Snapshots, interesting data and drawings in SL annual reports

View(s):

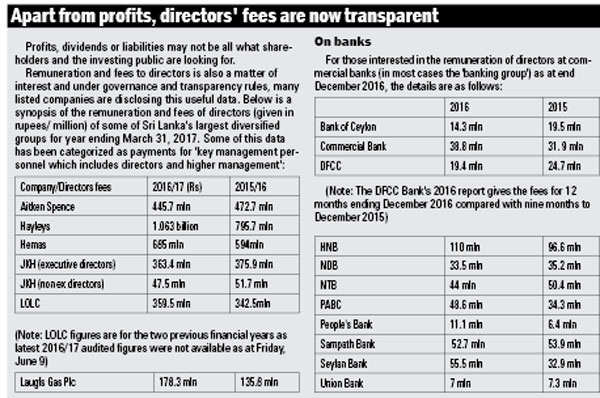

Laugfs annual report cover.

Annual reports of Sri Lankan corporates can be boring and loaded with technical data which few shareholders and the public understand but they could also be interesting particularly in the context of businesses that are showing profit and geared for growth.

In a cursory glance at a couple of annual reports this week as many reports rolled in at the end of the March 31 financial year, the Business Times (BT) found some interesting information and comments. Hotels (see separate report in the Tourism Page) complained about overcapacity while tea companies are showing profits since average tea prices have risen. The Laugfs report drew the BT interest for its innovative cover depicting water, ships, harbours and container terminals in a child-like drawing. Here is a snapshot of some of these reports:

Changes at Distilleries

The Distilleries Corporation of Sri Lanka (DCSL) said revenue was up by 25 per cent to Rs.90.3 billion by end March 2017 year. It said that owing to “a loss of control of subsidiaries, the profit after tax was – Rs. 70.2 billion against a net profit of Rs. 5.3 billion in the previous year.”

This is because Melstacorp Ltd became the ultimate holding company of the DCSL Group and DCSL became a wholly owned subsidiary of Melstacorp.

Drawings and Laugfs

What instantly drew the interest of the BT was the cover of the Laugfs annual report showing water, ships, ports and container terminals in a childlike drawing.

The report also took an unconventional path, listing the company’s role with the economy with the “Direct Economic Value Generated” being Rs. 18.6 billion which is made up of operating costs at Rs. 14.7 billion; employee wages and salaries at Rs. 1.7 billion; payments to providers of capital at Rs. 2 billion; and payments to Government at Rs. 243 million.

Its group revenue was Rs. 18 billion compared to Rs. 13.3 billion in the March 205/16 year. However it reported a net loss of Rs.627 million against a net profit of Rs. 1.3 billion in the previous year.

Chairman/Group CEO W.K.H. Wegapitiya, in his report, referred to the year as a challenging period for businesses in a growth phase. Interest rates climbed sharply with the benchmark AWPLR moving from 8.9 per cent to 11.5 per cent during the year. Exchange rates also increased during the year as the rupee depreciated by 5 per cent against the US Dollar while costs also increased due to increased taxation. Reduced harvests disrupted demand supply dynamics resulting in a contraction of consumer purchasing power.

He said retail prices have not been revised upwards since July 2015 when LPG prices were around US$416 /MT which have since increased to $573/MT in February 2017, closing the year at $564/MT. “We strongly urge the regulators to resolve this unsustainable stance and comply with the pricing agreement reached pursuant to the Supreme Court Order, facilitating sustainable value creation to our key stakeholders.”

He said profit growth is a key strategic deliverable and the board is focusing significant attention to implementing initiatives which are gaining traction to steer the course for delivery of this key goal in the financial year that has commenced.

Nawaloka preparing for mega car park

Nawaloka Hospital, which reported revenue of Rs.6.3 billion against Rs. 6 billion earlier and net profit rising to Rs.241 million from Rs. 206 million, is preparing for a mega car park being currently built.

Company Chairman Jayantha Dharmadasa said the construction of the car park building and specialist centre for Nawaloka Hospitals in Colombo is another feat that the hospital group is proud of.

“The multi-storey car park with 550 car parking facilities and specialist centre will make Nawaloka Hospitals the single largest private hospital complex offering exceptional patient comfort, family-centred care and an easily accessible platform for all healthcare needs,” he said.

