| The Sunday Times Economic Analysis By the Economist | ||||||

|

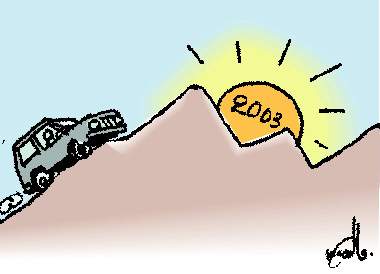

Economic hopes, expectations and fears in 2003 By The

Economist The economy

is at last on a growth up-trend that is expected to gain momentum

in the first half of this year. However these expectations can only

materialise, if we are spared both internal and external shocks.

Dark clouds are however looming on the horizon. Externally, the

global economic recovery is still strained by an inability of some

key countries to get moving and consumer spending still stagnant

in the US. The biggest threat to the Sri Lankan economy in the next

few months comes from the prospect of war in the Middle East. A war scenario

would be an especially harsh setback to the economy. Internally,

the fragility of the peace process and the stability of the government

are matters of concern for the economy. Let us first dwell on the

positive developments that are likely sans these dreaded shocks.

The second half of last year saw resurgence in our industrial exports.

This has been confirmed by the 5.3 per cent growth in the third

quarter. The continued gain in momentum in the fourth quarter is

expected to increase the annual growth in the economy beyond the

3 per cent predicted earlier. Agriculture performed reasonably well

last year and is expected to contribute significantly during 2003.

This is particularly

so with respect to paddy production that is likely to reach a new

high this year. Improvements in weather conditions, together with

larger extents of cultivation in the East, are expected to yield

higher production levels that may be adequate to meet the domestic

rice requirements. Whether similar out-turns could be expected from

other food crops remain uncertain. The record tea crop of 2002 requires

to be maintained. Tea prices that had climbed somewhat last year

may face a reversal if the international political situation is

disruptive. This may in

turn be a disincentive, particularly in the low grown areas. The

declining trend in industrial production and exports was arrested

in the third quarter. Industry recorded a growth for the first time

in third quarter of 3.1 per cent. Of particular concern has been

the poor performance of our main export garments that appeared to

be losing its competitiveness. This has to

be corrected if the economy is to grow significantly. It may be

also necessary for the country to look at a new industrial policy.

This is especially

needed as the country's cost structures are changing and our competitiveness

in labour intensive light industry may be declining. Also the impending

lapse of the Multi-Fibre Agreement (MFA) in two years makes it essential

to change our strategy with respect to quota type garment exports.

The growth in demand for our industrial exports remain in check

owing to the slow recovery of industrial economies, internal uncertainty

in their economies and cautious spending on the part of consumers. The new boost

to tourism from peaceful conditions in the country is expected to

push tourist arrivals to a new high of over 500,000. Earnings from

tourism are also expected to rise to around US$ 315 million. Apart

from the significance of these increased earnings for the balance

of payments, it would give a much-needed increased demand for local

commodities and increase the employment possibilities. The backward

linkages of the tourist sector would have both a direct and indirect

boost on several local industries, especially in travel and food

crops. Most of these

expectations could be dashed to the ground if a war breaks out in

the Middle East.The most serious impact on the economy would be

through a rise in oil prices. Already the unstable situation has

resulted in crude oil prices shooting up to US$ 30 or more per barrel.

The worst case scenario with Iraq burning the oil wells in the event

of an American attack projects the increase in oil prices up to

US$ 80 per barrel. Even if this were not to happen with the US releasing

stocks and other oil producing countries including Venezuela stepping

up its production after the recent strike, prices are likely to

rise to at least US$ 40 or more. This would

seriously affect our trade balance, increase energy and transport

costs and leave a dent in our balance of payments. The higher

costs of production of our industrial exports, coupled with decreased

demand for them would decrease export earnings at the very time

when imports costs rise. The tea export market is also likely to

be affected with a decreased demand from the affected Middle Eastern

countries. There are also

fears that Middle East remittances that are an important contribution

to the balance of payments would suffer a setback. Apart from these

darkest clouds, there are also lesser anxieties owing to the slow

recovery of the Industrialised countries. Industrial economies (OECD)

are likely to grow at 2.2 per cent. The US recovery

itself is predicted to be at a growth rate of around 2.6 per cent.

Europe, which went into recession later, appears to be taking more

time to recover, and expected to grow by only 1.8 per cent in 2003.

The growth in the Japanese economy is expected to be only an uncertain 0.8 per cent in 2003. The world economy is expected to grow by 2.5 per cent, with strong growth in China and Republic of Korea. Political instability in the country could add to the woes. If the President

decides to dissolve parliament and call for fresh elections, many

of the recent gains owing to the peaceful conditions and the prospect

of peace would be arrested and the final outcome of such an election

would be awaited. A coalition of the PA and JVP would send jitters in the business community and investment, both local and foreign, would be seriously impaired. Two Thousand and Three provides the prospects of a better economic performance, provided the external and internal shocks that we have outlined, are averted. We can only hope that in a year when several prospects are pleasing that these dark clouds would pass off to enable the much-awaited spurt in economic growth. |

||||||

Copyright © 2001 Wijeya Newspapers

Ltd. All rights reserved. |

The year begins with fresh hopes and high expectations

for a much-improved economic performance in 2003. The third quarter

economic growth performance and the fourth quarter's expected results

give credence for such hopes and expectations.

The year begins with fresh hopes and high expectations

for a much-improved economic performance in 2003. The third quarter

economic growth performance and the fourth quarter's expected results

give credence for such hopes and expectations.