Columns

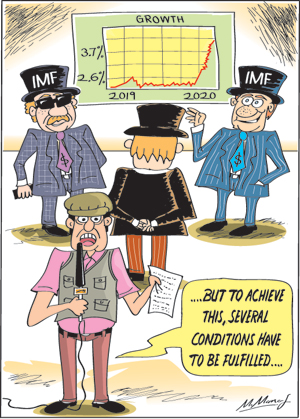

Guarded optimism of economic recovery in 2020

View(s): The cautious optimism of the IMF is also dependent on appropriate policy measures and correction of fundamental weaknesses.

The cautious optimism of the IMF is also dependent on appropriate policy measures and correction of fundamental weaknesses.

Fiscal Deficit

One of the fundamental weaknesses of the economy in 2019 was the fiscal slippage.

The fiscal deficit is estimated to be as much as 6.2% of GDP in 2019. This was one of the highest fiscal deficits in recent years.

It is a characteristic of the Sri Lankan economy to have large fiscal deficits in election years. In 2014 prior to the 2015 presidential election the fiscal deficit rose to 5.7% of GDP from 5.4% in 2013. Following the presidential election in 2015 the fiscal deficit ballooned to 7.6% owing to fiscal spending to gain votes at the parliamentary election of the same year.

There was an effort to achieve fiscal consolidation in 2017 and 2018 but the fiscal consolidation based on higher revenue collection was derailed by high public expenditure in 2018/ 2019. With the election of the new president in 2019 the new regime reduced a number of revenue measures as a fiscal stimulus to the economy. It also included a number of new welfare expenditure that increased government expenditure. Consequently, the fiscal deficit is expected to be 7.9% of GDP in 2020 according to IMF estimates. Such a large fiscal deficit will destabilise the economy and create inflationary pressures. It is therefore imperative that the government takes measures towards fiscal consolidation soon after the political compulsion of the 2020 parliamentary elections is over.

Fiscal Consolidation

The policy requisites to improve the macroeconomic fundamentals are politically difficult. This is especially so this year when the government is preparing for the parliamentary elections to consolidate its presidential victory. Correcting the fiscal slippage is a difficult challenge. One can only hope that the government will pursue measures to enhance government revenue that is a low proportion of GDP as well as reduce non development and wasteful expenditure.

There is some evidence that this would be the path the government will pursue from the latter half of 2020 onwards.

There is some evidence that this would be the path the government will pursue from the latter half of 2020 onwards.

Balance of Payments

Although the trade deficit was brought down significantly in 2019 from US$ 10.3 billion to around US$ 8 billion the balance of payments did not reflect this improvement. This was due to a decrease in tourist income, inadequate foreign investment and capital outflows. It should also be noted that the reduction in the trade deficit was brought about by a 10.3% reduction in imports and an export growth of only 0.4%.

The shrinkage in imports was also due to the slower growth in the economy. It is vital that export growth is accelerated in 2020 onwards to achieve a better balance of payments outturn.

External Vulnerability

The most serious problem facing the economy is the increased external vulnerability. The foreign debt increased to US$56 billion in 2019 and may exceed US$60 billion in 2020. The IMF estimates that the foreign debt in 2020 would be 62.1% of GDP in 2020. The consequent debt servicing obligations are estimated at over US$6.1 billion this year. Given the weak balance of payments position and low reserves of foreign exchange estimated at US$ 7.6 billion the country’s external vulnerability is high.

State Enterprises

In its staff appraisal statement the IMF has once again pointed to the need for reform of state owned enterprises. Most of the over 300 state enterprises are making huge loses. The reform of these enterprises to reduce the burden on public expenditure is vital. It appears that for ideological reasons and politically impossible reasons privatisation of state owned enterprises are not possible. Whether the government is able to improve the efficiency of state enterprises remains to be seen.

Concluding Reflections

Given the weaknesses in the country’s macroeconomic fundamentals the task of reviving the economy and facing the challenges of external financial vulnerability is imminent. The IMF’s expectation of an economic revival in 2020 to achieve a 3.7% growth is based on an improvement in tourism. The current setback to tourism owing to the novel coronavirus by latter part of this year will hopefully materialise. However it is still unlikely that tourist earnings will reach the level achieved in 2018. The growth in the manufacturing sector would also depend on global trading prospects. Another important factor that would determine the country’s economic growth is the capacity to attract foreign direct investment in to export manufactures. These are all formidable challenges that the government and the nation must face during 2020.

Leave a Reply

Post Comment