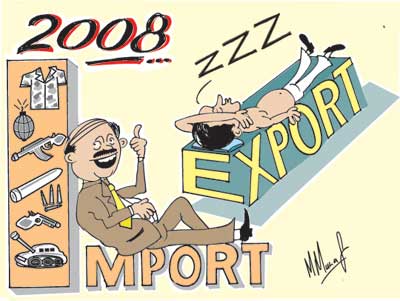

Heading for another large trade deficit this year

In the first nine months the trade deficit had reached US$ 2403, only slightly less than that for the same period last year. On the basis of this we could project the trade deficit to reach US$ 3200 million. However the indications in September and current global trade developments point to a trade deficit somewhat higher, at about US$ 3300 million. There has been an expectation recently that the trade deficit would be narrow this year compared to that of last year. This was particularly so a few months ago when the trade deficit was much less than for the corresponding period in 2006. At the end of September however the trade deficit for the first nine months was only 7.5 percent less than it was for the first nine months of last year. Further, the trade deficit in September this year was higher than that of September 2006. It was US $ 281.8m. in September 2007 compared to US$ 197.6m. in September 2006. In all probability the trade deficit will continue to grow in the next three months at a higher rate and at year's end it may be similar to that of last year. In any event, comforting ourselves by comparison with last year's massive deficit is inappropriate as the trade deficit last year was a record US $ 3370 million. Such a huge trade gap cannot be condoned. A small improvement with it in comparison is misleading. The fact is that the country has been running trade deficits continuously for the last two decades and these deficits have grown by leaps and bounds in the last three years. This is clear evidence that there is a fundamental disequilibrium in our trade. We must be mindful of this and corrective steps should be taken on both the import and export sides in order to prune the deficit to a manageable level. Achieving a trade surplus is of course a Utopian dream at present. This is especially so as the large trade deficit is not owing to the bridging of the savings investment gap but an excess of demand for imports in relation to our export capacity. Financially the deficit has been sustainable owing to inflows of capital. The country has faced this continuous and increasing trade deficit with a degree of complacency. There have been several reasons for this complacency. Although the country has suffered large trade deficits, it has recorded balance of payments surpluses in many years, including last year, when we incurred the massive trade deficit. In spite of last year's trade deficit of US$ 3370, the balance of payments recorded a surplus of US$ 204 million. This year too it is likely that the country would record a balance of payments surplus in the region of about US$ 200 million or more, while incurring a trade deficit of around the same magnitude. At the end of September this year the overall balance of payments registered a surplus of US dollars 70 million. The reasons for this are that there are large inflows of capital in the form of remittances, aid and foreign loans among others. These inflows of capital more than offset the trade deficit. The controversial loan of US$ 500 million too has contributed to this surplus. However despite this loan of US$ 500 million recently, the balance of payments surplus is likely to be only about one half the amount of the loan. Another factor that leads to complacency is the growth in exports. There is a monthly celebration of the growth of exports that masks the growth in imports. This is indeed a deception as the absolute amounts of imports are much larger than the amount of exports owing to the import base being larger than the export base. Consequently the trade gap widens as a similar increase in exports as imports increases the trade deficit and even a larger proportionate increase in exports than imports could lead to an increase in the deficit. Therefore we must view the trade statistics in terms of what the values imply rather than the proportionate growth in comparison with the previous month or the corresponding period. In September this year the growth in exports by 19 percent was more than wiped out by the 24 percent growth in imports. A third reason for complacency is that there is an attitude that we can do very little as the deficit is due to the terms of trade being unfavourable. The oil price rise that is beyond our control is adduced as the reason for the deterioration of the trade balance. Added to this now are the rises in prices of several other commodities, most notably wheat, milk and sugar. This attitude is hardly conducive to remedial action in the country's trade. The difficulty in curbing imports lies in the nature of the country's imports. A large proportion of imports consist of essentials for people's livelihood or for industry. The major proportion of imports is of intermediate goods like fertiliser and petroleum. Petroleum imports alone cost US $ 1609m. in the first nine months of this year, slightly higher than that of the previous year's nine months of such imports. Investment goods imports grew by 12 percent to reach US$ 1864 million. Military hardware imports would have been a significant reason for an increase in investment imports. It is imperative to recognise that the country has a serious problem in its external trade. It is only on the basis of such recognition that solutions to the problem could be found. There is a need to find ways and means by which we could curtail our imports, on the one hand, and on the other, find methods to enhance exports. An underlying and least recognised reason for excess import demand is the fiscal imbalance that generates excessive domestic demand that has a significant import content. In addition, the inflationary pressures that it generates results in the relative price levels tilting to the advantage of imports. Much of the increased demand is from the government that spends on an array of imports from petrol to military hardware. The government can play an important role in curbing imports and improving the trade balance. The government must develop a policy framework and action programme to provide incentives for production of exportable commodities. The country's export capacity suffers much from an inability to produce goods in sufficient quantity and assured supplies at competitive prices. It is this issue that must be addressed if we are to make a sufficient dent in our exports. |

|| Front

Page | News | Editorial | Columns | Sports | Plus | Financial

Times | International | Mirror | TV

Times | Funday

Times || |

| |

Reproduction of articles permitted when used without any alterations to contents and the source. |

© Copyright

2007 | Wijeya

Newspapers Ltd.Colombo. Sri Lanka. All Rights Reserved. |

This year's trade deficit is likely to be around the same as that of last year. In 2006 the country recorded the largest trade deficit ever of US $ 3370 million. Although there has been a slight improvement in the trade balance in the first nine months of the year, there are signs that we are heading for another massive trade deficit this year too. This year's trade deficit is likely to be over US$ 3000 million.

This year's trade deficit is likely to be around the same as that of last year. In 2006 the country recorded the largest trade deficit ever of US $ 3370 million. Although there has been a slight improvement in the trade balance in the first nine months of the year, there are signs that we are heading for another massive trade deficit this year too. This year's trade deficit is likely to be over US$ 3000 million.