Columns

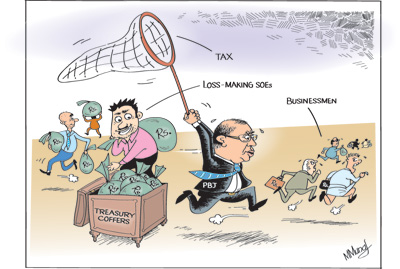

The daunting challenge of containing the fiscal deficit

View(s):Bringing down the fiscal deficit to below 5 per cent of GDP has been an objective for quite some time. It has not been achieved so far. Once again the need to bring down the fiscal deficit sharply was stressed by Treasury Secretary P.B. Jayasundera at the 19th Annual Tax Oration organised by the Faculty of Taxation, Institute of Chartered Accountants in Sri Lanka (ICASL) recently. He expected this year’s fiscal deficit to reach of 5.2 per cent of GDP.

He said a strong budget would bring down the fiscal deficit to around 3 per cent of the GDP over the next three years and consolidate the macro economy to fuel the upper middle income economy expansion. He went on to outline the means by which this objective could be achieved.

He said a strong budget would bring down the fiscal deficit to around 3 per cent of the GDP over the next three years and consolidate the macro economy to fuel the upper middle income economy expansion. He went on to outline the means by which this objective could be achieved.

Strategies

The measures he outlined to achieve a low fiscal deficit had an emphasis on the improvement of tax revenue from its current low level. The means by which the fiscal deficit could be brought down merits discussion. Two strategies Dr. Jayasundera stressed are of vital importance in bringing down the fiscal deficit. The first is the need to increase revenue substantially from its low revenue collection of only 14 per cent of GDP to 16 per cent or more of GDP. The second is to improve the efficiency of state enterprises to contribute to government coffers rather than be liabilities.

Both these strategies are vital to achieving a breakthrough in the country’s public finances. However, these are formidable tasks in the political milieu, inefficient and corrupt tax administration and inadequate concern for prudent management of state finances. Dr. Jayasundera has himself alluded to this weakness when he said that “lagging compliance, unethical businesses, tax practices and inadequate enforcement” were responsible for the poor tax revenue collection.

Both these strategies are vital to achieving a breakthrough in the country’s public finances. However, these are formidable tasks in the political milieu, inefficient and corrupt tax administration and inadequate concern for prudent management of state finances. Dr. Jayasundera has himself alluded to this weakness when he said that “lagging compliance, unethical businesses, tax practices and inadequate enforcement” were responsible for the poor tax revenue collection.

Buoyant tax structure

Dr. Jayasundera quite rightly stressed that “raising revenue efforts of the Government beyond 16 per cent of GDP needs a buoyant tax structure and high dividends from State enterprises. He said that despite a relatively simple rate structure, the tax base was still narrow, owing to a wide range of exemptions, lagging compliance, unethical businesses, tax practices and inadequate enforcement.

These are institutional weaknesses that cannot be easily changed. Therefore a tax regime that would rake in taxes automatically such as withholding taxes on certain transactions and incomes should be implemented. The other means is through much higher taxes on items of consumption by the very rich, those deriving illegal incomes or from sources that enable them to not disclose these, such as professional fees. These incomes can only be taxed through expenditure taxes on their investments and expenditures.

Dr. Jayasundera suggested that tax holidays and tax exemptions should be done away with. He was of the view that there was greater potential to raise a higher tax yield with an upper single digit tax rate giving fewer exemptions in comparison to the current tax structure.

Profits of SOEs

Interestingly Dr. Jayasundera viewed profits of state-owned enterprises (SOEs) as a source of revenue, when most such large enterprises are incurring huge losses. Losses incurred by public enterprises are a huge expenditure that has been increasing in recent years.

Reforms of these public enterprises to reduce public expenditure provide a significant means of reducing expenditure. The Government must take immediate and substantial steps to reform public enterprises to make them profitable.

The Treasury Annual Report recommends reforms such as allowing greater commercial freedom, ensuring the appointment of competent managerial staff and improving corporate best practices and accountability through the boards of directors and senior management.

Dr. Jayasundera said the government should stop making political appointments and instead appoint quality candidates to run SOEs. He advocated the removal of incompetent officials and their replacement by competent officials. The Treasury itself must play a role in ensuring efficient personnel.Dr Jayasundera’s recipe for reforming these enterprises is correct but impractical, as political considerations, rather than competence and efficiency, are the criteria for state sector appointments.

Priorities in expenditure

Dr. Jayasundera’s presentation implied that there was a need to combine increased revenue with a different prioritisation of expenditure. He remarked that “a good budget, backed by a higher tax to GDP ratio, should be able to allocate an increased volume of resources for human resource development, social security — especially for the elderly.” This need for social expenditure is indeed a national priority but revenue constraints and other priorities are likely to dominate.

He also stressed the need for core public investments in physical infrastructure, supported by an enabling environment that would in parallel attract private investments and defence. Whether increased revenue could be expended on physical infrastructure as well as defence and the crying social needs in education, health and care of the elderly is questionable.

Fiscal space

Despite the recognition of a shift in priorities in government expenditure, the continued high defence expenditure and high expenditure on physical infrastructure implies less fiscal space for social expenditure on education, health and the care of the elderly. This is particularly so as increasing revenue substantially is too much to expect.

Consolidated deficit

Alhough the fiscal deficit has been brought down in recent years from 8 per cent of GDP to 5.9 per cent last year, the actual fiscal deficit has been larger than the budget deficit figure, as it did not take into account the liabilities of lossmaking state enterprises to banks. It is the consolidated fiscal deficit that includes the total state liabilities and is much above 6 per cent that must be brought down. It would be more difficult to bring down the consolidated fiscal deficit as reform of state enterprises to increase their efficiency and generate profits is unlikely.

Bottom line

Despite bringing down the fiscal deficit being crucial for economic stability and economic development, institutional weaknesses, the tax structure and inefficient tax collection, imprudent public expenditure and lack of a political will makes it a difficult to reduce the consolidated fiscal deficit sharply. Political expedience rather than economic imperatives will prevail much to the detriment of the economy.