Columns

Foreign Direct Investments continue to be inadequate

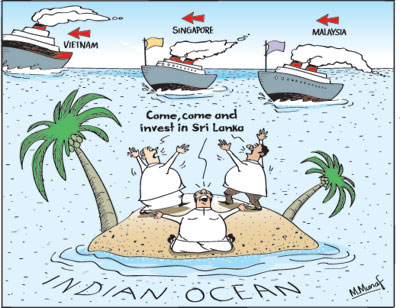

View(s):The expectation of higher amounts of foreign direct investment (FDI) remains unrealised. Foreign investment has been far below expected levels and low in comparison with other Asian countries. FDI is less than 1 per cent of the country’s GDP and much less than what countries like Vietnam and Bangladesh have been able to attract in recent years. Vietnam, a former communist country, is able to attract FDI of over 6 per cent of her GDP.

The end of the civil war in 2009 and the change of government in 2015 led to expectations of much higher FDI. Despite the unity government’s recognition that increased foreign direct investment is vital for the economic development, FDI remains inadequate. Why is FDI important and why have we failed to attract more investments?

Why FDI

Foreign investment comes in several forms: portfolio investment, foreign loans and foreign direct investment. Of these FDI in industry and services are the most valuable as they are risk free to the country and bring with it advantages of advanced technology, management practices and assured markets. An important advantage of FDI is that such investments lead to technology transfers as the work force, technicians and managers gain knowledge of the manufacturing processes and management practices. The value added by foreign industries contributes to GDP, earns foreign exchange, creates employment, increases incomes and contributes much to economic growth.

There is a need to invest around 35 to 40 per cent of GDP for the economy to grow by 7 to 8 per cent a year. National savings fall short of this by about 10 per cent. Therefore foreign borrowing and foreign investments have to meet this investment-savings gap.

Advantages of FDI

Foreign borrowing is costly and does not bring with it the several advantages cited above. Furthermore, if these investments fail the costs have to be bourne by the country. There are no such liabilities if a foreign investor fails. These advantages of FDI are generally recognised and successive governments have attempted to provide various incentives to foreign investors. However foreign investment has been far below expected levels and low in comparison with most other Asian countries. For instance India obtains FDI of about 2 per cent of her large GDP.

Recent FDI

There has been increased foreign investment in the hospitality trade, construction and real estate. Investment in hotels is beneficial as tourism contributes handsomely to foreign exchange earnings and such investment would increase tourists from many parts of the world. It is not merely an increase in FDI that is needed but also investment in key areas of manufacture that contributes economic growth.

Setbacks to foreign investment

Setbacks to foreign investment

The country missed many opportunities to attract foreign investments in industry owing to the ethnic conflict. When conditions after the 1977 liberalisation of the economy were conducive to attracting FDI, the ethnic disturbances of July 1983 put paid to such expectations. We missed the chance of attracting very important foreign investors. Large corporations such as the Harris Corporation, Motorola, Marubeni, Sony, Sanyo, which had decided to invest in Sri Lanka shifted to other countries like Singapore and Malaysia after 1983. We lost the opportunity of becoming a Newly Industrialised Country (NIC).

Security

Security

The security situation was the foremost reason for the country being unable to attract substantial foreign direct investment during recent decades. Tax concessions, financial incentives and assurances hardly offset this drawback. The Japanese, the highest aid givers and an important trading partner, did not become large investors in Sri Lanka owing to security conditions. The usual practice of aid, trade and investment moving in tandem did not occur in Sri Lanka owing to the civil war. This lost opportunity was very costly as it is much more difficult to attract FDI today.

New expectations and setbacks

Once peace and security was restored, there were once again expectations of FDI pouring into the country. This did not materialise as there was a lack of law and order, secure property rights and hostility to private investments. The Revival of Underperforming Enterprises and Underutilised Assets law empowering the government to take over underperforming and underutilising private enterprises was a serious disincentive to both domestic and foreign investors. While other countries guarantee the safety of investments, the overhang of a law of this nature that gives discretionary powers to the government to take over enterprises was a serious concern to investors.

Other constraints

Peace and security are necessary conditions, but not sufficient conditions to attract foreign investment. This is clear from the fact that FDI has been below expectations even after the change of government in 2015. Many other conditions have to be put in place to attract FDI. It is important to ensure an attractive investment climate. Consistent macroeconomic policies, good governance, economic stability, guarantee of property rights, rule of law and absence of corruption are among the conditions required to attract FDI. Consistency and predictability in economic policies and political stability are preconditions to attract FDI.

Labour laws in the country are unattractive as investors do not have flexibility in hiring and is continuing workers. While we have a literate work force for low end industries the wage rates are high in comparison with other countries like Bangladesh and Vietnam. On the other hand, high tech industries are not attracted to the country owing to the lack of highly skilled labour. Improvement in technical education is essential to attract high tech industry.

A natural disadvantage the country has is the limited domestic market. Large countries like India have the advantage of a large domestic market. The new free trade agreements with India, Singapore and China are expected to resolve this problem by attracting investors to produce goods for these larger markets.

Summing up

Increased foreign direct investment in export industry is vital for the economic development of the country. It is not merely an increase in FDI that is needed but also investment in key areas of manufacture. To attract such investment it is essential to ensure an attractive investment climate. Consistent macroeconomic policies and macro economic stability are essential.

The guarantee of property rights, rule of law and absence of corruption are among other conditions required to attract FDI. Without these, an adequate foreign investment of the right type will not be forthcoming.

Leave a Reply

Post Comment