Closer look at the fiscal dynamics of Budget 2014

Sri Lanka stands at important crossroads as it makes a decisive transition into a middle-income economy. With GDP growth targeted at 7.5 – 8 per cent over the medium term, the need for effective fiscal consolidation cannot be overemphasised. In this light, recent budgets have shown concentrated efforts to address fiscal management by pursuing the commendable strategy of cutting down on recurrent expenditure while maintaining higher capital expenditure. Contracting current expenditure from 18.2 per cent of GDP in 2009 to an estimated 14.1 per cent of GDP in 2013 and shrinking the budget deficit from 9.9 per cent of GDP in 2009 to an estimated 5.8 per cent of GDP in 2013 have been successful outcomes of recent fiscal consolidation efforts (Table 1). Following this trend, Budget 2014 too seems to place due emphasis on fiscal management as it targets reducing the budget deficit further to 5.2 per cent of GDP in 2014. Thus Sri Lanka seems to be moving in the right direction in addressing fiscal consolidation. However, several issues still exist.

Increased Reliance on Foreign

Financing

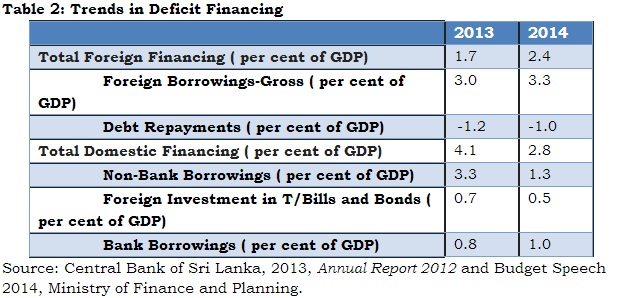

A key feature of Budget 2013 – increasing the reliance on domestic borrowing while lessening the reliance on foreign borrowing – - seems to have been reversed in Budget 2014. Estimated foreign financing which was 1.7 per cent of GDP during 2013 is estimated to shoot up to 2.4 per cent according to Budget 2014, while domestic financing which accounted for an estimated 4.1 per cent of GDP in 2013 seemed to have declined to an estimated 2.8 per cent in 2014 (Table 2). Thus, the emphasis placed on foreign financing in bridging the budget deficit seems to be greater in 2014. Though lower reliance on domestic borrowing in financing the budget deficit will limit crowding out of the private sector, greater reliance on foreign borrowing brings forth issues of its own.

Exports as the Game-Changer for Sri Lanka

Given the tilt toward foreign financing in bridging the budget deficit it is essential that the country strengthens its non-borrowed official reserves position in line with the growing foreign debt burden. This requires that Sri Lanka focuses on strengthening its foreign exchange earnings capacity through the export of goods and services. However, Sri Lanka’s export performance in recent years has been a cause for concern, given that exports as a percentage of GDP has declined from 22 per cent in 2010 to 16.4 per cent in 2012. Promisingly, several key export promotion efforts have been proposed in Budget 2014.

Though Budget 2014 places much emphasis on improving services exports, the promotion of goods exports has been given less attention. Apart from some measures to improve the exports of selected products including apparel, handloom and rubber products, export promotion efforts of Budget 2014 seems to be rather subdued. Although the tea sector has been given attention in Budget 2014, the response from industry sources on such measures has been somewhat negative[i].

Selective protection provided to domestic industries is another striking feature of this year’s budget. For example, only permitting the duty free importation of ceramic/porcelain wall tiles, floor tiles, marble floor tiles, and granite and quartz tiles and several other selected construction related products if such items are not available from local suppliers and the maintenance of high taxes on imported dairy products, fish stocks including dried fish/Maldive fish/ canned fish/ fish food, etc may result in reducing the efficiency of local industries due to the absence of competition.

Lackluster revenue thrust

Lackluster revenue thrust

Additionally, fiscal consolidation efforts of Budget 2014 on the revenue front seem to be rather weak. Tax revenue as a percentage of GDP has remained stagnant at around 12 per cent since 2009. Hence increasing revenue remains imperative for the country to strengthen the fiscal management process. Budget 2014 offers several proposals in order to strengthen the country’s revenue base such as the increase of the income tax rate applicable to SMEs with an annual turnover less than Rs. 500 million per annum from the concessionary rate of 10 per cent to 12 per cent, reduction of the threshold for chargeability of VAT for Wholesale and Retail Traders from Rs.500 million per quarter to Rs. 250 million per quarter, the upward revision of the Telecommunication Levy from 20 per cent to 25 per cent, imposition of a 2 per cent Nation Building Tax (NBT) on financial services etc. However, it appears that Sri Lanka continues to rely heavily on indirect taxation measures which are inherently regressive in nature and works against equity considerations. On a positive note, the automation of the Inland Revenue Department (IRD) with the introduction of the Revenue Administration Management Information System (RAMIS) that will facilitate online tax payments may help in improving tax administration thereby leading to positive spillovers on the revenue front.

Conclusion

Overall, it is clear from Budget 2014 that Sri Lanka is taking noteworthy steps in improving fiscal consolidation. However, the quality of fiscal consolidation still remains to be improved in the context of increased reliance on foreign borrowing in the face of a weakening export earnings position and sluggish revenue growth. However, the country seems to be steering in the right direction with determined efforts to cut back on current expenditure while raising capital expenditure. Nevertheless, Sri Lanka must make more concentrated efforts to promote its export sector, as building a strong reserve base through increased export earnings remains the linchpin of the country’s overall fiscal consolidation process.