The public debt and fiscal deficit are inextricably connected. The size and composition of the public debt affects the fiscal deficit. Continuous large fiscal deficits accumulate into a large public debt. The servicing of a large public debt increases the expenditure of the government and leads to further deficits and borrowing. The cyclic relationship of the two leads to serious difficulties in containing either and results in economic instability and may even lead to a national financial crisis. The United States, the world’s largest economy has the largest public debt. It is able to sustain this deficit as it enjoys the special circumstance of the rest of the world being willing to hold its debt in dollars. Sri Lanka and other countries are in no such position.

Sri Lanka’s huge accumulated debt of Rs 4590 billion at the end of 2010 is a result of persistent deficits over the years. The massive public debt and crippling debt servicing costs distort public expenditure priorities and hamper economic development. Government borrowing to service the debt results in inflationary pressures that destabilise the economy. Inflationary pressures generated by large fiscal deficits increase the cost of living and cause severe hardships, especially to the lower wage earners, pensioners and fixed income earners. This in turn leads to strikes with demands for higher wages and industrial unrest. Wage increases enhance the costs of production and reduce export competitiveness. The depreciation of the currency to restore export competitiveness would lead to further inflation and increased hardships to people.The servicing of the large public debt is itself a factor that increases the deficit and public debt. There is therefore a need to break the cyclic debt burden. Therefore the containment of the public debt is crucial in reducing the fiscal deficit, as debt servicing costs are the highest item of government expenditure. Containing the fiscal deficit is vital for stabilization of the economy and economic growth. Sri Lanka’s huge accumulated debt of Rs 4590 billion at the end of 2010 is a result of persistent deficits over the years. The massive public debt and crippling debt servicing costs distort public expenditure priorities and hamper economic development. Government borrowing to service the debt results in inflationary pressures that destabilise the economy. Inflationary pressures generated by large fiscal deficits increase the cost of living and cause severe hardships, especially to the lower wage earners, pensioners and fixed income earners. This in turn leads to strikes with demands for higher wages and industrial unrest. Wage increases enhance the costs of production and reduce export competitiveness. The depreciation of the currency to restore export competitiveness would lead to further inflation and increased hardships to people.The servicing of the large public debt is itself a factor that increases the deficit and public debt. There is therefore a need to break the cyclic debt burden. Therefore the containment of the public debt is crucial in reducing the fiscal deficit, as debt servicing costs are the highest item of government expenditure. Containing the fiscal deficit is vital for stabilization of the economy and economic growth.

Growing burden of debt

The accumulation of a large public debt, comprising both foreign and domestic borrowing, is a result of cumulative fiscal deficits. In the late 1970s and in the early 1980s fiscal deficits were high. However, much of the deficits were incurred for development activities such as the Accelerated Mahaweli Development programme. In the last decade war expenditure was a significant component of public expenditure and a cause for the rising debt. War expenditure is particularly pernicious as it does not result in increased production. In fact it leads to destruction of national assets and reconstruction costs that are not taken into account by the international national accounting system.

Among the other reasons for the large fiscal deficits is the limited revenue base of between 14 to 16 per cent of GDP, huge expenditure on public service salaries and pensions, big losses in public enterprises, wasteful conspicuous state consumption, expenditure, subsidies and welfare costs and the large debt servicing cost itself. The large public debt has itself led to a massive debt servicing burden. Current revenue is inadequate to even meet the costs of servicing this debt and the government has to resort to further borrowing to meet its recurrent as well as capital expenditure.

Debt burden Debt burden

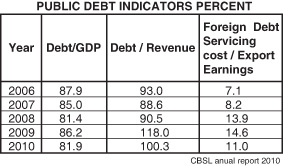

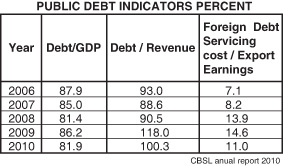

In 2002 the public debt was 105 per cent of GDP. In subsequent years it was brought down as a proportion of GDP (See Table). In 2009 it was 86 per cent of GDP. Although the public debt increased substantially in 2010, the debt to GDP ratio declined owing to GDP increasing and the appreciation of the Rupee lowers the foreign debt component in rupees. Rupee appreciation has been made possible owing to the large foreign reserves from foreign borrowing. Therefore the public debt as a proportion of GDP does not convey the extent of the debt burden.

The debt servicing cost as a proportion of revenue is a better indicator of the crippling effect of the large public debt. In 2009 debt servicing costs were 118 per cent of revenue. That means the costs of servicing the debt required further borrowing amounting to 18 per cent of revenue. In 2010 debt servicing costs were a little higher than government revenue at 100.3 per cent. This results in further increases in debt servicing costs. Consequently, the country is caught up in a vicious cycle of debt. This means that funds are not available for other essential expenditure. Nevertheless the government has undertaken an ambitious programme of infrastructure development through foreign and domestic borrowing. This increases the foreign debt further.

Reduction of debt

The reduction of the public debt and its servicing cost is a pre-requisite for economic stabilization and growth. This has been stressed ever so often and accepted by the Central Bank of Sri Lanka, multilateral agencies such as the IMF, World Bank and the Asian Development Bank (ADB) and repeatedly stressed by the Institute of Policy Studies (IPS). When the IMF gave the standby credit of about US$2.6 million, it required the government to bring down the fiscal deficit to 7 per cent of GDP in 2009, but the fiscal outcome was a deficit of 9.8 per cent of GDP. The fiscal deficit has been brought down to 8 per cent of GDP in 2010. The target is to bring down the fiscal deficit to 7.2 per cent this year and to 5.6 per cent in 2012. If these targets are achieved, the country would be on a path of fiscal consolidation.

