Columns

From paradise to hell: The inside story of how SriLankan Airlines was skyjacked and plundered

- Minister Kabir Hashim reveals details of how billions were wasted or pocketed by unqualified political lackeys

- Cancellation of huge Airbus order costs millions, but minister says there is no option; Govt. gives six-month lifeline for turnaround of national carrier

- Economic crisis: Govt. must stop giving top jobs to racketeers who rob people’s money

Public Enterprises Development Minister Kabir Hashim

SriLankan Airlines, the country’s national carrier, that once offered a “taste of paradise” to its clients, is now on life support with Treasury handouts. The enormity of its mismanaged financial debacles unfolded last Wednesday when Prime Minister Ranil Wickremesinghe chaired a top level meeting. There, Finance Minister Ravi Karunanayake agreed to continue Treasury funding for the airline only for the next six months. Public Enterprises Development Minister Kabir Hashim, who is responsible for SriLankan, has been tasked to formulate new strategies within this period to pull it out of its deep financial mess. A number of options are being looked at including a possible tie-up with another airline. Even views of different international consultancy firms have been sought by the airline. They will meet the Premier again when proposals are ready to make urgent decisions.

RANIL REVEALS STATE OF THE ECONOMY

That it comes when the Government faces a serious economic crisis has made matters worse. Premier Wickremesinghe told Parliament on Thursday, “Minister Kabir Hashim informed me that the exact debt concerning SriLankan Airlines could be higher than the amount stated at present. The national carrier may not be able to repay it. We have to decide whether the Treasury is going to shoulder this burden. We will inform Parliament of any such decision as soon as the Cabinet of Ministers decides on it. Within the next month the Government will make a final decision on how to handle the current debt situation of SriLankan.”

Wickremesinghe added, “We have had to amend the Budget proposals from time to time due to the fast changing situation in the global economies. The Government has initiated agreements for a US$ 1.5 billion swap from the Reserve Bank of India, while it had also sought another US$ 1 billion swap from the Central Bank of China to face the prevailing foreign exchange issues. There are also ongoing discussions with regard to the tax proposals.” Some will be implemented, he said, from next month and the rest from September. He said the discussions with the IMF are mainly to deal with the tax system while the discussions on “a loan are secondary.” Such a standby loan of US $ 1.5 billion is being sought from the IMF was formally announced for the first time at a news conference by Special Assignments Minister Sarath Amunugama.

Finance Minister Ravi Karunanayake

At a tea party on Thursday to mark his 67th birthday, an ebullient Premier Wickremesinghe told reporters gathered at ‘Temple Trees’, of course jokingly, that they may have to liquidate the airline if they cannot turn it around. It transpired at Wednesday’s meeting that SriLankan cannot continue to function with the existing structure as the losses incurred on operations do not even support servicing its loans. In other words, the airline is now insolvent. “This joke can become a serious thing,” warned an official who stood close by. As Minister Karunanayake was to tell Treasury officials at a meeting on Friday that Sri Lankans had to pay more for their essential food commodities because the previous Government pumped millions of rupees to an airline which was then known to be failing. He charged that this was one of the worst ‘economic crimes’ of the previous administration. “We have been dumping billions of rupees to a bottomless pit,” he added.

ARROGANCE OF POWER

In 2008, former President Mahinda Rajapaksa unceremoniously abrogated the management agreement where the Dubai-based Emirates Airlines managed SriLankan. It was over an ‘ego battle.’ Peter Hill, the then Country Manager of Emirates in Colombo, had refused a request from Sajin de Vass Gunawardena, the then Monitoring MP of the Ministry of External Affairs, to accommodate a presidential entourage on a flight from London to Colombo. This was just before it was to depart. Hill had said that the flight was fully booked with fare paying passengers and a last minute cancellation was unfair. Hill was also unceremoniously asked to leave Sri Lanka. It was nothing but the ‘arrogance of power’ at the expense of the country. This folly has proved to be financial disaster for the national carrier and a lesson on how inexperienced, unqualified persons had virtually run it to the ground. Making matters worse was the inability of the new Board of Directors appointed by the United National Front Government to make a turnaround. It is known that the Board is divided into two factions. An acute lack of aviation experience or knowledge among them is known to be a major cause.

