News

Airbus bribery scam: How racketeers piloted SriLankan into disaster

SriLankan Airline's former CEO Kapila Chandrasena (right) and his wife Priyanka Wijenayake being led to a prisons vehicle after they were remanded by the Fort Magistrate.

Kapila Chandrasena, then Chief Executive Officer (CEO), led a four-member ‘working committee’ that negotiated the deals. He and his wife, Priyanka Wijenayake, were remanded this week. They are accused of accepting US$ 2 mn (Rs 362mn) out of a total US$ 16.84mn (Rs 3bn) bribe promised in return for ensuring SriLankan bought aircraft from Airbus.

The other members of the working committee were Chief Operations Officer Captain Druvi Perera, Head of Finance Yasantha Dissanayaka and Head of Engineering Division Priyantha Rose.

Questionable from the start

SriLankan’s Airbus deal was shady from the start. And it was scrutinised multiple times. The Parliamentary Committee on Public Enterprise (COPE) looked at it. A Board of Inquiry headed by J.C. Weliamuna dissected it. The National Audit Office produced a detailed report on it.

A Presidential Commission of Inquiry (PCoI) appointed by Maithripala Sirisena to check alleged irregularities at SriLankan gathered evidence on it. So did the PCoI to investigate and inquire into serious acts of fraud, corruption and abuse of power, state resources and privileges (PRECIFAC).

The Commission to Investigate Allegations of Bribery and Corruption (CIABOC) delved into it. The Financial Crimes Investigation Division (FCID), now a unit under the Criminal Investigation Department (CID), has been on its tail since 2016. The CID also separately inquired. And the Attorney General’s Department had the files.

The Commission to Investigate Allegations of Bribery and Corruption (CIABOC) delved into it. The Financial Crimes Investigation Division (FCID), now a unit under the Criminal Investigation Department (CID), has been on its tail since 2016. The CID also separately inquired. And the Attorney General’s Department had the files.

Yet it took a decision of England’s High Court to spur any arrests here. Last month, Airbus was fined a record £3bn in penalties for paying huge bribes on an “endemic” basis to land contracts in 20 countries. One of those countries is Sri Lanka and involves the purchase of six A330 and four A350 airbuses and the lease of four other planes in deals agreed to between 2012 and 2013.

Criminal investigators in Sri Lanka say it was months before they got the required information from international partners under anti-money laundering legislation. But a study by the Sunday Times of the many reports on SriLankan’s Airbus deal shows barefaced manipulation of systems and processes in order to execute contracts and agreements that made no financial sense to the struggling airline.

In the words of one retired management pilot: “Those Airbus deals were the downfall of SriLankan. Our debt burden skyrocketed.”

Back then, professionals were perturbed at how “hush, hush” the negotiations appeared to be. That was not how costly aircraft deals ought to be done, they say. Only a handful of employees knew what was happening.

“When Air Lanka bought the TriStars from Lockheed Corporation years ago, we had a team meeting for a whole year beforehand,” the pilot recalled. “There were representatives from cargo, from operations, marketing, corporate, engineering, finance, and so on. It would be discussed for months and every department was to be involved. There was nothing like that here.”

Sweeping irregularities

Sweeping irregularities

To this day, there is no explanation for why the crucial “special” board meeting at which in-principle approval was granted for purchase of six A330-300s (powered by Rolls Royce Trent 700 engines) and four A350-900s (with Rolls Royce XWB engines) as well as lease of three more A350-900s was held at the official residence of then Speaker Chamal Rajapaksa in Battaramulla.

Among the directors who attended was his son, Shameendra Rajapaksa, meeting minutes obtained under a Right to Information application filed by the Airline Pilots’ Guild of Sri Lanka show. Also present were Chairman Nishantha Wickremasinghe, Mr Chandrasena and Directors Nihal Jayamanne, PC, and Lakshmi Sangakkara. Head of Finance Yasantha Dissanayake, who later gave extensive evidence before the PCoI, attended by invitation.