The containment of the fiscal deficit to a reasonable level is not a controversial issue. It has been recognised as important in Central Bank Annual Reports and in Budget Speeches. In December 2002 the Fiscal Management Responsibility Act (FMRA) passed in parliament made it mandatory for the government to take measures to ensure that the fiscal deficit is brought down to 5 per cent of GDP in 2006 and kept at that level thereafter. As it turned out, the fiscal deficit was 8 per cent of GDP that year and averaged 8 per cent of GDP in the five years (2004-2008). The FMRA also required the public debt to be brought down to 60 per cent of GDP by 2013. Bringing down the public debt to 60 per cent of GDP by 2013 is unrealistic as foreign borrowing has increased substantially in the last two years.

Foreign debt

Foreign borrowing can assist in resolving constraints in foreign resources for development, supplementing inadequate domestic savings for investment and undertaking large infrastructure projects. Foreign borrowing can spur an economy to higher levels of economic growth than its own resources permit. It can also assist in overcoming temporary balance of payments difficulties. However the extent, costs, terms of borrowing, and use of funds have significant implications for macroeconomic fundamentals. Foreign borrowing could have either beneficial or adverse impacts on economic stability and development.

The foreign debt component of the public debt was 44 per cent in 2010. The foreign debt doubled since 2000 to reach US$ 18 billion in 2009 and increased to about US$ 20 billion (Rs 2025 billion) by the end of 2010. As much as 14.6 per cent of export earnings were required for capital and interest repayments in 2009 and 11 per cent of export earnings in 2010. The increase in foreign debt has been particularly sharp between 2009 and 2010, when it increased by 15 per cent. Recent increases in commercial borrowings have also tilted the debt profile more towards commercial borrowing from the earlier bias towards concessionary loans from bilateral and multilateral sources. In 2010 non-concessional loans, as a proportion of the foreign debt portfolio, had increased to 37 per cent from 28 per cent a year earlier. The proportion of export earnings needed for servicing the debt is a strain on the balance of payments.

Foreign debt should be incurred for developmental purposes. According to the Ministry of Finance 75 per cent of recent foreign borrowing has been for infrastructure development such as for power and energy, ports, roads, bridges, water supply, agriculture, fisheries and irrigation, among others. Nevertheless all infrastructure development is not necessarily justified from an economic perspective. Infrastructure projects that either save or earn foreign exchange are the least burdensome. Prioritisation of infrastructure development on this criterion is a prudent economic strategy.

Conclusions

Containing the fiscal deficit is vital for stabilization of the economy and economic growth. Large fiscal deficits harm the economy in many ways. Fiscal deficits lead to borrowing and in turn to huge debt servicing costs. Sri Lanka’s huge accumulated debt is a result of persistent deficits over the years. Fiscal consolidation and reduction of the public debt are both important for good economic management and good governance. Successive governments have paid lip service to the need to contain the fiscal deficit but not had the political will, courage and resolve to follow prudent fiscal policies to reduce the fiscal deficit. Consequently the macroeconomic outcomes are not conducive to economic development. The objective of reducing the fiscal deficit to 6.8 per cent this year and reducing it to 5.2 per cent in 2012 is a move in the correct direction. It is important that the goals set for this year and the next are achieved.

|

Sri Lanka’s huge accumulated debt of Rs 4590 billion at the end of 2010 is a result of persistent deficits over the years. The massive public debt and crippling debt servicing costs distort public expenditure priorities and hamper economic development. Government borrowing to service the debt results in inflationary pressures that destabilise the economy. Inflationary pressures generated by large fiscal deficits increase the cost of living and cause severe hardships, especially to the lower wage earners, pensioners and fixed income earners. This in turn leads to strikes with demands for higher wages and industrial unrest. Wage increases enhance the costs of production and reduce export competitiveness. The depreciation of the currency to restore export competitiveness would lead to further inflation and increased hardships to people.The servicing of the large public debt is itself a factor that increases the deficit and public debt. There is therefore a need to break the cyclic debt burden. Therefore the containment of the public debt is crucial in reducing the fiscal deficit, as debt servicing costs are the highest item of government expenditure. Containing the fiscal deficit is vital for stabilization of the economy and economic growth.

Sri Lanka’s huge accumulated debt of Rs 4590 billion at the end of 2010 is a result of persistent deficits over the years. The massive public debt and crippling debt servicing costs distort public expenditure priorities and hamper economic development. Government borrowing to service the debt results in inflationary pressures that destabilise the economy. Inflationary pressures generated by large fiscal deficits increase the cost of living and cause severe hardships, especially to the lower wage earners, pensioners and fixed income earners. This in turn leads to strikes with demands for higher wages and industrial unrest. Wage increases enhance the costs of production and reduce export competitiveness. The depreciation of the currency to restore export competitiveness would lead to further inflation and increased hardships to people.The servicing of the large public debt is itself a factor that increases the deficit and public debt. There is therefore a need to break the cyclic debt burden. Therefore the containment of the public debt is crucial in reducing the fiscal deficit, as debt servicing costs are the highest item of government expenditure. Containing the fiscal deficit is vital for stabilization of the economy and economic growth. Debt burden

Debt burden