In 2008, when Emirates pulled out, the accumulated profit of SriLankan was Rs. 9.288 billion in that financial year. From 2008 to 2015, when the Rajapaksa administration ran it, the loss for the seven years was Rs. 128.238 billion.

Shareholders equity which stood at Rs. 15.5 billion was Rs. 74.1 billion from 2008 to 2015. Interest Bearing Liabilities (Bank and Financial Owings) which stood at Rs. 953.57 million was Rs 76,065.63 million. Current assets of SriLankan (inventories, trade and other receivables, aircraft maintenance reserve, cash and bank balances) as at January 31, 2016 total US$ 368.58 million. The current liabilities during the same period (trade and other payables, income tax payable, interest paying liabilities) total US$ 937.47 million. In simple terms, the national carrier owes more than it owns. Its cash requirement from now till October is placed at US$ 187.47 million or Rs. 26,995.68 million.

BANK LOANS

BANK LOANS

SriLankan Airlines has obtained facilities from a number of local banks and foreign concerns. This includes the Bank of Ceylon, the People’s Bank, Standard Chartered Bank, Commercial Bank, Amana Bank, Air Lease Corporation and the Ceylon Petroleum Corporation (for fuel). The total amount involved is US$ 518.35 million of which US$ 272.79 million still remains to be paid. The Treasury has now agreed to issue letters of Comfort to Bank of Ceylon and the People’s Bank calling upon them to extend beyond March 31 the payment date as the equity required to repay these loans is not forthcoming.

Ironically, the losses mounted in the recent years as SriLankan management used the national carrier more for fun and frolic. A Government in power then ignored the goings on and for it the airline was a job bank. “Lot of people ask me whether we are selling SriLankan. I tell them no, we may have to bury it,” Minister Hashim declared underscoring the serious situation. The colossal losses, if avoided, would have been enough to build 300 schools or 65 fully equipped hospitals,” he told the Sunday Times.

Hashim revealed that a fleet of Airbus aircraft had been procured 30 % above the market price. “They were ordering aircraft like purchasing three-wheeler scooters. There was unbridled corruption and some appear to have made it very rich,” he said. I asked him why there was no accountability when vast sums of public funds were involved. I pointed out that at least one high ranking SriLankan personality (now serving) had remarked that it was not his job to investigate corruption and malpractices of the past. Hashim’s reply: “I am sorry the SriLankan Board of Directors has not investigated the wrong doings. It was a very serious lapse on their part. There is no question about it. I also must take the responsibility for not asking them then. There are some influential corrupt elements who have interfered to stall matters being investigated and the wrongdoers identified. I am aware of them. I will ensure the Board of Directors of SriLankan undertakes a detailed investigation. Immediately thereafter, I will ensure law enforcement agencies follow up on the findings and bring the culprits to book.” He said ‘looters’ of public funds should not be allowed to get away, however powerful or influential they were.

Attorney at Law J.C. Weliamuna who was a one-man “Board of Inquiry” that probed SriLankan in his voluminous report in March last year made strong strictures on Chairman Nishantha Wickramasinghe (brother of Shiranthi Rajapaksa) and Chief Executive Officer Kapila Chandrasena. Whilst “there was no justification for a full time Chairman,” the report said the appointment of Chandrasena was questionable. The latter’s “only airline experience was a short stint at Mihin Lanka, whilst his apparent qualifications and experience was in telecommunications.” The appointment of the CEO was void of “any competitive interview process,” further advancing the questionability and suitability of his appointment, the report said.

