Columns

Clarity and certainty in government’s economic policies important

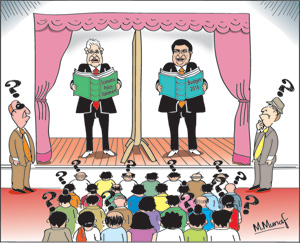

View(s): The government’s economic policies must be unambiguous and certain. At present there is much confusion in economic policies. The November 5, 2015 Economic Policy Statement of Prime Minister Ranil Wickremesinghe has not been implemented in the budget that followed. Consequently there is uncertainty and confusion about the government’s economic policies.

The government’s economic policies must be unambiguous and certain. At present there is much confusion in economic policies. The November 5, 2015 Economic Policy Statement of Prime Minister Ranil Wickremesinghe has not been implemented in the budget that followed. Consequently there is uncertainty and confusion about the government’s economic policies.

At a time of serious economic difficulties, as at present, there is a need for clarity in economic policies to foster business confidence and investment, domestically and internationally. Certainty in economic policies is especially needed as the government is a coalition of two parties that have had different policies in the past. Discordant voices from government ministers too are not conducive to the country’s economic stability and advancement.

Economic Policy Statement

Economic Policy Statement

The Prime Minister’s Economic Policy Statement was a carefully crafted, wide ranging and comprehensive framework of policies. It contained the essential policies required to resuscitate the economy. Most important was the fiscal policy stance needed to ensure economic stability. It announced a progressive reduction of the fiscal deficit to 3.5 per cent of GDP by 2020. Government policies towards this objective would have strengthened the economy and imbued confidence.

Some of the PM’s proposals such as the mega projects were ambitious and controversial. Nevertheless, the outstanding merit was that the statement outlined key policies that should be pursued to ensure economic stability. It announced the intent to ensure fiscal consolidation and fiscal sustainability and spelled out the taxation principles to increase revenue more equitably. Progressive direct taxation and reduction of losses of state owned enterprises were key policies that were announced.

Budget

About a fortnight later on November 20th, the 2016 Budget diverged from the principles enunciated in the Economic Policy Statement and these were not consistent with the announced economic policies. The fiscal deficit was hardly reduced and several features in the budget indicated an increase in the budget deficit owing to lower taxes and higher expenditure.

The budget is the centre piece of a government’s economic policies and the means of implementing the government’s economic principles and policies. While the Economic Policy Statement indicated a progressive reduction in the fiscal deficit from 6 per cent in 2015 to only 3.5 percent of GDP in 2020, the budget proposals and the subsequent amendments increased the deficit.

Fiscal consolidation

Steps towards fiscal consolidation would have stabilised the economy, induced confidence in the country’s macroeconomic soundness, reduced the trade deficit, contained the public and foreign debt and enabled the gradual strengthening of the balance of payments and the foreign reserve position. The intent of such a reduction in the fiscal deficit in the Economic Policy Statement was not evident in the budget.

Divergent policy

The divergence between the economic policy statement and the budget that followed was weird and disconcerting. The budget was not indicative of fiscal policies that would reduce the deficit. It estimated a fiscal deficit of 5.9 per cent that was hardly an improvement of the 2015 deficit estimated at 6 per cent of GDP. In fact the fiscal deficits of these two years are likely to be much higher than 6 per cent owing to increased expenditure and reduced revenue in these years.

There were several indications in the 2016 Budget itself that government revenue would be inadequate to reduce the deficit. The lower taxation of personal and corporate incomes would gather less revenue. There were no firm taxation measures that would have increased revenue much above the 13 per cent of GDP. The Budget and the subsequent amendments reduced government revenue, on the one hand, and increased government expenditure on the other.

Regressive taxation

The Prime Minister had indicated that the country’s regressive taxation system that relied on indirect taxes for 80 per cent of revenue would be reduced to 40 per cent and that direct taxes would rein in 60 per cent of revenue.

Indirect taxes that are mostly on basic consumption items are a heavy burden on the poor. Lesser reliance on these would have been a boon to the poor. For this to be realised however there has to be a more than commensurate increase in direct taxes. In fact direct personal income taxes and corporate taxes were reduced and the reliance on indirect taxes is estimated at 85 per cent of revenue. Admittedly the increase in indirect taxes do not all fall on the poor, some new indirect taxes increases taxes on affluent consumption.

Nevertheless there was no significant relief for the lower income households through a new taxation system. On the other hand, the threshold on direct income taxes was increased to a very high 2.5 million a year and the tax rate reduced to 15 per cent. Some effective withholding taxes too were removed.

These measures besides not taxing the affluent are likely to reduce government revenue. Furthermore, amendments to taxation measures would decrease revenue even more. The bottom line is a fiscal deficit much higher than the 6 per cent of GDP envisaged in the original estimates. Far from the realisation of the Prime Minister’s intent to reduce the fiscal deficit sharply, the budget took steps in the opposite direction.

Loan conditions

The IMF is likely to advice the government to follow a package of policies similar to Prime Minister Wickremesinghe’s statement. It is likely to require the government to undertake far-reaching reforms that are needed to address the core problem of the large fiscal deficits to bring it to about 4.5 per cent of GDP in 2016 and reduce it further to the PM’s objective of 3.5 per cent in 2020. Steps would also have to be taken to bring down the foreign debt to less than 60 per cent of GDP from its current level of 73 per cent.

The IMF would require the government to reduce public expenditure. The reduction of losses incurred by state owned enterprises that are a heavy burden is one important means of reducing expenditure. These losses have to be lessened by reforms of public enterprises that the Prime Minister announced in his Economic Policy Statement.

Conclusion

It is vital that the government’s economic policies follow the framework announced by the Prime Minister. The IMF conditions for the stand by facility too would be similar. Fiscal consolidation has to be the cornerstone of the country’s economic policies. It is vital that the government’s economic policies are clear and certain.

Leave a Reply

Post Comment