Columns

Fundamental weaknesses and vulnerabilities in external finances

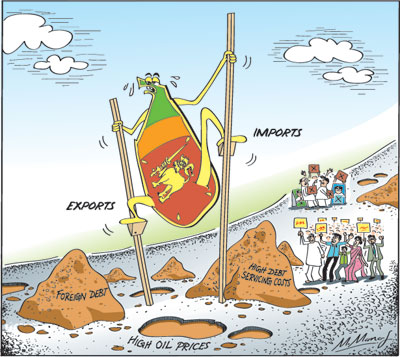

View(s):Furthermore, the current global uncertainties: trade embargoes, rising fuel prices and interest rate policies of the US Federal Reserve make the country’s external finances volatile and vulnerable. These weaknesses and threats must be addressed with effective monetary and fiscal policies.

Persistent trade deficits

Persistent trade deficits

As this column pointed out last week, the large and increasing trade deficits are the underlying cause for the weak balance of payments and foreign reserves. Improving the trade balance is therefore vital to strengthen the external finances.

Trade deficits are not a new phenomenon. Since 1950, there have been trade deficits in all but four years. The last trade surplus forty years ago in 1977 was a small one of only US$ 144 million. It was, achieved with stringent import and foreign exchange controls.

In spite of this, there have been small balance of payments surpluses in some years owing to workers’ remittances, earnings from services and capital inflows. These have perhaps led to complacency in addressing the persistent trade deficits.

Cumulative impact

The cumulative impact of widening trade deficits, especially the large deficits of recent years, has caused severe weaknesses in external finances. The trade deficit increased from US$ 7 billion in 2013 to US$ 8.8 billion in 2016, and to US$ 9.6 billion in 2017. This year’s trade deficit could exceed US$ 10 billion as the trade deficit had reached US$ 5.7 billion in the first half of this year.

Fundamental weakness

Even though there have been balance-of-payments surpluses in some years, persistent trade deficits have been a fundamental weakness in the country’s external finances. Large and expanding trade deficits weaken the balance of payments (BOP) and in turn weaken the external reserves and debt repayment capacity. Trade deficits have been the primary reason for balance of payments deficits or reduced balance of payments surpluses and consequently low foreign reserves.

Foreign debt

The large foreign debt and its huge servicing obligations are a severe burden on the external finances. However, the increase in the foreign debt is not only due to persistent trade deficits. The large borrowing to finance the war, high cost infrastructure projects since 2010 and borrowing to repay debt have increased the foreign debt to US$ 51 billion at the end of 2017 that is around 77 percent of GDP. This has resulted in an onerous debt servicing burden.

Foreign debt servicing costs are massive next year and in the years to follow. Next year’s debt servicing obligations are estimated at US$ 4.1 billion. These debt service obligations weaken the external finances further.

Strengths

Increases in the trade deficit could have led to a serious deterioration in the balance of payments, if not for the inward remittances of Sri Lankans living abroad and the increased earnings from tourism. In spite of the large trade deficits, the balance of payments has been in surplus owing to workers’ remittances, earnings from tourism and receipts from other services.

Workers’ remittances

Workers’ remittances

Workers’ remittances over many years and earnings from tourism that have increased in recent years have been two strengths of the external finances. These have often offset the entire trade deficit to yield a balance of payments surplus. While the widening trade deficit weakens the balance of payments, remittances and tourist earnings offset it to improve the final balance of payments outturn.

This indispensable feature of the balance of payments is however very vulnerable as both remittances and tourist earnings could have reversals. Since over one half of the remittances are from workers in the Middle East, the highly unstable geopolitical situation in the region makes dependence on remittances risky. In the last two years remittances had setbacks at times as the security situation resulted in a shrinkage of workers to these countries. These unstable security conditions could worsen unpredictably

Oil prices

Fluctuating oil prices also have a bearing as recruitment of workers is reduced when international oil prices fall. At present, as oil prices are high, there is a demand for workers, but the security situations in several countries dissuade workers taking jobs.

Tourism

Although tourism is a fast growing global market sporadic outbursts of communal violence, as well as political protests and disruptions that are ever present features of the country could deter tourists. Furthermore, high rates for tourist accommodation, traffic congestion, inadequate public transport facilities, harassment and molestation of tourists and even murder of tourists could make the country less attractive to tourists.

Nevertheless tourist arrivals have increased in recent years and earnings from tourism brought in US$ 3.9 billion in 2017 and US$ 2.1 billion in the first half of the year.

Import dependency

The recent deterioration in the trade balance has been due to large increases in imports surpassing the growth in exports. The high import dependency is to an extent inevitable for a small resource scarce export dependent economy.

Most manufactured exports have a high import content and infrastructure development too is highly dependent for imports of capital goods and construction materials. The country is also dependent on oil imports that constitute 25 to 30 percent of the import bill and is also dependent on basic food imports like wheat, sugar, dhal and milk. However total food imports last year are only about 13 percent of total imports.

Cars and gold

On the other hand, motor car and gold imports have risen in 2017 and the first half of this year. In 2017 vehicle imports cost US$ 772 million and gold imports also cost US$ 772 million. Together they cost US$ 1.5 billion or 7.1 percent of total imports. Is it justifiable to expend so much on these imports when the country has a severe trade imbalance?

Policy imperatives

Complacency about the country’s trade balance could lead the country to severe difficulties in external finances. In the country’s position of high indebtedness, it is vital that there is a much higher balance of payments surplus. The outcome in trade is an important determinant of the balance of payments outcome.

There must be a strategy to curtail non-essential imports. Both monetary and fiscal policies must ensure that non-essential imports are contained and do not expand beyond the country’s capacity. The dependence on tourism and remittances has risks and uncertainties. Increased exports and earnings from tourism should not be dissipated in non-essential imports.

Leave a Reply

Post Comment