Loss-making SriLankan Airlines aircraft on the tarmac of loss-making Mattala Airport

WORKING FOR NAMAL

One instance pointed out by the Board of Inquiry highlights the state of affairs that prevailed. It related to the release of a cabin crew member, purportedly to work at the Presidential Secretariat. She had admitted that she worked at Namal Rajapaksa’s office in ‘Temple Trees’. She had been “illegally” granted Rs. 75,000 a month from SriLankan as fuel re-imbursements. The former Chairman or the CEO had approved such payments totalling Rs. 2,853,935.04. The petrol bills submitted, it turned out, had false serial numbers.

The Board of Inquiry termed SriLankan’s re-fleeting programme as “irrational” and was completely untenable since the decisions were taken in 2011 when the airline was facing a dire financial crisis. It added “The BOI also scrutinised the role played by Seabury, which acted as a consultant to SriLankan. Seabury is a global advisory and merchant banking firm based in Connecticut in the United States. The BoI noted a conflict of interest since Seabury, which participated in the re-fleeting recommendations, was actively involved in the aircraft negotiations with Airbus and Boeing and was responsible for the final selection of Airbus as the supplier. This possible conflict of interest is consequent to the fact that it is customary in large-scale businesses of this nature that a 3-5 % fee is normally paid as a facilitation fee on the purchase of aircraft.”

Minister Hashim said the Government was looking at the possibility of cancelling orders already placed for six A330-300 and four A350s. Needless to say it will cost the Government millions though, ironic enough, that is one way of saving more millions being lost otherwise. These aircraft, he said, were not suitable for Sri Lanka. A middle man or more have made a load of money. “There is no choice but to take tough decisions. This is downright treachery,” he said. According to Deputy Foreign Minister Harsha de Silva, who tabled a background note on SriLankan in Parliament on Thursday, for the purchase of the new aircraft, and the lease of an additional A350s in 2017, the memorandum submitted to the Cabinet of Ministers “did not disclose the full picture.”

In a memorandum dated March 14, 2012, the then Civil Aviation Minister Priyankara Jayaratne obtained approval for raising US$ 175 million from the Mashreq Bank in Dubai on the strength of an “anticipated Government guarantee.” He said the loan would be utilised, to pay creditors (mainly the Ceylon Petroleum Corporation), short term bank loans and to meet capital expenditure including investment required for Hambantota (Mattala) International Airport to provide ground and air cargo handling services.

However, on December 4, 2013, the then Minister Jayaratne forwarded another cabinet memorandum seeking “Government guarantee on behalf of SriLankan to a syndicate of Banks led by Standard Chartered for US$ 50 million plus interest thereon valid for a period of three years.” He also recommended that “SriLankan be authorised to carry out an international bond issuance up to US$ 175 million and that the principal, interest and other levies and charges payable on the said international bond issuance be guaranteed by the Government of Sri Lanka. Furthermore, that the Secretary to the Ministry of Finance and Planning (or his nominee) be authorised to negotiate and finalise the documentation relating to such guarantee.” The sum effect of these recommendations by the then Minister Jayaratne was to ensure that the “outstanding guarantee of US$ 175 million issued to Mashreq Bank, UAE was cancelled.” Ministers of the former Government who were called upon to approve recommendations were not provided with any note or documentation related to SriLankan when matters were placed before ministerial meetings.

Hashim said that in 2008 there were 5,130 employees in SriLankan. Former President Mahinda Rajapaksa, he charged, had “packed the place” with those from Hambantota. In 2015 employee strength stood at 6,987. If the staff per aircraft was 365.21 in 2008, it was 332.71 in 2015. This is when there was no Srilankan aircraft which had even 300 seats. This ratio is said to be above the global average or best conditions adopted by reputed airlines.

ADVICE FROM EXPERT

SriLankan Airlines engaged Nyras, a British aviation consultancy company having among its clients British Airways, Etihad, Lufthansa and Royal Jordanian Airlines. It was called upon to recommend specific options to overcome the grave financial status. It forwarded four alternatives and the current management preferred one which recommended the use of only its A 330 fleet and the sublease or disposal of all A350s. The recommendation is based on the assumption that all debts of Srilankan are to be settled with capitalisation and fuel prices are structured on a US$ 50 per gallon of crude oil. Here is how Nyras has elaborated its option which the Board of Directors of Srilankan appears to be in favour conditionally.

