Columns

Trade deficit tops US$ 8b in 2014 as import growth wipes out export growth

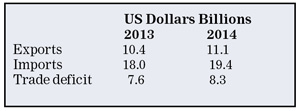

View(s):Last year’s trade deficit increased to as much as US$ 8.3 billion from US$ 7.6 billion in 2013. This 8 per cent increase in last year’s trade deficit was disappointing, as the trade gap was expected to be reduced owing to exports gaining momentum and lower expenditure on fuel imports due to declining international oil prices.

Although exports increased by 7 per cent, the large increase in imports, especially later in the year, wiped out the prospect of a decreased trade deficit, as well as a significant balance of payments surplus. Although exports grew to US$ 11.1 billion, the trade deficit increased owing to imports being much larger at US$ 19.4 billion. A trade deficit of about US$ 7 billion would have been offset by workers’ remittances of US$ 7 billion last year and generated a balance of payments surplus of about US$ 2.5 billion.

Although exports increased by 7 per cent, the large increase in imports, especially later in the year, wiped out the prospect of a decreased trade deficit, as well as a significant balance of payments surplus. Although exports grew to US$ 11.1 billion, the trade deficit increased owing to imports being much larger at US$ 19.4 billion. A trade deficit of about US$ 7 billion would have been offset by workers’ remittances of US$ 7 billion last year and generated a balance of payments surplus of about US$ 2.5 billion.

Balance of payments

Last year’s balance of payments surplus was only US$ 1.37 billion: an increase of only 0.39 billion from that of US$ 0.98 billion in 2013. A balance of payments surplus of around US$ 2.5 billion could have been achieved had imports been restrained. This would have assisted in reducing the large foreign debt, rather than keep borrowing at high interest rates.

There is little prospect of strengthening the country’s external finances without a reduction in the trade deficit. A manageable trade deficit has to be achieved by restraining aggregate demand by reducing the fiscal deficit, while increasing exports and constraining imports.

Export performance

The export performance in 2014 was the best in recent years. After a drop in exports to US$ 7 billion in 2009, exports recovered and increased to US$ 10.5 billion in 2011. Exports dipped to US$ 9.8 billion in 2012, but gained momentum since then to increase to US$ 10.4 billion in 2013 and to US$ 11.1 billion last year.

Increased export earnings last year were due to higher agricultural and industrial exports. Agricultural exports grew by 8.2 per cent with tea exports growing by 5.6 per cent. However, earnings from tea decreased in the latter months owing to lower prices which offset increased volumes.

The largest contribution to export growth came from industrial exports that grew by 6.5 per cent with garments exports that contribute about 60 per cent of industrial exports and 45 per cent of total exports, increasing by 9.4 per cent. However, earnings from textiles and garments exports declined by 0.6 per cent in December 2014, despite increased exports to the US by 11.5 per cent, due to a drop in garment exports to EU countries.

The largest contribution to export growth came from industrial exports that grew by 6.5 per cent with garments exports that contribute about 60 per cent of industrial exports and 45 per cent of total exports, increasing by 9.4 per cent. However, earnings from textiles and garments exports declined by 0.6 per cent in December 2014, despite increased exports to the US by 11.5 per cent, due to a drop in garment exports to EU countries.

Setbacks

Exports had setbacks in the last quarter of 2014. Growth in exports lost momentum in the latter three months owing to decreased tea prices resulting from decreased demand from oil exporting countries as oil prices fell; decreased exports of fish owing to sanctions from EU countries; and less than expected growth of garments exports to EU countries. Some of these setbacks in the main exports could continue to affect exports adversely this year unless remedial actions are taken.

Improved foreign relations with the West that is the main market for manufactured exports and fish could be important in averting further setbacks to exports. The revocation of the EU ban on export of fish is likely owing to a change in our licensing policy to foreign fishing craft. The restoration of the EU’s GSP Plus status may boost garments exports later this year. However, tea exports to oil exporting countries, including Russia, that are large markets could continue to depress tea prices.

Import expansion

Expenditure on imports increased by 7.9 per cent to US$ 19.4 billion in 2014. The increase was responsible for the increase on the trade gap to US$ 8.3 billion that is far too high. Imports of consumer goods increased by 21.1 per cent owing to substantial increases in both food and non-food categories. The substantial increase in rice imports mainly contributed for the increase in food imports. Import expenditure on non-food consumer goods increased mainly due to a growth in vehicle imports, particularly small motor cars.

Imports of intermediate goods increased by 8 per cent in 2014 and accounted for 59 per cent of total imports. Textiles and textiles accessories, wheat and maize, mineral products and base metals contributed significantly for the growth in imports of intermediate goods. Although import expenditure on fuel declined significantly in the latter months of the year, fuel imports increased by 6.7 per cent and constituted 24 per cent of total import expenditure.

Although there was an increase in imports of investment goods in the latter months, especially in December, owing to increased imports of transport equipment with a significant hike in imports of buses and auto trishaws, investment goods imports for the year declined by 2.4 per cent. This was a deviation from recent experience of large investment imports.

Concluding observations

Concluding observations

There are important lessons from last year’s trade performance for the management of the country’s external finances. The overall weakness in the trade balance is the result of expanding aggregate expenditure and slower export growth compared to the growth of imports. Conversely, import growth has increased by a higher amount to wipe out gains in export growth, as has happened in 2014.

A manageable trade deficit has to be achieved by an increase in exports and a constraint in imports. Monetary and fiscal policies have to be geared to ensuring that aggregate demand is kept in check. Public expenditure has to be constrained so as to not increase imports. Tariffs and import policies must be such as to ensure a manageable amount of imports. In short, balance of payments implications must be kept in mind when determining economic policies.

In the context of a large foreign debt and high foreign debt servicing costs that absorb about one fourth of export earnings, it is important to contain the trade deficit by restraints in imports and a vigorous thrust in exports. A lower trade deficit would enable a significant balance of payments surplus that could be used to reduce the country’s foreign debt.

Leave a Reply

Post Comment