Columns

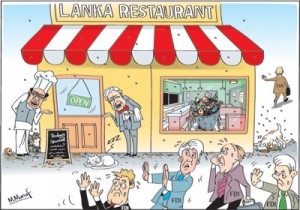

Why we can’t attract more foreign investments

View(s): The insufficient and decreasing inflow of foreign direct investments (FDIs) is most disappointing. FDIs have been declining from US$ 1070 million in 2014 to US$ 970 million in 2015 and it was only US$ 445 million in the first nine months of last year. Furthermore, most FDIs have been in property development and the hospitality industry rather than into export manufacturing.

The insufficient and decreasing inflow of foreign direct investments (FDIs) is most disappointing. FDIs have been declining from US$ 1070 million in 2014 to US$ 970 million in 2015 and it was only US$ 445 million in the first nine months of last year. Furthermore, most FDIs have been in property development and the hospitality industry rather than into export manufacturing.Sustained economic growth of 8 percent or more that would double per capita incomes in about ten years can be achieved only if annual investment is increased to at least 35 percent of GDP from the current level of about 28 percent. With cash strapped public finances most of this higher investment would need to come from domestic and foreign private investment.

While the quantum of foreign investment is important, the nature and type of FDI determines the long-term development of the country. A paramount need is investments in hi-tech export-oriented manufacturing.

Significance of foreign investment

FDI not only fills the savings-investment gap, it is a significant driver of economic development, as FDIs bring with them advanced technology and management practices and access to international markets. They also contribute to improving work ethics, skills and knowledge of workers. In due course there would be a transfer of technology that would increase the country’s economic efficiency and capability.

It is the realisation of these economic benefits that has made former communist countries such as China, Vietnam and formerly inward-looking India to actively seek foreign investments. These three countries attract a large amount of foreign investment, with China leading the world as the largest recipient of foreign investment.

It is the realisation of these economic benefits that has made former communist countries such as China, Vietnam and formerly inward-looking India to actively seek foreign investments. These three countries attract a large amount of foreign investment, with China leading the world as the largest recipient of foreign investment.

India obtains FDI of about 2.1 percent of its GDP, while Bangladesh gets 1.7 percent of GDP and Vietnam 6.3 percent of GDP. China attracts as much as 2.3 percent of its huge GDP.

The inflow of foreign investment to Sri Lanka is particularly low when compared to what other countries have been able to attract. It is only 0.8 percent of GDP.

Recognised importance

Recognising the importance of FDI, the Government has taken several measures to attract it. Investor forums, visits of the President and Prime Minister to investor countries and meeting political leaders and business leaders, welcoming foreign investors to the country and business enterprise development symposia are manifestations of the government’s enthusiasm for enhancing investment.

Many investors have expressed their satisfaction about the conditions in the country and articulated the view that Sri Lanka was now a good location for investment. The latest such pronouncement was from a Canadian business delegation. Yet these have not borne any tangible results so far as the figures demonstrate. Hopefully they would enhance FDI in due course.

Reasons for low FDI

The reasons for the low FDI are manifold. Foreign investment is influenced by an overall assessment of political and economic conditions, political and macroeconomic stability, certainty in economic policies, tax and other incentives, labour regulations, work ethics, social and economic infrastructure, costs of production, potential domestic market, ease of doing business and absence of bribery and corruption. For one or more of these reasons, the international investment community does not appear to consider Sri Lanka a favourable destination for investment.

Politics

The political situation is stable in the sense that the President and the Government are secure to rule for another two and a half years and have a large majority in parliament. However, international investors consider other features in the polity such as the violent protests of the Joint Opposition as destabilising.

Macroeconomic conditions

Among the macroeconomic conditions that may be dissuading investors are high fiscal deficits, a large foreign debt of about 75 percent of GDP, debt-servicing costs that absorb more than the government’s revenue, external debt-servicing cost of about 25 percent of export earnings, potential inflation and instability in currency value. There is uncertainty regarding government policies on foreign private investment.

There are fears that inflation may rise owing to the weaknesses in economic fundamentals. The low foreign reserves and large trade deficit and foreign borrowing cast doubts about the external finances of the country.

Production costs

Costs of production play an important role in investor determination of investment locations. Sri Lanka is no longer a cheap labour country. There are other countries such as Vietnam and Bangladesh where labour productivity is probably higher and wages cheaper. Several other production costs too are high; this is especially so with respect to energy costs that is deemed one of the highest. These factors make it rather unattractive to foreigners to invest here.

Labour laws

Sri Lanka’s Labour regulations also affect investment. Sri Lanka is perceived as a country where labour regulations do not permit labour discontinuance either owing to changing market conditions or on disciplinary grounds.

Domestic market

Further the possibility of selling in the domestic market is limited. Large countries like India and China offer good prospects of local sales. This is why reputed manufacturers of cars such as Mercedes Benz and BMW have manufacturing plants in India and China.

Since Sri Lanka is a location for export manufacture, the uncertainty in western countries offers poor prospects for exports. The exception to this trend of low foreign investment is the recent purchase of land in prime property areas for construction of large international hotels.

Conclusion

Factors determining foreign investment are many. Whatever be the precise reasons for tardy foreign investment, the Government must look into the reasons and provide a climate for enhanced foreign direct investment. Without a larger inflow of foreign investment, sustained economic growth of 8 per cent or more is unrealistic.

Foremost among the prerequisites to attract FDI is certainty in economic policies. A consensus on economic policies and certainty in their implementation are prerequisites to inspire confidence among foreign investors.

The chaotic political environment and policy uncertainty are underlying causes for the lack of investor confidence. The political environment of opposition to nearly every policy of the government, the protests and road demonstrations causing huge traffic problems are serious impediments to attracting foreign investment. The opposition to Chinese investments in Hambantota is a clear instance where politics has hampered an important foreign investment. One can hardly expect foreign investors to invest in a country where people protest violently to foreign investments.

Leave a Reply

Post Comment