Real estate market overview: commercial property segment

Recent trends

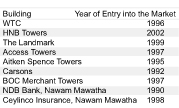

Starting with the capital, the demand for office space at the heart of the Colombo city centre has been at the frontline of commercial real estate development over the years. However, during the long years of conflict, demand for office space in Colombowas stifled due to security considerations. Frequently exploding bombs, the erection of multifarious checkpoints and the closing-off of many roads were just some of the factors that contributed to diverting businesses away from Colombo city toward the sub-urban areas. For example, the break-down of the cease-fire in 2006 resulted in a fall of occupancy levels in some of the high-end developments whilst square foot prices of sub-urban commercial properties increased (RIU Real Estate Market Report 2008) thereby demonstrating the inverse relationship within the this market segment. The first large development that can be considered as offering international standard commercial space was the World Trade Centre (WTC) in Colombo 1 in 1996. The WTC is still ahead of the pack despite the entry of several other developments since then. However, it is important to note that no new development has entered the arena since 2002 (HNB Towers) and this is essentially a reflection of the downturn in business sentiments that prevailed throughout much of the last decade.

Definition: Grade A

Whilst there are no formal classification systems for commercial office space, we can identify several factors that can be used to identify high-end or Grade A office real estate. These factors include the age of the building, the location, standard of maintenance, prestige related factors and the availability of ample parking.

In addition, these buildings will have high-quality furnishings, state-of-the-art facilities and excellent accessibility. Typically, the most popular types of facilities that are to be found at the top end of the market include air conditioning (central and split types), security, elevators and escalators, on call maintenance teams, 24-hour stand-by power, water / toilets, modern fire alarms, and kitchen /  pantries and good Internet connectivity. Some grade A developments also boast of panoramic views of the ocean and the city, private gymnasiums and roof top recreation.

pantries and good Internet connectivity. Some grade A developments also boast of panoramic views of the ocean and the city, private gymnasiums and roof top recreation.

“… the office buildings that you see in the heart of the financial district with lots of brass and glass fixtures and huge, expensive lobbies” and “… often occupied by banks, high-priced law firms, investment banking companies, and other high-profile companies with a need to provide the trappings of financial success.” (Urban Land Institute).

This high-end segment of the market is often targeted towards appealing to the international market, demanding rents that are well above prevailing averages. In the Sri Lankan context, WTC and HNB Towers are considered as meeting the mark in all respects of Grade A commercial property whilst the other developments included in this sample meet the criteria in a ‘more-or-less’ sense.

Capacity and occupancy trends

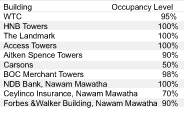

The past three years has witnessed a complete and remarkable turn-around in fortunes for the commercial property market segment in Colombo city. This is reflected in the high occupancy levels of existing Grade A developments as illustrated below. The only outlier being the Carsons development and the reason for the low occupancy can be explained with reference to the fact that they only recently started to offer office space to outside parties.

There are two points to note with regard to the trend in occupancy levels over the past 3-5 years. Firstly, those developments that are owned by organizations like HNB have not had any issues in achieving full occupancy, even during difficult times. This is entirely due to the fact that such large organizations have many departments and subsidiaries that need office space. On the other hand, internal problems have also had an impact on building occupancy as was the case with the Ceylinco building where occupation dropped from 100 per cent in 2009 to 75 per cent in 2008 as several of their subsidiaries went out of business. Secondly, the developments that  entered the market as ‘standalone entities’ to cater to the office space market, like the WTC, have been impacted significantly by the overall economic environment where occupancy levels are concerned. For example, before the dawn of peace in 2008, occupancy levels were around 50-60 per cent and much of this was accounted for by government agencies like the BOI who are based at the WTC. However, since 2009, there has been a remarkable upward trend in occupancy and currently the level is over 95 per cent with no space available for rent. We can note that the environment has now completely transformed as IT and finance sector companies stumble over each other to grab office space in prestigious locations like the WTC.

entered the market as ‘standalone entities’ to cater to the office space market, like the WTC, have been impacted significantly by the overall economic environment where occupancy levels are concerned. For example, before the dawn of peace in 2008, occupancy levels were around 50-60 per cent and much of this was accounted for by government agencies like the BOI who are based at the WTC. However, since 2009, there has been a remarkable upward trend in occupancy and currently the level is over 95 per cent with no space available for rent. We can note that the environment has now completely transformed as IT and finance sector companies stumble over each other to grab office space in prestigious locations like the WTC.

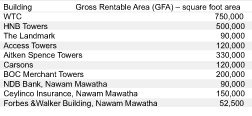

According to RIU’s ongoing research the gross floor area (GFA) of the main Grade A developments covered in the table below, in Colombo 1, 2 and 3 total 2.282 million sq. ft. This represents around 90 percent of the total Grade A commercial property availability in the Colombo 1,2,3 and 4. The lion share of the break down is accounted for by WTC followed by HNB towers and Aitken Spence.

In most cases, the rentable area accounts for around 65-85 per cent of the total gross floor area. This is due to the fact that various amenities like restaurants, retail outlets, lifts, escalators and service areas all have to be accommodated within th buildings. The range varies according to the total volume of space as well as the level of facilities that are on offer where some developments even provide gymnasiums and recreation areas for senior staff.

Prevailing price levels

The prevailing rental rates show that the WTC is still well ahead of the pack. Looking at the overall rental price levels, we can note that the market has enjoyed exceptional price hikes over the past 2-3 years. If we note that the average square foot price for high-end office space in Colombo 3 was around Rs.70-Rs.100 in 2007 (RIU Report 2009), then the prevailing averages represent phenomenal price growth.

Whilst occupancy levels have not been directly impacted by the economic environment in many cases, we can note that prices have. In 2007 for instance, Grade A space could be had for a little as Rs.75 per sq. ft. at Ceylinco and for Rs.120 at the WTC. However, now, these have more than doubled in the case of the latter.

Island-wide

The market for commercial property island-wide seems active in most districts, given the strong economic growth that has been experienced in the past three years. We can note that after Colombo, Kandy is the next most expensive city to rent followed by Gampaha, Trincomalee and Galle. A similar price pattern exists with regard to the commercial rental market with Negombo also showing a good demand for commercial space.

Free trade zones (FTZ’s)

There are 14 Free Trade Zones around the country and about 250,000 workers are employed at these FTZs. It is estimated that 80 per cent of them are women workers. Since the 1980’s the government has had incentives for domestic and foreign companies to locate at these FTZs. With the development of infrastructure, we can expect to witness more FTZs coming into the areas, especially at key locations around the outer circular road.

For more information contact

Roshan@riunit.com