- The GOSL will write off the losses in the books via a capitalisation to present a clean balance sheet and achieve a zero finance cost status. This will cost the GOSL approximately Rs. 135 billion or US$ 939 million.

- The four A350 900 aircraft be subleased to other operators or cancel the lease contract at a cost of US$ 200 million to US$ 300 million and the GOSL to foot the bill. This will cost the GOSL approximately Rs. 43.2 billion or US$ 300 million.

- Although resource optimisation is strongly recommended by Nyras, the costs and outcome have not been incorporated in its projections. The implementation of a resource optimisation programme will have a cost impact in the year of implementation and could be in the range of Rs. 15 billion to Rs. 18 billion or US $ 100 million. Analysing the above, Nyras says, the cash outlay would be in the range of Rs. 175 billion to Rs. 200 billion.

- Among the factors covered by the Nyras plan are a shrink in Srilankan fleet from 25 to 20, increase in aircraft utilisation, increase passenger numbers, increase seat capacity, increase block hours and “consider Alternative D to remove ‘hangman’s noose’ of Aercap, Airbus and Rolls Royce contracts.” This alternate “D” related to the administration process.

The SriLankan Board of Directors, sharply divided over several key issues, has said that to use A 330s and sublease/dispose of all A350s will be possible only if there is a firm commitment from the GOSL to fund the airlines. In other words, the directors are still seeking Government handouts for which Sri Lankans would have to pay through different means. The Board has added: “Given the fact that the post restructure results of air transport activity are yet a negative US$ 30 million per year, this segment of business is very unlikely to reach a profitable status in the short term due to the unprecedented level of price competition from the Middle Eastern carriers. This is unless the GOSL is willing to come up with a committed funding programme.

The plan presented for the revival of SriLankan will require a minimum six months to initialise. Therefore, Nyras has said the organisation needs to be supported to end October 2016 in its present mode of operation if we are to embark on a serious restructure plan for the turnaround of the ailing airline. This requires State/Treasury funding of operations and the need amounts to an immediate US$ 67.28 million and a further US$ 120 million staggered over the six months — April to October 2016.

The Ministry of Public Enterprises Development has also come up with a blueprint to enable “the management survive the coming six months with the injection of required funds.” Some of the highlights:

- Evaluate and adopt the optimal strategy in consultation with the management and Nyras.

- Mitigate the risk and minimise the loss on the cancellation of the Airbus aircraft lease contracts. Seek appropriate legal assistance. At present, there is no other practical option in this regard.

- Set up the right restructure team to drive the preferred strategy and achieve the envisaged results. This will need external resources to drive the change process.

- The Government will need to seriously evaluate the finance restructure in the strategic plan. The recommendation to capitalise losses in order to clear debts and supplier credit to present a clean balance sheet will involve heavy capital investment.

- The Board, the management and the Government need to work in unison to achieve realistic and sustainable turnaround. At present, there is a very visible divide between the board and the management.

- The only option available to create value that will attract a potential partner or a buyer is to restructure the organisation as per the selected strategy. This would require a committed time frame of a minimum 12 to 18 months. There is no short cut to achieve a sustainable turnaround. The overall Srilankan liabilities as at December 31, 2015 is US$ 3,252 million or Rs. 461 billion.

What seemed ironic is that the previous Government in June 2015 approved a plan to restructure SriLankan but it was not implemented. Among the matters the Cabinet of Ministers decided then was to cancel the lease of the four A350-900 aircraft and route “rationalisation by shifting the European sectors to a more optimised Asian centric model.” Other measures included transfer of ownership of Mihin Lanka to SriLankan and to make it a fully owned subsidiary and divest 49 percent of the stake in 2016/2017 in Srilankan Catering. The Government decided to make an equity contribution of US$ 25 million in 2015/2016 to 2017/2018 to Mihin Lanka. A Cabinet Minister of the previous Government declared that the “directors then were more powerful than us. What the ministers said always fell on deaf ears. Some even feared to speak for there would have been repercussions.”