But worse irregularities took place than the conduct of a discussion in the residence of a director’s dad. Even the manner in which Mr Chandrasena was made Director/CEO was questioned in the Weliamuna report. The son of a licensed surveyor and a teacher, he lived while schooling at the Anderson Flats in Park Road (although he is later reported to have bought property at Rosmead Place).

In May 2011, Mr Chandrasena assumed duties as CEO Designate. He was appointed CEO on August 1 that year, reportedly on the Chairman’s recommendation. But when the Weliamuna committee questioned him, Nishantha Wickremasinghe “categorically said he had reservations on this person as he was not suitable due to his ‘bad record’ and lack of any airline experience”.

Mr Wickremasinghe conveyed his concerns to his brother-in-law, then President Mahinda Rajapaksa, but was ignored. It led even him to conclude that the CEO’s appointment “could most certainly have been part of a much bigger scheme”.

Mr Chandrasena came with other baggage. “There was a suspicious purchase of an MA60 aircraft by Mihin Lanka and thereafter transferring those aircraft to Sri Lanka Air Force,” the report observes. “There is prima facie evidence that the purchase of MA60 aircraft fails to meet expected bona fide framework of transparency, competitive sourcing and accepted procurement standards.”

The report indicates that Mr Chandrasena was not truthful with most of his evidence on the MA60 transaction which contradicted other documentary evidence. It was recommended that the Bribery Commission investigated this “as a matter of priority and urgency”.

Mr Chandrasena, whose experience and qualifications are limited to telecommunications and information technology, claimed he was selected to the national carrier on his competence and on the basis of an interview by the Chairman and a few Board members. This was not supported by evidence. Mr Wickremasinghe said there was no selection process. The nominee was called into the meeting and the decision conveyed. The offer was accepted. That was all.

Three business plans in four years

Soon, a five-year business plan emerged of which a key thrust was re-fleeting. There was no argument that the company needed to replace its ageing aircraft. But a previous business plan in 2008 took a more prudent and financially sound approach.

A team of local experts led by SriLankan’s former Chief Financial Officer S A Chandrasekera was behind that roadmap which was intended for three years and suggested an infusion of US$ 180mn through internal sources such as an initial public offering of Sri Lankan catering, sale-and-leaseback of aircraft and a share issue of Sri Lankan Airlines. The Board approved it but then Treasury Secretary P.B. Jayasundera held back the sale of shares even after considerable work was done.

When Emirates left in 2008, SriLankan had 14 aircraft. This was to reduce to 12 as two leases were expiring. Mr Chandrasekera’s plan envisaged bringing it up to 14 through fresh leases. There was no other proposal for re-fleeting as the company has no financial strength.

The idea was to infuse capital through a share issue rather than raising loan capital, observes the PCoI report, a copy of which the Sunday Times saw. This way, SriLankan would be self-supportive without burdening the State or the public.

What transpired was the direct opposite. SriLankan handpicked two international consultants, Via Capital and InterVISTAS, to “validate” Mr Chandrasekera’s business plan. Via Capital was a new company with no experience as a corporate body in the relevant field and had no referral. It rode on InterVISTA’s reputation and was chosen from among other companies that had between 50 and 10 years of robust international experience.

These consultants significantly changed the earlier roadmap’s main components, floating “a very ambitious plan at a time the company was financially unable to meet its liabilities”. It called for equity infusions of US$ 300mn to be spread over a three-year period.

It also envisaged growing the fleet from 12 to 24. And its forecasts were wild. For instance, it anticipated capacity growth in terms of passenger kilometres of 75 percent over a five-year period and aimed to capture a market share of 55 percent of projected tourist arrivals. It expected a growth of network traffic through Bandaranaike International Airport (BIA) at an average annual rate of 4.2 percent.

