have reduced their spending down to “survival types” avoiding much of the higher levels of spending. This decline in demand further reduces production and supply; the decline in production and supply, in turn further reduces jobs, livelihoods and incomes. All this results in a downward spiral, an important character of an economic recession.

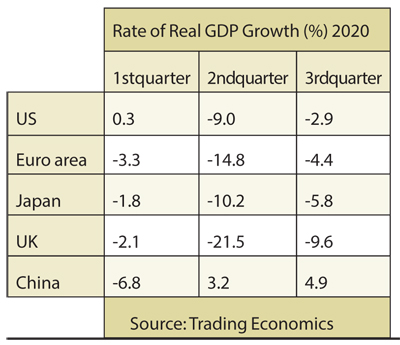

The contraction in the volume of economic activity due to both falling demand and supply is reflected through negative growth rates of the world economy.

As per the World Economic Outlook of the IMF, the world economy is expected to shrink by 5.2 per cent this year with a negative 7 per cent growth in advanced countries and a negative 2.5 per cent in developing countries. About 65 per cent of the world GDP is produced in the US, Euro area, Japan, the UK, and China; thus their economic performance is critically important for the entire world. Their economic contraction has continued throughout the year, except China which has been able to confine its negative rate of growth only to the first quarter. These economies will have negative spiral effects in their same locations and negative spillover effects in the rest of the world.

Rising budget deficits

In economic recessions, governments are compelled to increase spending. There is a moral obligation and an economic rationale for spending more during economic recessions than in normal times. As people have lost their jobs and incomes, governments cannot overlook their obligation to look after them. Therefore, the governments in many countries in the world have initiated granting unemployment benefits to people and even paying the salaries of the people who lost jobs and incomes. Secondly, the economic rationale is that it would also help to sustain demand for goods and services. In effect, it is expected to sustain business activities functioning and economic activities operating, minimizing the negative repercussions of the recession. Thirdly, the governments are also expected to extend a helping hand to businesses in recessions in the form of providing fiscal stimulus, including tax cuts.

The whole idea of the economic rationale for increased government spending is that when the private sector – businessmen and consumers, is – weaker, the government must be stronger. In acting in such a way, the impact of recessions is expected to be mitigated until the economy is back on track.

While governments must spend more in economic recessions, the irony is that the recessions themselves cause lower tax revenue for the governments. Governments collect taxes “directly” from people’s incomes such as wages and profits as well as “indirectly” from people’s expenditure on goods and services. As businesses and supplies have declined and incomes reduced, governments are having a hard time to generate their direct tax revenue. In the same way, as people have cut down their spending, governments are also having a hard time to generate their indirect tax revenue from sales of goods and services too. Apart from the natural reduction in tax revenue, governments are also expected to cut down taxes – both direct and indirect taxes, as part of the fiscal stimulus packages designed to support businesses and consumers.

Borrowings and money printing

The resulting budgetary outcome of increased spending against falling tax revenue is the unprecedented increase in budget deficits. And the budget deficit must be covered through borrowings and money printing, which of course has a limit. Nowhere in the world has borrowings and money printing made a country prosperous but has worked temporarily. The limits on borrowings are set by the country’s debt sustainability on the one hand, and the rating that the lenders would attribute to the borrowing country on the other hand. Already this year four countries – Argentina, Ecuador, Lebanon and Zambia, have defaulted their sovereign debt obligations. It was only last week that Zambia became Africa’s first country in the year to default sovereign debt after failing to repay US$ 42.5 million debt obligation.

Money printing can go deeper in recessions as the link between money and inflation is broken. Governments too find it a lucrative environment to get their central banks to print more money. In economic recessions, unless it is a “stagflation”, typically both supply and demand shrink pushing inflation down. Perhaps, it may go down even below zero levels – the so-called “deflation”, which is reported nowadays in many European and Scandinavian countries as well as in Japan. Being free from the fear of inflation, therefore, it is an easier time to accelerate the money machine for both financing the budget deficits of the governments and stimulating the crisis-ridden businesses and consumption. Of course, getting some inflation back by pumping more money can also be a purpose for some of these countries.

Money printing can go deeper in recessions as the link between money and inflation is broken. Governments too find it a lucrative environment to get their central banks to print more money. In economic recessions, unless it is a “stagflation”, typically both supply and demand shrink pushing inflation down. Perhaps, it may go down even below zero levels – the so-called “deflation”, which is reported nowadays in many European and Scandinavian countries as well as in Japan. Being free from the fear of inflation, therefore, it is an easier time to accelerate the money machine for both financing the budget deficits of the governments and stimulating the crisis-ridden businesses and consumption. Of course, getting some inflation back by pumping more money can also be a purpose for some of these countries.

Money printing too, cannot go too far without limits. There is no guarantee that it would not build inflationary pressure. Some of the developing countries are experiencing high inflation in spite of economic recession – the so-called stagflation; these countries include Turkey in the European Union, Venezuela and Surinam in the South American region, Iran and Lebanon in the West Asian region, and Pakistan in the South Asian region as well as many African countries. The second limit on money printing is in the countries which continue to struggle with foreign exchange. They must deal with worsening trade deficits and defending their exchange rate from falling. The countries that are comfortable with using the money printing machine in recessions are those which had performed well in their export growth and had accumulated significantly large stocks of foreign reserves.

Emerging opportunities

Recessions are not permanent and nor are the booms; they all are cyclical patterns of the world economy. Therefore, the expansion of the world economy would, indeed, come back sooner than later, while the countries which are ready to exploit that opportunity will begin to grow fast, leaving others behind. This is because the countries which are ready to exploit the opportunity would prepare themselves to be competitive and attractive in the globalizing economy. With an emerging economic boom, the significance of increased government spending and its underlying credit-financing and money printing would decline too demanding a different set of policies for stability – cutting down budget deficits and tightening excessive money and credit. (The writer is a Professor of Economics at the University of Colombo and can be reached at sirimal@econ.cmb.ac.lk and follow on Twitter @SirimalAshoka).