‘Crude behaviour’ at

Lanka IOC?

The headline would imply Lanka IOC or LIOC was up to some ‘dirty’ tricks.

That’s far from the truth and ‘crude behaviour’ was a sub heading in the LIOC annual report to reflect on crude oil prices and production trends.

Great headline, anyway. For the record, company revenue was Rs. 81 billion, up from Rs. 71.3 billion in the year ending March 31, 2016.

Its chairman B.S. Canth had this to say on the oil market. “The single most critical factor that affects your company’s performance is the absence of pricing formulae for auto fuels. LIOC has been incurring losses on sale of petrol since January 2015, but LIOC could manage the situation due to cross subsidization of positive margins on diesel with negative margins on petrol.

But with recent increase in taxes on diesel, this cross subsidization is not possible now. Oil companies could not pass through these incremental taxes in their selling prices to consumers. Apart from taxes, due to substantial depreciation of Sri Lankan currency and increase in international prices of both petrol and diesel, the margins on both of these products have become negative as of date”:

He said that while the government takes steps to implement pricing formulae for auto fuels, in the meantime, immediate steps need to be taken to either increase the retail selling prices of auto fuels or reduce the taxes so that the operations of oil companies remain sustainable.

“Most of the developed economies, along with many developing economies have already implemented pricing formula for petroleum products and it is working very fine in these countries. Due to frequent changes in oil prices, consumers have become habitual of increase/decrease in petroleum prices. It may be noted that in case, increase/decrease is done after a gap of many months, it becomes an issue with the public.”

Prices in Sri Lanka, he noted, are very low as compared to the retail selling prices prevailing in the neighbouring countries or any oil importing nation. Whatever taxes governments in these countries have imposed, it has been passed on to the consumers. The retail selling prices prevailing in Sri Lanka are not only the lowest amongst its neighbouring Asian countries, but also very low if selling prices, net of taxes, are compared with the major economies in the world.

KVC re-examines options

The 117-year old C.W. Mackie is re-examining its options as per the Kelani Valley Canneries (Pvt) Ltd (KVC).

KVC manufactures a wide range of food and beverage products (F&B), which is mostly distributed in the local market under the KVC brand. However, distributing its products in the local market is constrained due to the high level of competition that prevails from other local F&B brands.

The report said that the strategy is, therefore, to pursue growth through exports, where there is considerable potential to expand the business.

Already small orders are being exported to Canada, Australia and Dubai.

Japan and Germany have been identified as markets that could be exploited, “The possibility of packaging F&B products under other proprietary brands for a fee is also being explored and this has been started in a preliminary way and will be pursued, as it also enables gainful utilization of surplus capacity,” it said.

In the background of rising cost of FMCG due to high fiscal duties and the depreciation of the Sri Lanka rupee against the US$ and Euro, the strategy on expansion is to introduce more locally manufactured food and beverage products for distribution in the domestic market. In the year 2016/2017 several new products in the bakery range, produced mostly out of local ingredients have been launched.

Healthcare costs rise

Healthcare costs continue to rise compounded by the Value Added Tax (VAT) imposed on specialist consultant fees and hospital room charges, says Durdans Hospital Executive Chairman Ajith Tudawe.

In the companyâs latest report, he said that additionally many customers have a high out-of-pocket spend as a percentage of private household expenditure as opposed to medical insurance of which penetration in the country remains significantly low.

âOn the other hand, the senior citizen segment of society does not qualify for medical insurance which poses a financial strain. As a result, the pressure is on the public healthcare sector which continues to face multiple problems of overcrowding, inconsistent service standards, lack of specialist care and in general strained resources to cater to the numbers seeking treatment,â he said.

Mr. Tudawe said that with its state-of-the-art private sector healthcare establishments, sound diagnostic facilities, relatively low costs versus global and regional players, very competent physicians, and nursing staff, Sri Lanka has much potential to become a popular destination for medical tourism and rank itself on the Medical Tourism Index. âAlthough, the country does see an influx of patients seeking treatment from China, Maldives and Africa especially Seychelles, this component is small. With Sri Lanka being a popular tourist destination, there remains much potential to improve the standards of medical tourism within the country.â