News

Importers and exporters stagger as dollar rises

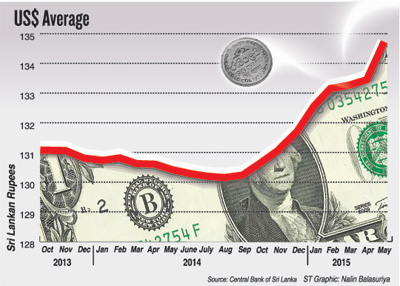

The depreciation of the rupee against the dollar has pushed up prices of drugs, imported food and essential goods, with the impact felt hardest in the housing sector.

The President of the National Chamber of Commerce, Tilak Godamanna, said imported products were going up in price not only because of the appreciating dollar but also because of the duty component charged by Customs on the rupee value.

He said that Customs charges, VAT, the Nation-Building Tax and port charges drove costs even higher. “It is costly for the average consumer unless they go for the local product,” he said.

He said that Customs charges, VAT, the Nation-Building Tax and port charges drove costs even higher. “It is costly for the average consumer unless they go for the local product,” he said.

The rupee was around Rs. 134 against the US dollar this week. The cost of essential food items including sugar, dhal and other cereals have risen considerably. In an attempt to bring down the price of dhal the government last week slashed the tax to 25 cents from the original levy of Rs. 5 per kilo.

The building industry has been hit most by the rupee devaluation. Chamber of Construction Industry Chairman Dr. Surath Wickramasinghe said around 70 per cent of building materials were imported.

“As of now the increase has gone up to 2 per cent and if the dollar keeps on increasing there will be up to a 5 per cent increase in construction materials such as floor tiles, steel bars, cement and mechanical equipment,” he said.

Sri Lanka Chamber of Pharmaceutical Industry Vice President Sanjeewa Samaranayake said that government should intervene and stabilise the dollar. “We operate on thin margins of 1 to 2 per cent,” he said.

Those in the car industry said the dollar’s value was being boosted locally partly due to the increase in the importation of vehicles. Tilak Gunewardena, head of Sathosa Motors, said there has been a 90 per cent increase in the sale of small cars, motor bicycles and three-wheelers.

The decreased tax on motor vehicles less than 1000cc capacity in the January budget along with the increase of salaries to public sector employees had caused increased demand for Alto, Martu, Bajaj motor cycles and three-wheelers. “For the last four months the demand for Indian vehicles has risen by 94 per cent,” Mr. Gunewardena said.

With 90 per cent of the vehicles coming from India and all transactions being done with the greenback there was a greater demand for the dollar in Sri Lanka. Baur & Co. said although the cost of fertiliser would remain stable due to government subsidies other plant chemicals could rise if the dollar kept high although price increases would not become effective

until current stock was exhausted.

Exporters, who should have been happy about the strengthening of the dollar, said they were affected by higher costs of imported raw material and packaging material. The Tea Exporters Association of Sri Lanka said the buying power of key countries including Russia, Ukraine, Europe and the Middle East which buy 60-70 per cent of total tea exports had been reduced. “When the dollar goes up, the buying volume falls,” association President Rohan Fernando said.

Although tea production in the first quarter of this year increased by 6.8 million kg from last year for the same period the prices fetched were low. The sale price was Rs. 419.04 per kg whereas in 2014 a kilo fetched Rs. 486.65. Oil prices, which have a correlation with the dollar, have dropped by nearly half – from $US107.30 in June 2014 to below US$60 a barrel.

Economists expect the dollar to peak in September when the federal banks increase interest rates. With Europe, China and Japan pumping in liquidity to cushion their economies the dollar is set to strengthen further. The US economy has been growing since 2008, with its housing market, employment and financial conditions improving. The dollar is at a 12-year high against the euro and a seven-year high against the yen.

The euro peaked against the dollar during the financial crisis but plunged due to softening economic growth together with geopolitical issues including the fighting between Russia and Ukraine and the Greek financial crisis. The Japanese yen began weakening in September 2012 as fell from 77.8 to 121.3 to the dollar.

The Sri Lankan spot rupee edged up on Friday after hitting a record low in the previous session as a state bank, through which the central bank usually directs the market, raised its dollar selling rate by 10 cents to 134.10, dealers said. On Thursday, the currency fell 0.15 per cent (20 cents) to hit an all-time low of 134.20 rupees per dollar. It closed at 134.10 on Friday.