Columns

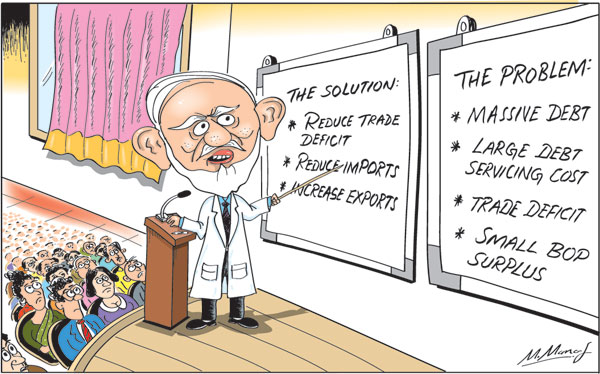

A larger balance of payments surplus essential to reduce external vulnerability

View(s): The horrendous terrorist attacks on Easter Sunday make the achievement of a balance of payments surplus this year very unlikely. Last Sunday’s attacks on churches and hotels and the consequent insecure conditions would once again plunge the country’s economy into a state of instability and low growth. It would certainly have a serious adverse impact on the balance of payments and on the country’s external financial vulnerability.

The horrendous terrorist attacks on Easter Sunday make the achievement of a balance of payments surplus this year very unlikely. Last Sunday’s attacks on churches and hotels and the consequent insecure conditions would once again plunge the country’s economy into a state of instability and low growth. It would certainly have a serious adverse impact on the balance of payments and on the country’s external financial vulnerability.

The economic consequences of the current situation will be discussed in detail next Sunday. The following analysis is what could have been achieved had peace prevailed.

It is only by achieving a substantial balance of payments (BOP) surplus that the nation’s external financial vulnerability could be reduced. Generating a larger balance of payments surplus would enhance the country’s foreign exchange reserves that could be used for repayment of debt.

Reducing trade deficit

The reduction of the large trade deficit is imperative to achieve a balance of payments surplus of over US$ 3 billion in the next few years. This is needed to make a dent on the country’s foreign debt burden. Otherwise, the government’s borrowing to meet debt repayment obligations would increase the foreign debt and lead to a debt trap.The larger the trade deficit, the lesser the likelihood of a balance of payments surplus of significance.

Recent BOP

In 2018 the trade deficit of US$ 10.3 billion was offset by workers’ remittances of US$ 7 billion and tourist earnings of US$ 4.1 billion that amounted to US$ 11.4. This, together with other income resulted in a small BOP surplus of US$ 1.4 billion. Had the trade deficit been around US$ 8.5 billion, then the overall BOP surplus would have been about US$ 3 billion.

The story of the balance of payments was similar in 2017. In 2017 the trade deficit of US$ 9.6 billion was offset by workers’ remittances of US$ 7.2 billion and tourist earnings of US$ 3.3 billion that amounted to US$ 10.5 billion. This was US$ 0.9 billion more than the trade deficit. This, together with other income resulted in a BOP surplus of US$ 2.07 billion. Had the trade deficit been around US$ 8 billion, then the overall BOP surplus would have been much higher, about US$ 4 billion.

Importance of reducing trade deficit

This profile of the BOP underscores the importance of reducing the trade deficit. A lower trade deficit is imperative to achieve a balance of payments surplus to reduce the country’s external financial vulnerability as further foreign borrowing at high cost for foreign debt servicing would weakens the external finances and drive the country into a foreign debt trap.

Foreign borrowing

Foreign borrowing

The consequence of the inability to achieve a BOP surplus is that further foreign borrowing is needed to meet the debt repayment obligations of over US$ 5 billion this year (2019). As the debt repayments from 2020 onwards are also large, it is of paramount importance to achieve a significant balance of payments surplus of at least about US$ 3 billion from this year onwards. This is possible if the trade deficit could be reduced from the massive US$ 10.3 billion to about US$ 8 billion.

Improving trade balance

A multifaceted approach is needed to achieve a lower trade deficit. Reducing nonessential imports is an immediate task. The medium to long to term sustainable strategy is to increase exports. While increasing exports significantly is the medium to long term strategy, containing imports is the short term solution. As pointed out in earlier columns, this is a difficult and challenging task owing to the character and composition of the country’s import dependency.

Reducing imports is difficult as most imports are either essential consumer items or intermediate inputs for production. Several basic food items, such as wheat, sugar, milk and dhal are essential imports.. Food imports amounted to about 10 percent of total imports in recent years. On the other hand, imports of fuel and intermediate goods that are also essential increased.

Imports in 2018

In 2018 consumer items accounted for 22.4 percent of total imports with food imports constituting 10.3 percent of total imports. The most significant change in imports was the higher amount of intermediate goods imports. Imports of raw material such as textiles and chemicals that are vital for manufactures increased. Fuel import too increased owing to higher prices. increased needs of fuel for thermal generation of electricity, increased transport needs and for industrial uses. Consequently fuel imports constituted 18.6 percent of total imports in 2018.

Increasing imports

Total imports increased by 6 percent from US$ 21.billion in 2017 to US$ 22.2 billion in 2018. This significant increase of imports has been the main cause of the widening trade deficit from US$ 9.6 billion in 2017 to US$ 10.3 billion in 2018. This trade deficit is far too high and must be reduced this year.

Non-essential imports

In this import structure non-essential imports must be drastically curtailed. In the last two years , a significant amount of imports have been for vehicles and gold. In 2018 vehicle imports cost US$ 1.6 billion, while gold imports amounted to US$ 0.6 billion in 2017 and 0.4 million in 2018. These two items amounted to about 10 percent of total imports in 2018. The country’s export and service earnings cannot be frittered away on these imports. Some import constraints have been put in place but are they adequate? A comprehensive strategyneed to contain import demand, is crucial.

Conclusion

If the trade deficit is not contained to achieve a significant balance of payments surplus, foreign borrowing is needed to meet foreign debt obligations and finance development expenditure. Further foreign borrowing would increase the currently large foreign debt and enhance the country’s external financial vulnerability. The problem is serious and merits stringent policies.

Leave a Reply

Post Comment