Columns

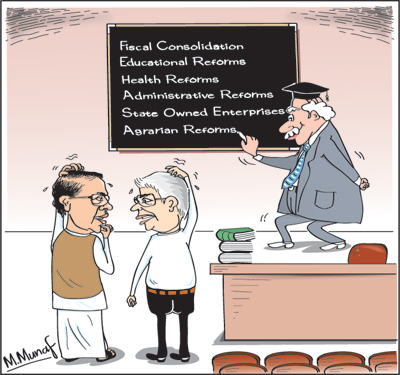

Formidable economic challenges for the new government

View(s):Hopefully the coalition government would provide political stability, ensure good governance and take bold economic and social policy decisions for the country’s development. President Sirisena has a critical role and responsibility in ensuring political stability and good governance.

The UNP-led United National Front for Good Governance (UNFGG) that obtained 106 of the required 113 seats to command a majority in parliament has formed the government with President Maithripala Sirisena’s loyalists. Hopefully the coalition government will have the strength and resolve to take measures towards economic stabilisation and begin a reform programme that would ensure economic and social development.

The UNP-led United National Front for Good Governance (UNFGG) that obtained 106 of the required 113 seats to command a majority in parliament has formed the government with President Maithripala Sirisena’s loyalists. Hopefully the coalition government will have the strength and resolve to take measures towards economic stabilisation and begin a reform programme that would ensure economic and social development.

Coalition’s stability

A stable and strong government for the next five years is a prerequisite for effective economic policy making aimed at economic development. Therefore, the terms and conditions on which the coalition government is formed should have an agreed agenda to minimise conflicts on policy issues. An unstable government would not be in a position to take bold and often unpopular political decision for the country’s economic advancement.

Fiscal consolidation

Fiscal consolidation

The new government has the challenging tasks of fiscal consolidation and the undertaking of reforms to enhance productivity. Fiscal consolidation (reducing the fiscal deficit) is essential for economic stability and for obtaining fiscal space that would enable a prioritisation of government expenditure for long run economic development. The promises for increased expenditure on health and education can be implemented with much higher government revenue and by cutting wasteful, extravagant and unproductive expenditure.

Increasing revenue from its current level of about 12 percent of GDP to 15 percent requires significant tax reforms and increased efficiency of the tax administration. Reducing the public debt, the trade deficit and the foreign debt burden are closely related challenges.

A priority task would be to reform the tax system. A beginning to such reform could be an open and free discussion of the Presidential Tax Commission Report that has been kept secret by the previous government for unknown reasons. It is vital that the budget for 2016 that is scheduled to be presented in November this year proposes a rational and effective taxation system that would be a cornerstone for economic stability and growth.

Improving investment climate

Investment is a key issue in ensuring economic growth. How the required level of investment is obtained is important. The revenue to GDP ratio has been declining from 20 percent of GDP to about 12 percent. How domestic resources required are obtained is crucial to achieve growth and high human development. It is not only the amount of revenue obtained but from what sources these are obtained has relevance for economic growth. The investment environment is crucial to specially getting the private sector to be the engine of growth.

Much of the growth would have to come from higher foreign direct investment that has been inadequate in the past. Policy reforms that are conducive for foreign investment are vital to generate a high growth momentum. Policy reforms that are conducive for foreign investment are vital to achieve a high and sustained economic growth momentum.

Reforms

In as much as fiscal consolidation is vital for macroeconomic stability, a wide range of reforms are needed to reduce government expenditure and enhance economic productivity.

The enhancing of institutional capacities, reforms in education and health sectors and drastic changes in the management of state enterprises that are a huge burden on the public finances and significant impediments to growth have to be addressed.

Reforms are needed in education, health administration and agriculture, among other areas. Without such reforms productivity cannot be enhanced to achieve the country’s potential development. This requires pragmatic steps that are difficult to implement due to political considerations overriding economic considerations.

Administrative reforms

The efficiency of government institutions is important for economic development. The country has an excessively large but inefficient public service that makes doing business slow and expensive. The Administrative Reforms Commission addressed these issues, but its recommendations have not been considered. The new government must look into these reforms suggested by the Wanasinghe Commission.

Educational reforms

Educational reforms are vital for economic development. There is incontrovertible evidence the world over that improvements in education are crucial for growth. This is especially so in modern economic development where hi-tech technology and scientific skills are vital for developing industries and services that are the powerful drivers of growth by enhancing comparative and competitive advantages.

Although increasing investment on education is vital it will not suffice to achieve the desired objectives unless it is accompanied by educational reforms. It is not only the proportion of GDP publicly expended that matters, but reforms that improve the quality and relevance of education. Public expenditure on education must be reoriented to enhance education in fields that develop educational infrastructure in science, mathematics, English, computer science and other useful subjects to provide the skilled staff for the expansion of high tech industries and ICT services that enhances economic growth.

Health

Sri Lanka’s universal free health system has achieved much. Yet there are gaping deficiencies such as inadequate doctors and nursing staff, unavailability of drugs and insufficient diagnostic devices and facilities congestion and lack of beds at government hospitals. There is an urgent need to enhance geriatric care and for illnesses associated with the country’s ageing population. Increased expenditure would resolve some of these problems by recruitment of more doctors, for giving technology and increased drugs. Yet the efficacy of the increased expenditure can only be achieved with changes in hospital administration and improvements in service conditions of staff. An investigative commission that recommends health reforms is essential.

Wrapping up

While reforms are critical for the enhancement of economic efficiency, they are difficult to implement. Reforms are even more daunting challenges than fiscal consolidation as vested interests, ideological factors and an anti-reform culture prevails in the country. Most reforms are politically unpopular as there is a built-in fear that resists changes.

A strong government that is stable for at least five years provides the opportunity to undertake reforms that are often unpopular in the short-run.

Leave a Reply

Post Comment