A growth of 80.1 percent over the five years was forecasted with regard to cargo carriage and a 97.7 percent growth rate was expected in respect of revenue from passenger, cargo and excess baggage. The plan also anticipated the unit cost to be contained at the same level (despite higher lease charges for new aircraft) by raising employee productivity and operation expansion. And it expected to turn the then deficit airline operation to a surplus in the fourth year.

The aircraft purchases

There were 13 narrow-body planes to be phased out between 2014 and 2020 on expiry of their lifespan. On June 19, 2013, six A330-300 aircraft with seating for 300 were bought from Airbus during 2014/2015 on sale-and-lease back. On June 28 the same year, SriLankan signed to buy four A350-900s with seating for 330 directly from Airbus, to be delivered in 2020/2021.

And, on September 27, 2013, and November 12, 2014, SriLankan signed to acquire four more A350-900s on operating lease to be delivered in 2016/2017.

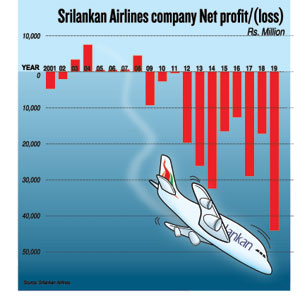

Soon, SriLankan was in dire financial straits. The group’s net loss which was US$ 47.1 million in 2015/2016 rocketed to US$ 90 million 2016/2016. It owed US$ 45mn to the Ceylon Petroleum Corporation (CPC) and US$ 15mn to Airport and Aviation Services Ltd (AASL) by March 2016.

So bad was its financial situation that SriLankan could not pay the total base rent (the minimum amount of rent that is due under the terms of a lease) of US$ 174.96mn for the four A350-900 aircraft for 12 years at US$ 1.215mn per month per aircraft. They were to be delivered in 2016 and 2017.

There was no evidence that the SriLankan management made a comprehensive cost-benefit analysis on possible contribution to its profits in running these aircraft on particular routes, the National Audit Office subsequently held. In retrospect, what did cost-benefit or return-on-investment matter if the commissions were the deciding factor?

Seabury, another consulting firm, helped negotiate and sign the agreements. The PCoI found that, in the end, it was neither Mr Chandrasekera’s nor Via Capital/InterVISTAS business plan that was adopted but a new one by Seabury. The total cost of all these consulting contracts was more than Rs 195mn. Mr Chandrasekera got the lowest fee, the PCoI states, at just Rs 750,000.

But its final report in 2017, Seabury claimed it was not the consultant’s responsibility to evaluate the rationale of the business plan or review the number of wide-body aircraft required by SriLankan. It was for the company to determine the type and number of required aircraft through a cost-benefit analysis. Its proposals for re-fleeting were made on targets and limits set by the company management, Board of Directors and Government, Seabury maintained.

“It appears from the evidence led that the capital infusion came from the Government, where a certain portion to be used for re-fleeting was used to settle the credit of the Ceylon Petroleum Corporation,” the report of the PCoI states. “Thus, when the company was in a financially dire state, suffering from a severe cash shortage, the Board of Directors of the company at the time decided to go for a re-fleeting transaction.”

“Despite being well aware about the severe shortage of cash…they were unanimous in approving the re-fleeting exercise,” it concluded.

Why? Do all roads lead only to Mr Chandrasena?

