Columns

Concerns on economic downturn and post-poll growth

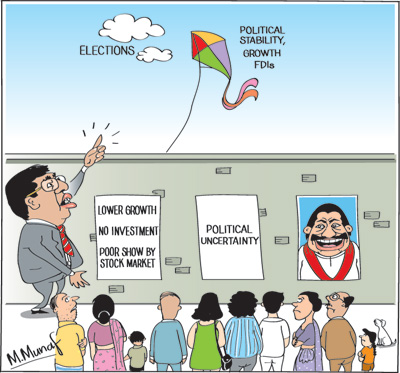

View(s): Many reasons account for the growing anxiety about the economy. The stoppage of several large foreign-funded construction projects has slowed down the construction sector. The mismanagement of the Treasury bond issue and the interim government’s economic management have not helped improve business confidence. The downward trend in stocks and low turnover reflects the depressed investment climate. And above all political controversies have created uncertainty and economic pessimism that is not conducive to private investment and economic growth.

Many reasons account for the growing anxiety about the economy. The stoppage of several large foreign-funded construction projects has slowed down the construction sector. The mismanagement of the Treasury bond issue and the interim government’s economic management have not helped improve business confidence. The downward trend in stocks and low turnover reflects the depressed investment climate. And above all political controversies have created uncertainty and economic pessimism that is not conducive to private investment and economic growth.

More significant is the scepticism that the current political bargaining and party configurations are not likely to enable the election of a government capable of resolving the critical economic problems. It is difficult to perceive of a government being elected with political courage and resolve to address the widespread reforms that are needed to release the full potential of the economy.

Economic performance

The 6.4 percent economic growth of the first quarter of this year, though a dip from 7.6 percent in the previous year’s first quarter, was reasonably good. The decline in GDP growth in the first quarter is part of a trend that began in the fourth quarter of last year, when growth fell to less than 7 percent from nearly 8 percent growth in the first three quarters.

The setback is due to the change of government and the consequent change in economic policies. These changes are not necessarily detrimental to economic progress as the stoppages of large foreign-funded construction projects are not sustainable in the long run. Even though their disruption at this stage is a setback to economic growth, adaptation of these to more manageable proportions with less foreign debt and considerations of the environment, are in the best interests of the economy and the broader interests of the country in the long run.

Changes in right direction

Changes in right direction

The changed priorities in government spending, lower corruption, increased expenditure on health and education are all economic developments in the right direction. The benefits of these will not manifest this year or the next, but will be in the long run interests of the economy. The immediate impact of readjustment of priorities may not be salutary, but will bring returns in the fullness of time.

Despite the apprehensions, the economic performance this year has not been as bad as is generally assumed. The economy’s performance so far, though a setback, is not a matter of much concern. While investment has been restrained most private sector firms have performed well. Their first quarter results are an improvement over that of last year. The services sector grew at 7.5 percent, industries at 6.5 percent and agriculture at 0.7 percent.

This performance of the first quarter has hardly been affected by the political uncertainty this year. This is especially so with respect of agriculture, where weather rather than the political climate plays the major role. This sector is a buffer against political instability. Fortunately, many economic activities have a momentum of their own undeterred by political conditions.

Agriculture

Agricultural growth was sluggish at less than 1 percent. Tea production increased by 7.1 percent compared to the drop of 2.3 percent in the first quarter of 2014, coconut grew by 2.6 percent and food crops were up by 4.9 percent. Rubber production continued to decrease by 12.8 percent, while minor export crop production declined by 3.8 percent. Fishing that has grown since the end of the war contracted by as much as 21.1 percent. These performances, good or bad, are not due to government policies.

Industries

The industrial sector, which contributes 32.7 percent to GDP, grew by 6.5 percent in the first quarter of 2015 compared to the growth of 12.6 percent in the first quarter of 2014, due to the suspension of some large construction projects. Manufacturing that is a sub sector of the industrial sector, and makes the highest contribution of 54.3 percent to the industrial sector, grew by 6.6 percent in the first quarter.

Retardation in investment

However, there is clear evidence of retardation in private investment with credit growth to the private sector increasing insignificantly by 0.9 percent. While core sectors of the economy performed reasonably well, as they were least affected by political uncertainty, long term growth remains in doubt. Political uncertainty has discouraged foreign direct investment in export oriented manufactures. Increased FDI will materialise only when a stable government with certainty and predictability in economic policies is elected.

Export performance

During the first quarter exports grew by only 1.6 percent compared to the first quarter of last year due to agricultural exports declining by as much as 6.4 percent owing to a drastic decline in demand for tea from oil exporting countries: Russia and the Middle East. Industrial exports, on the other hand, increased 5.4 percent, but exports of garments, the main industrial export, increased only marginally.

Total exports of US$ 2.86 billion in the three months of this year are not a bad performance. This performance too was mostly due to international factors rather than domestic conditions.

Summing up

The political and economic policy change this year has had a detrimental impact on growth, though not a serious setback to long term economic prospects. In fact, some policy changes are in the country’s interests in the long run. Besides this, the core sectors of the economy are likely to perform without hindrances. External conditions are likely to have a greater impact than the political instability this year.

Economic concerns and anxiety should not be focussed on the economic performance of this year. What is of real concern is whether the elections will bring about a stable government with clear cut and pragmatic policies, not only to stabilise the economy, but also to undertake reforms to achieve the country’s economic potential.

A hung parliament would be the worst outcome of the election. A coalition government that is most likely is also detrimental to economic development as the policy differences within such a government would create uncertainty and inaction.

A stable government that recognises the fundamental weaknesses in the economy and undertakes reforms that enable the country to grow in the medium and long term is the need of the hour. The real anxiety is not the current state of the economy, but the prospects of good economic governance for development after the elections.

Leave a Reply

Post Comment