News

Vehicle imports drop in first six months of the year

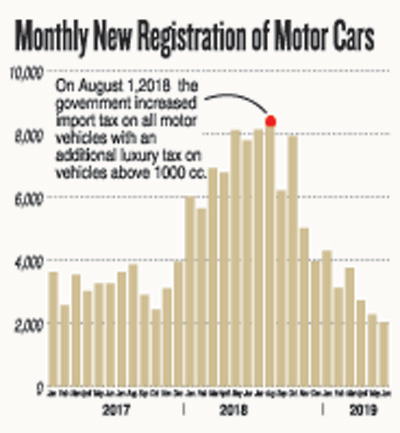

Registrations of new cars dropped by 36% in the first six months of this year, compared to last year’s corresponding period, Motor Traffic Department statistics revealed.

Car imports have continued to fall following the 2019 budget which announced various measures to control the import of motor vehicles into the country.

In an August 2019 pre-budget announcement, the government imposed an exorbitant tax based on a vehicle’s engine capacity and an additional tax based on the manufacturing value of the car.

Accordingly, vehicles with engine capacity below 1,000 cc were slapped Rs1650,000; vehicles of 1,000 cc increased to 2 million, vehicle engines with 1,000-1,300 capacity shot up to Rs4.16 million and a vehicle with an engine capacity of 1,300-1,500 cc had Rs.5.55 million slap on it.

All vehicles with a CIF (cost, insurance and freight) value of Rs3.5 million or above were subject to an additional tax on top of the import tax.

The depreciation of the rupee against the American dollar contributed to a significant price increase.

In addition, the government also imposed the requirement of a 100% cash margin when establishing LCs, a temporary suspension on permits and an adjustment on loan to value ratio for vehicle financing.

The Vehicle Importers Association of Sri Lanka (VIAL) said imports had dropped by almost 90% in the last six months.

President VIAL Indika Sampath Merenchige said the imposition of the luxury tax had an adverse impact on the industry, with regular importers leaving the industry due to lack of business. He said the demand and supply chain was broken, and potential buyers had strayed away from the market due to the exorbitant prices of vehicles.

Mr Merenchige said the high prices of vehicles were discouraging customers from purchasing new vehicles. “They are holding on and have stopped investing in new vehicles,” he said.

Vice President, Ceylon Motor Traders Association, Niranga Peiris said that the present system of imposing tax on the CIF value of a car was discriminatory to the buyer at the lower end.

“A person who buys a small car under the Toyota or Alto brand with a 1,500 capacity engine ends up paying the same tax as those who go for a Benz or Mercedes. This is unreasonable,” he said.

He said that although the tax increase was introduced to increase the revenue to the country, it had a negative impact on the economy. “There is a drop in imports. The market is at a standstill,” he said.

He added that the market was influenced by the slap on vehicle financing in the purchase of a motor vehicle. In order to reduce vehicle congestion on the roads, the government imposed restrictions on borrowing from banks and finance companies with a regulation that a buyer must come up with 50% down payment to purchase a vehicle. Previously, a loan of 90% could be obtained on the vehicle.

As per statistics from the Department of Motor Traffic, in January 2019 vehicle registrations were at 4,294 units; this has halved to 2,045, by end June 2019. The total number of cars that have been registered for the first six months of 2019 stood at 18,239 units.

In comparison, the first half of 2018 recorded the highest number of motor vehicle imports with 41,293 units imported for the first six months of the year; at the end of the year a massive 80,766 units had been imported. This followed the government budget announcement to bring down the tax on small and hybrid cars. Many private dealers and individuals entered the fray, flooding the market, and sidelining regular importers in the industry who started crying out for control measures on vehicle imports into the country.