| Affected countries must be paid compensation: TISL Compensation must be paid to the countries which are victims of corrupt deals involving Airbus, Transparency International Sri Lanka said this week. The national carrier paid US$ 116mn (Rs 18.5bn) penalty for cancelling an order for four A350-900s between 2015 and 2017. “It is important to recall that the fallout from this deal is widely reported to have cost in excess of 17 billion rupees (USD 116mn) in cancellation penalties,” Asoka Obeyesekere, TISL Executive Director said. “Given that the evidence now shows that corruption was involved in the procurement process, it is imperative that action is taken both internationally and locally to ensure that Airbus and its agents are held accountable for losses inflicted on Sri Lanka.” On the bribery trail The Fort Magistrate Court heard from investigators that SriLankan Airline’s former CEO Kapila Chandrasena’s wife Priyanka Wijenayake had formed a company called ‘Biz Solution’ in Brunei under her name, maintaining an account for it in a Singapore bank. In December 2013, this account received US$ 2mn from EADS (European Aeronautic Defence and Space Company), the mother firm of the French Airbus SE. The money was then remitted in four installments to another account Mr Chandrasena held in an Australian bank. The Attorney General’s Department indicated that there may be other suspects in Sri Lanka and abroad. The Criminal Investigation Department (CID) first reported the case to the Fort Magistrate’s Court in September last year. But the probe was ongoing since 2016. It was only in November 2019, while Mr Chandrasena and Ms Wijenayake were serving travel bans, that the CID received the relevant bank details from Singapore. The case was taken up several times since then during which time the suspects attempted to get the travel ban lifted without informing Court of a reason. The Magistrate decided this week that there was reasonable doubt they would avoid investigation and Court and remanded them till February 19, 2020. Documents filed in England’s High Court show that Airbus SE hired Ms Wijenayake as a business partner through the dummy company in Brunei. Mr Chandrasena himself used his private Gmail account to communicate with and invoice Airbus for US$ 2mn (in November and December 2013) in exchange for buying aircraft from the corporation. Payment was approved and US$ 2mn was paid in euros in December 27, 2013. Ms Wijenayake registered her straw company on October 5, 2012, even as negotiations were ongoing between SriLankan and Airbus for the aircraft deal. In March 2013, Airbus engaged her as a business consultant through this company although she had no aerospace expertise. The first Airbus orders from SLA came three months after her firm was hired.

| |

| Was presidential VIP kit an inducement for hefty Airbus deal?The Sunday Times first exclusively reported in October 2014 that SriLankan had commissioned a “VIP conversion kit” for one of its new A330-300 aircraft so that then President Mahinda Rajapaksa and his inner circle could travel abroad in comfort.It is now in question whether this was also an inducement for the hefty aircraft deal the country awarded Airbus at the expense of its national carrier. The kit allows transformation of the forward commercial passenger area into a spacious VIP section. At the time, officials–including the service provider–refused to divulge details, including cost.The conversion kit is produced and installed by the Airbus Corporate Jet Centre (ACJC). And its Marketing Director told the Sunday Timesat the time their customers “ask for discretion”.The National Audit Office (NAO) in a special report on SriLankan Airlines re-fleeting said a paragraph in a Cabinet memorandum dated March 27, 2013, indicated that the VIP kit might have been one factor in choosing Airbus over Boeing.When Airbus and SriLankan signed in June 2013 for purchase of six A330-300s, a separate agreement was entered into for VIP cabins in addition to the above.SriLankan agreed to receive two A330-300s to be delivered in October and December 2014 as VIP aircraft. There would be one VIP cabin set to fix in these two aircraft, the NAO states. These planes feature a VIP section at the front of the cabin, and airline-style seating at the rear. The kit was to include a bedroom with two beds, office and conference area. The VIP kit was directly tied to the aircraft purchases. The agreement states that, where SriLankan refrains from buying at least one A350-900, Airbus shall have the sole right to revoke the deal. Under a revision to the contract in December 2013, SriLankan agreed to purchase a secondary VIP kit in addition to the principal VIP kit. The financial cost for designing VIP kit in respect of first aircraft was US$ 7.5 million and US$ 7.5 million for second aircraft. It was agreed that US$ 0.5mn will be paid as pre-delivery payment by SriLankan as soon as the agreement is signed, followed by US$ 2mn and US$ 4.75mn in January and December 2014. These pre-delivery payments were settled by a credit note to the value of US$ 15 million. The agreement entered into for the VIP kits was revoked in February 2015. Under a written request by SriLankan, the credit note to the value of US$ 15 million granted by Airbus for the kits was totally used. |