Columns

Balance of payments difficulties reflect structural weaknesses

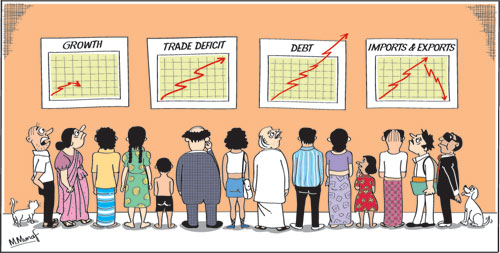

View(s):The current crisis in the balance of payments and the low external reserves of the country are symptomatic of fundamental weaknesses in the structure and performance of the economy over a period of time. Balance of payments crises will continue to recur if bold decisions are not taken to remedy the fundamental weaknesses in the economy.

Balance of payments

Balance of payments

Although the balance of payments (BOP) deficit of US$500 million (499.7 million) in 2016 was appreciably lower than the 2015 BOP deficit of US$1,488.7 million, it was significant enough to erode the country’s external reserves to a dangerously low level. At the end of 2016, external reserves were US$6 billion adequate to finance imports of only 3.7 months.

Causes

The large trade deficit of US$9.1 billion and the net outflow of capital owing to debt servicing costs (debt repayment and interest costs) and an outflow of foreign investment in government securities of US$324.3 million were mainly responsible for this depletion of foreign exchange reserves.

The situation would have been unsustainable had the government not received the first tranche of the IMF’s Extended Fund Facility (EFF). The government also borrowed from commercial sources to meet debt repayment obligations. These borrowings increased the foreign debt of the country to an estimated US$60 billion at the end of 2016.

Remittances and tourism

The external finances of the country would have been in a worse plight had we not received substantial amounts of remittances from abroad and earnings from tourism. Remittances of US$7.2 billion and earnings from tourism of US$3.6 billion together amounted to US$10.8 to more than offset the massive trade deficit of US$9.1 billion of last year. Although tourist earnings increased by 17 percent last year, worker remittances increased by a mere US$0.2 billion. This set back needs to be taken note of in expectations for the balance of payments for the future.

Trade deficits

Trade deficits have been a recurrent feature. There have been only about five years since independence when the country has had a trade surplus. The last trade surplus was 40 years ago in 1977 when a small surplus was achieved with stringent import and exchange controls and scarcities of basic needs.

Last year’s trade deficit was the largest in the country’s economic history. This large trade deficit was due to a decline in exports by 2.2 percent and an increase in import expenditure by 2.5 percent to US$19 billion. In recent years imports have been nearly twice the value of exports as in 2016.This is the fundamental weakness in the trade balance.

Last year’s trade deficit was the largest in the country’s economic history. This large trade deficit was due to a decline in exports by 2.2 percent and an increase in import expenditure by 2.5 percent to US$19 billion. In recent years imports have been nearly twice the value of exports as in 2016.This is the fundamental weakness in the trade balance.

GDP growth

The paradox of the Sri Lankan economic experience in the post war years is that the economy grew at a fairly rapid pace but the country’s external finances deteriorated. This was owing to economic growth being achieved mostly through large investments in infrastructure projects that did not increase the production of tradable goods. The large investments were mostly financed by foreign loans and were import dependent. Consequently economic growth did not increase exports but increased imports and led to high foreign indebtedness.

Import dependent growth

Sri Lanka’s economic growth was not an export led growth, as in most other Asian countries. It was a foreign debt and import dependent growth. Consequently high economic growth was achieved with increasing foreign indebtedness and large trade deficits. This economic experience has been aptly described as one of living beyond our means through increasing indebtedness.

Growth and indebtedness

The consequent debt repayment and interest obligations are a severe strain on the balance of payments. Debt servicing absorbs as much as one fourth of export earnings. The balance of payments is vulnerable owing to the huge foreign debt whose annual capital repayments and interest payments are a large drain on the reserves.

Between 2010-2015 the economy grew by an annual average of over 6 percent, foreign debt increased from about US$39 billion to US$57 billion and trade deficits expanded to over US$8 billion. Economic growth increased the trade deficit rather than reduced it. The foreign debt of US$57.4 billion at the end of 2015 is now estimated at about US$65 billion. Interest payments and capital repayments of this high external debt continue to make the BOP vulnerable.

Further debt

This legacy continued into the post 2015 years and the new regime was unable to strengthen the economy’s external finances by foreign direct investments and increased exports. The two years since 2015 has seen further increases in foreign debt to an estimated US$65 billion at the end of 2016.

Trade deficits increased rather than decreased. The trade deficit increased from US$7 billion in 2014 to US$8.4 billion in 2015 despite significant reduction in the oil import bill. The deterioration in the trade balance was owing to imprudent fiscal management and inappropriate monetary policies that increased import expenditure.

Despite improvements in fiscal, monetary and exchange rate management the trade deficit increased to as much as US$9.1 billion in 2016 owing to a poor export performance. The government has failed to develop an investment friendly environment to attract investments in export manufacturing industries. The imbalance in the country’s trade is clearly seen in the fact that imports are almost twice (percent) the value of export earnings.

Policy implications

The external finances of Sri Lanka reflect the poor management of the domestic economy. Domestic policies must be formulated and implemented to increase investment, encourage exports, restrain imports and attract foreign investors. The long-term improvement in external finances is dependent on right economic policies.

There is an urgent need to restructure the country’s economy towards a less import dependent export led economy. This can only be achieved by an investment friendly economic climate that attracts both domestic and foreign investors for export manufacturing industries.

Larger amounts of foreign investment in export manufactures to international supply chains are vital to boost exports.

Policy consistency and certainty in the implementation of policies is vital to gain such confidence. The last two years have seen vacillations in policies, withdrawal or not implementing announced policies and weak governance.

Foremost among the prerequisites to attract FDI is certainty in economic policies. A consensus on economic policies and certainty in their implementation are prerequisites to inspire confidence among foreign investors. The political environment and policy uncertainty are underlying reasons for the lack of investor confidence.

Leave a Reply

Post Comment