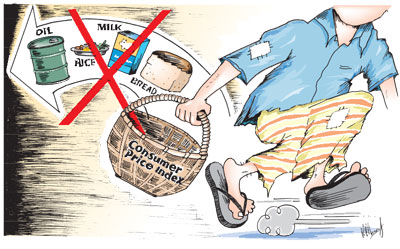

Inflation: No light at the end of the tunnelThe control of inflation is becoming increasingly illusive. The inflation rate has now jumped from near 20 to near 30 and some of the factors exerting an important influence aren’t slowing down. Meanwhile theories and statistical calculations are aplenty. But these are of no avail in the practical task of controlling prices. In fact these theories and calculations impliedly tell us that prices cannot be controlled. One of these statistical concepts is core inflation that the Central Bank of Sri Lanka continues to focus on rather than the general level of price increases estimated by the price indices. Core inflation in the words of the Central Bank is: “The measure of underlying inflationary pressures, compiled by removing food and energy prices from the consumer price index.”

A few months ago the Central Bank of Sri Lanka began speaking of core inflation being of a single digit and now tells us that it has declined slightly. Core inflation on an annual basis is running at 9.3 percent at the end of March. In a context of economic propaganda, it is very likely that readers would think that the concept of core inflation is an ingenious invention of the Sri Lanka Central Bank. This is not so. In fact many central banks the world over are focusing on the calculation of core inflation, including the Federal Reserve Bank of the US, the Bank of England and the Central Bank of the Philippines that announce the rate of core inflation. The concept of core inflation is one of removing those items in a price index that are subject to high price volatility. Food and oil prices have been excluded in the calculation of core inflation on the grounds that these are subject to high price volatility. The argument for adopting core inflation as a measure of inflation is that by excluding food and energy prices from a price index a better measure of underlying inflation is obtained. It is argued that including food and energy prices that are subject to wide fluctuations either way in an index give the impression that general prices are rising or falling more rapidly than they really are owing to the wide price fluctuations of these two items. Economists have pointed out that environmental factors that can damage crops of one year could have an impact on prices that would not last. Again in the case of oil prices that are also excluded, it is argued that fluctuations in the oil supply from the OPEC cartel or war in petroleum producing areas of the world could affect oil prices temporarily. Another corresponding argument for excluding changes in food and energy prices from measures of inflation is that their prices are quickly reversed and so do not require a monetary policy response. This latter contention has substance, in that monetary policy can hardly do anything to quell prices of these items. However monetarists argue that this is not so as the control of the money supply could temper and tame this impact on prices. In contrast some economists contend that measures of inflation that incorporate food and energy prices are still useful and are closely followed for clues to the behaviour of the overall price level. They view the sensitive nature of food and energy prices as a symptom of future overall price increases. A rise in aggregate demand that might set off a period of higher inflation may initially show up in increases in certain sensitive prices. If these prices are ignored because they are ˜volatile”, these early signals of inflation may be missed. In addition, these price increases feed into other price increases as they are important in the cost of production of important items of consumption and tend to remain at these levels even after decreases in the prices of the inputs. This is the well known ‘ratchet effect’ in price behaviour that tends to move prices in one direction. To recognize the validity of the argument that food and energy are more sensitive to price changes, there must be an acceptance of the notion that the prices of those goods may frequently increase or decrease at rapid rates and that their price changes may not be related to a trend change in overall prices. The contention that changes in food and energy prices are more likely related to temporary factors that may reverse themselves later is questionable in the current context of price trends of these two items. In the light of the experience of rising food and oil prices in the last twenty four months, it is unrealistic to consider the uptrend in either oil or food prices as temporary. It is even more difficult to think that these prices would be reversed. It may be granted that there could be a temporary fall in prices, such as a drop in oil prices due to a lesser demand during the coming summer months or a somewhat better harvest of grains next season. However, much of the increase in prices of food are demand driven and increasing demand for food would continue to sustain and enhance food prices. Apparently, everything is fine if core inflation is coming down and food and fuel prices that are not included in the core inflation index are rising!! In reality core inflation is of little relevance to people when they are experiencing increasing prices on an almost daily basis. Their concern is the rise in prices that they have to face. Everyone knows that it is the energy and food prices that are most important. By removing food and energy prices from the consumer price index the most pertinent items of consumption for people from the basket of consumption is excluded. Core inflation is an irrelevant statistic to the public as it excludes inflation generated by other than these two important drivers of current inflation that affect the livelihoods of people the world over. Such an index number does not matter to the general public for whom prices of food and utilities are those that matter most. In reality prices are rising fast. Core inflation is of no significance to people. Admittedly the government is in a difficult situation as import prices are rising and generating inflationary pressures. International oil prices have now reached around US$ 130 per barrel. Rice and wheat prices, as well as milk are continuing to increase. These imports have an important bearing on the domestic price level both directly and indirectly. The Central Bank’s tight money policy will not help much in this context. The plain truth is that the cost of living is unbearable for the poor and there is no light at the end of the tunnel. |

|

||||||

|| Front

Page | News | Editorial | Columns | Sports | Plus | Financial

Times | International | Mirror | TV

Times | Funday

Times || |

| |

Reproduction of articles permitted when used without any alterations to contents and a link to the source page.

|

© Copyright

2008 | Wijeya

Newspapers Ltd.Colombo. Sri Lanka. All Rights Reserved. |