Columns

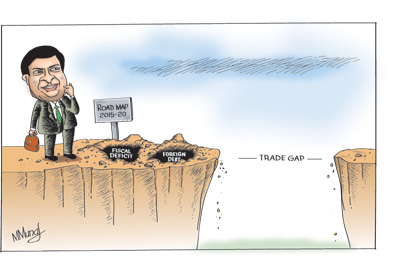

Reduction of large trade deficit third economic imperative

View(s):The three most important challenges facing the new government are, in order of priorities, the containment of the fiscal deficit, reduction of the foreign debt and lessening the trade deficit. Sustained economic growth is not possible without resolving these interrelated fundamental problems. An improvement in each leads to improvements in the others.

Fiscal consolidation and reduction of the foreign debt were discussed in previous two columns. The third issue of reducing the trade deficit discussed today is of vital importance for stability in external finances, the fiscal balance and reduction of the foreign debt.

Fiscal consolidation and reduction of the foreign debt were discussed in previous two columns. The third issue of reducing the trade deficit discussed today is of vital importance for stability in external finances, the fiscal balance and reduction of the foreign debt.

Large trade deficits serious setbacks

Recent large trade deficits have been serious setbacks to economic growth. The trade deficit must be reduced to achieve a higher balance of payments surplus that would enable a reduction in borrowing and redemption of the foreign debt that is in excess of US$ 44 billion and over 60 per cent of GDP. A substantial balance of payments surplus could be utilised to redeem debt rather than incur further foreign liabilities.

Persistent trade deficits

Persistent trade deficits

There have been very few years when the country was able to achieve a trade surplus. The last trade surplus achieved in 1977 was with stringent import and exchange controls that caused enormous hardships to people and stifled economic growth by their adverse effect on efficiency. Recent large trade deficits have been a strain on the balance of payments and an underlying reason for increased foreign borrowing.

Trade deficits 2010-2014

The trade deficit was a moderate US$ 4.8 billion in 2010. It increased to a massive US$ 9.7 billion in 2011 and created a balance of payments crisis that required remedial measures in 2012. The rupee was devalued and its float resulted in continuous depreciation of the rupee. The trade gap fell somewhat to US$ 9.4 billion in 2012. Although there was an improvement in the trade balance in 2013, the deficit of US$ 7.6 billion was high.

The trade deficit was expected to decline in 2014 owing to improved export prospects since mid-2013. As expected, exports grew till October of last year when there was a setback to both agricultural and manufacturing exports. Even more serious was that imports grew by more than exports and by October the trade gap had reached US$ 7.3 billion – higher than that of the same period in 2013.

The trade deficit for 2014 is expected to be above US$ 8 billion — higher than in 2013. In 2014 export earnings were only about 60 per cent of import expenditure that has been increasing owing to an increase in investment goods imports, petroleum imports and election related imports.

The trade deficit for 2014 is expected to be above US$ 8 billion — higher than in 2013. In 2014 export earnings were only about 60 per cent of import expenditure that has been increasing owing to an increase in investment goods imports, petroleum imports and election related imports.

Deficits weaken external finances

Although trade deficits have been continuous features of the balance of payments, the large trade deficits of recent years have weakened the country’s external finances and increased foreign indebtedness. Last year’s trade deficit estimated at above US$ 8 billion is about 12 percent of GDP. This is excessive even though the Central Bank expects a balance of payments surplus of about US$ 3 billion owing to workers’ remittances of about US$ 7 billion, tourist earnings of US$ 2 billion, other earnings from services of around US$ 1 billion and net capital inflows.

Complacency

There has been complacency regarding the large trade deficits owing to the large inflows of workers’ remittances that have eased the strain on the balance of payments. In recent years these remittances have offset about 60 percent of the trade deficits. The large inflow of remittances in 2014 is likely to offset about 90 per cent of the trade deficit. Increased tourist earnings and other service earnings are likely to result in a balance of payments surplus. Consequently there is not much concern about the trade deficit.

The other reason for a lack of concern has been the large scale foreign borrowing. There is scant concern that the country’s foreign debt is about 65 percent of GDP and that its servicing absorbs about 25 percent of the country’s export earnings.

Dr. P.B. Jayasundera, the former Secretary to the Treasury, called this concern “debt mania of some intellectuals, retired bankers, and politicians.” He said that debt is part of the economy and what matters was the proper management of debt to the GDP ratio. In fact what matters, is the purposes for which debt is used; what the debt finances between tradable and non-tradable goods and the rate of return to those activities.

The Road Map of the Central Bank for 2015 envisages policies that would increase imports owing to the improvement in the balance of payments rather than utilise the balance of payments surplus to redeem foreign debts. Since the Central Bank has to repay US$ 500 million this year to the IMF and there are other repayments due this year and in 2016, it is important to reduce the trade deficit to generate a higher balance of payments surplus to improve the country’s foreign indebtedness.

Trade prospects in 2015

The deterioration in the trade balance since October foreshadows serious setbacks to exports in the coming months leading to a large trade deficit once again in 2015 unless remedial measures are taken as the country is vulnerable to external shocks. Exports may not fare well this year owing to the decline in oil prices of the country’s export markets for tea. Although there was an expectation of higher growth in Western countries this is not certain. The lower prices for tea and lower demand for manufactures may increase the trade gap unless imports could be contained. On the other hand, the precipitous fall in oil price could reduce import expenditure this year provided prudent pricing policies for petroleum products are adopted.

Managing the trade balance

Export growth in the short to medium-term would depend on further strengthening of outward looking economic policies, prudent public expenditure management that does not lead to excessive imports and maintaining overall aggregate demand. In the longer run the diversification of exports and export markets and ensuring an investment climate to generate exportable products is needed.