Columns

Fragile economic fundamentals and weak economic performance in 2015

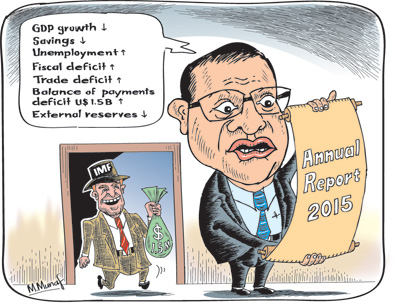

View(s):The dip in economic growth to 4.8 per cent in 2015 was as expected. It was a continuation of the declining trend in economic growth of recent years compounded by politically motivated economic policies in 2014 and 2015, disruption and distraction of two elections and unfavourable global economic conditions.

The fragile economic indicators and the growing economic instability in 2015 were more serious than this lower economic growth. The fiscal deficit was high, the trade deficit reached a peak, the balance of payments was in deficit and the country’s external reserves reached a critical level. Foreign debt reached US$ 44.8 billion, more than twice what it was in 2010, and became a severe strain on the external reserves.

The fragile economic indicators and the growing economic instability in 2015 were more serious than this lower economic growth. The fiscal deficit was high, the trade deficit reached a peak, the balance of payments was in deficit and the country’s external reserves reached a critical level. Foreign debt reached US$ 44.8 billion, more than twice what it was in 2010, and became a severe strain on the external reserves.

Declining growth

The decline in economic growth to 4.8 per cent in 2015 from a slightly higher 4.9 per cent in 2014 was a continuation of the declining trend in economic growth of recent years. The economy that grew by 8.2 per cent in 2011 tapered down to 6.3 per cent in 2012 and 7.2 in 2013 (old series). In 2014 it grew by 7.4 per cent on the old series but by only 4.9 per cent under the adjusted new series of national accounts.

The diminishing peace dividend and the non sustainability of the post 2010 high foreign funded infrastructure development strategy and bad fiscal management contributed to much of the declining growth.

Savings and investment

Savings and investment

Sri Lanka’s national savings, that is low for her per capita income, declined from 29.5 per cent of GDP in 2014 to 27.8 per cent of GDP in 2015. Domestic savings, that excludes savings of nationals abroad remitted to the country, declined from 24 per cent of GDP in 2014 to 22.6 percent in 2015. The decrease in domestic savings was due to the slowdown in private savings and the increase in government dis-savings due to the higher fiscal deficit. This decrease in savings has adverse implications for investment and economic growth.

Unemployment

Unemployment increased from 4.3 percent in 2014 to 4.6 per cent in 2015, amidst a marginal increase in labour force participation, particularly by females. Female unemployment increased from 6.5 per cent to 7.6 per cent, while male unemployment declined from 3.1 per cent in 2014 to 3 per cent in 2015.

Populist policies

The populist irresponsible fiscal policies in 2014 to face the impending Presidential election of January 8, 2015 not only slowed the growth momentum, but eroded macroeconomic fundamentals. Economic growth fell to 4.9 per cent as its consequence. The fiscal deficit increased to 6 per cent of GDP in 2014 and the trade deficit ballooned to US$ 8.3 billion. However, owing to increasing remittances, higher earnings from tourism and other services and a net inflow of capital, there was a balance of payments surplus of US$ 1.4 billion in 2014, in contrast to the deficit of US$ 1.5 billion last year.

Economic management

The poor economic management in 2014 impacted on the economy in 2015. The newly elected government aggravated economic conditions by honouring its election promises and further irresponsible and imprudent measures to placate the electorate to strengthen itself at the August 2015 parliamentary election. These are the real reasons for the slowing down of the economy, erosion of economic fundamentals and the balance of payments crisis the country is facing today.

Fiscal deficit

These policies resulted in the deterioration of the fiscal balance in 2015. The fiscal deficit increased substantially from 5.7 per cent of GDP in 2014 to 7.4 per cent of GDP in 2015, way above the 2015 and 2016 budget targets of 5 per cent and 5.9 per cent, respectively. According to the Central Bank, the reasons for this deterioration in the country’s public finances were: “the lower than expected collection of government revenue, high level of recurrent expenditure, particularly on salaries and wages, welfare expenditure, and higher than estimated outlay on interest payments”. Shortfalls in government revenue and overshooting of government expenditure have been an unfailing annual recurrence in public finances to such an extent that budgetary estimates are a ‘financial fiction’.

Trade deficit

These developments in fiscal performance had serious implications on the external finances. The increase in aggregate demand owing to higher public expenditure and fiscal policies resulted in much higher imports, despite oil import expenditure falling sharply. Consumer imports increased significantly, with a conspicuous increase in vehicle imports by 52 per cent in 2015 that wiped out the gains of lower oil prices.

Imports were US$ 18.9 billion, whereas exports declined to US$ 10.5 billion due to lower demand for tea, curtailment of fish imports to EU countries and a sluggish global demand for manufactured goods. Consequently, the trade deficit increased beyond the 2014 peak of US$ 8.3 billion to US$ 8.4 billion. This was an underlying cause for the deterioration in the balance of payments.

Balance of payments

The balance of payments recorded a deficit of US$ 1.7 billion owing to workers’ remittances not increasing as in past years. They declined marginally by US$ 0.5 billion owing to lower incomes in oil exporting Middle Eastern countries. However an increase in earnings from tourism and other services reduced the balance of payments deficit to US$ 1.5 billion.

External reserves

This deterioration of the balance of payments resulted in the gross official reserves declining from US$ 8.2 billion at end 2014 to US $ 7.3 billion by end 2015. This forced the Central Bank to adopt a more flexible exchange rate policy that resulted in the depreciation of the rupee by 9 per cent by the end of 2015.

Way forward

The Central Bank has pointed out that “decisive steps are necessary to correct these vulnerabilities to ensure the country’s progress along a high growth – low inflation path.” And that “it is necessary for the country to adopt a proper blend of structural reforms, including fiscal reforms on revenue and expenditure fronts as well as with regard to State Owned Enterprises (SOEs)…”.

Will the unity government undertake the fiscal reforms that are needed to increase government revenue and reduce the fiscal deficit? Will it undertake reforms in public enterprises that would reduce the colossal losses of state owned enterprises? Will it have the political will and resolve to take policy measures that would rescue the economy from the current crisis?

Leave a Reply

Post Comment