SLOW PROGRESS OF INVESTIGATIONS

Now Government leaders who are familiar with the worrying state of affairs at SriLankan say those responsible for bleeding the country’s economy by causing mounting losses should be brought to book. They say that the goings on at SriLankan, particularly the purchase of new aircraft and the subsequent decision to cancel them, is a clear sign that all was not well. Some are even suggesting a Commission of Inquiry with a distinct time frame. Yet, the question is whether such inquiries will add to the list of investigations which are now moving at snail’s pace.

In fact the matter was raised at last Wednesday’s weekly ministerial meeting by Minister Champika Ranawaka. He was alluding to several inquiries, particularly those relating to members of former President Mahinda Rajapaksa’s family. President Maithripala Sirisena was to assure he would ask that the process be stepped up. Senior CID officers say that they had to pay heed to periodic advice by the Attorney General’s Department to ensure the investigations are thorough so there would be a fool proof case in a court of law. They claim this was the reason for the slow movement of some cases. The discussion also focused on recent remarks by Ven. Uduwe Dhammaloka Thera that he was suspicious of the death of Ven. Maduluwawe Sobitha Thera. He alleged foul play. Premier Wickremesinghe noted that a statement from Ven. Dhammaloka Thera would reveal whether he had any evidence to confirm such an accusation. In such an event, even the appointment of a Commission of Inquiry is not being ruled out.

Participating in last Wednesday’s meeting were Chief Ministers of different provinces. Their presence has been sought to discuss some perceived anomalies with regard to financial matters. It has been noted that some Provincial Councils were receiving funds from non-State agencies without recourse to the relevant line ministries. This has been causing concerns. The Chief Ministers were told that the Government will not put an immediate stop to it. It would be continued for the current year but that matter is to be reviewed thereafter.

There is a strong lesson for the Government to learn from the manner in which SriLankan has been operated. Though to a lesser degree, it is the same fate when it came to other loss-making state concerns. The time has come for the Government to introduce stringent legislation to impose deterrent punishment on those known to have deliberately squandered away public funds. The PMO (Prime Minister’s office) is said to be taking a supervisory role of the under-performing state institutions. It started with the Ministry of Foreign Affairs, but up till now, no particular changes have been seen in the way the ministry is run. In the case of SriLankan, the material for a probe exists with the Weliamuna report. Until stricter discipline is enforced to prevent misappropriation and mismanagement of state ventures, the malaise is bound to continue.

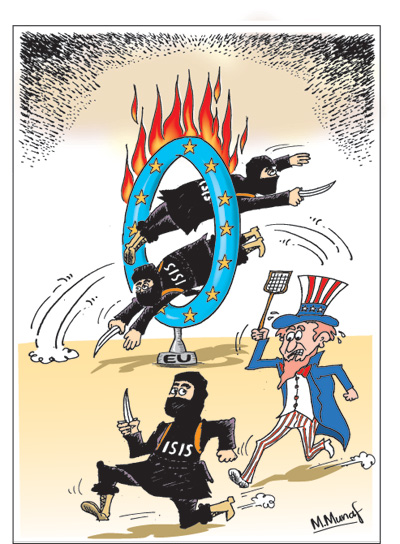

The question is whether the Government is prepared to go that extra mile to legislate to take to task those ‘vultures’ who have preyed on public funds. In fact, a sizeable volume of the bleeding economy is the residue from the previous administration. The people, however, see those ‘vultures’ doing business with the new Government also. The question is whether that should be allowed to continue. It goes without saying that in specialised areas, those who possess expertise and not mere ‘businessmen’ or lobbyists (to all sides) should head state ventures or be part of it. In the case of SriLankan Airlines, the message has become clear only after billions have gone down the drain and some of it, into the pockets of those who managed it.

Leave a Reply

Post Comment