24th October 1999

Front Page|

News/Comment|

Editorial/Opinion| Plus|

Sports|

Sports Plus| Mirror Magazine

![]()

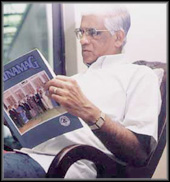

HNB chief on bank's new moves

Hatton National Bank (HNB), one of Sri Lanka's largest listed commercial banks, is venturing into the capital market after a lapse of several years to issue 15 mn non voting shares. HNB's bold decision to tap the equity market at a time the Colombo bourse is experiencing some 'rough weather', has received mixed signals from the market. On the eve of the bank's new share issue, HNB CEO/Managing Director Rienzie Wijetilleke who has held the reigns for the past eleven years speaks to The Sunday Times Business on the move behind the new shares and the bank's future plans. Excerpts from the interview with Mel Gunasekera:

STB: What is the purpose behind the new issue?

RW: There are certain little problems with regards to our capital structure. We have a small capital though we have a big shareholder base. This was something that was worrying us but it is outside my control. It is something the directors have to approve. But the board has been appreciative of this, but felt it was not the time to expressly invest in this market because of a small return on investment.

Despite that, the expansion has been rapid. The board decided after much deliberations over a year that it was the time for us to go for a share issue to strengthen our base.

We also had certain major requirements. The building was also there,

we felt there were opportunities for us to expand our asset portfolio further,

but on a longer term basis. If we have to contribute to the development

of the growth of the economy we have to be able to extend credit  facilities

at a long term.

facilities

at a long term.

Even if we don't take up large macro projects, the opportunity is there as a commercial bank to take up the medium term projects and its ancillary business, so we have to be prepared for it. That is the major reason why we felt the time was appropriate for us to go for long term funding.

STB: How are you going to spend the money?

RW: Rs. 400 mn for the building and the rest for long term funding.

STB: There has been a lot of concern about the building project, how do you propose to finance it?

RW: Its correct for people to be concerned. A building is a long term investment. On the other hand, if I postpone it by another five years the cost is going to be much higher. Another thing the public is not aware is that in Colombo alone, we have our head office in about six or seven units. So there about 100,000 square feet which we have rented out in Colombo. Our organisation is getting larger, for the purpose of management controls its necessary we bring all these under one roof. That is why we decided to go for the building despite the constraints.

Part of the new issued capital about Rs.400 mn will be put into the building. The balance we have Rs. 3 bn in repos. We have a plan for that. For the next three to four years we hope to put out about Rs. 300 mn to Rs. 350 mn out of our retained earnings for the building. If you go on the present form, last year we made about Rs. 683 mn of post tax profits, if we leave Rs. 200 mn alone for our post tax profits, we still have Rs. 300 mn to invest in the building. Over the next three to four years there will be Rs. 1 bn for investment in the building. Next year we are going to the capital markets and draw up some debt instruments to get around Rs. 1.5 bn.

There may be investors who are interested in putting money on a long

term may be five to ten years so we have definite plan of action. And we

will ensure we will cushion the direct impact on our  productivity

on account of this expenditure.

productivity

on account of this expenditure.

The head office will consist of 23 floors, two basements and facilities for parking of vehicles with a total floor area of 430,000 square feet. Built on a 100 perches bloc, the skyscrapper would rise up on Saranankara Mawatha behind Darley Road Colombo 10.

STB: How much are you planning to earn from the building given the context that there is a glut of office space in Colombo for instance the World Trade Centre?

RW: One third of our building about 150,000 square feet is going to be rented out to people for five to six year period so that when we require for expansion we can take it back. But remember that in the parameters outside Fort itself, the glut of space is there because of the security concerns and people are not coming. But at the same time we are aware that in places like Darley Road and Colpetty there is a severe demand for space. That's the basis of a definite plan. There is going to be a long term tangible return as well as short term, the strain is not going to be as bad as people think it would be.

STB: What do you plan to do with your existing building?

RW: Our branch offices situated here are completely congested, we will expand it to another floor. We are going to have the front offices like the leasing department and insurance, when we are permitted to take it up.

We have also started a private banking unit which we are going to expand so we are certainly going to maximum use of the space here and we have plans for that.

STB: How much of money will you save in terms of numbers by moving into your new head office?

RW: For instance the rental we are paying right now for say the leasing office which we have rented out behind the temple trees from Buddhi Batiks is a fair amount of high rent. Our overheads are going to cut down by about 20% from this.

STB: If you don't get the money what are your plans?

RW: We have not ignored it. We are very confident of getting the money. For last 20 years or so we have not gone to the market for funds. Our bank has done so well that we have gone on our own steam. People have been waiting to buy our shares. At one time HNB shares went as high as Rs. 500 to Rs. 600. Now we are offering for Rs. 70.

There is a fair amount of commitment from our present shareholders that they will take up their rights. I don't want to be very optimistic but I can assure you that the shares will be taken up. Even if it is not fully taken up, we are going to set aside the Rs. 400 mn funds for the building first. The balance is going to be utlised for long term lending.

The only problem there is that we will have to slowdown our long term lending or otherwise think of some long term sources of funding - which also is not a difficult thing. We have a very clear plan as to what will be done if things don't work out.

STB: There was market perception that HNB opted for non voting shares because the existing shareholders did not want to dilute their control, is this true, because it has also reflected in your share price which has dropped dramatically since your plans were announced?

RW: No. We are going to clarify this position in the prospectus. Two of our major shareholders hold the maximum shareholding possible under the Banking Act. 18% for individual shareholders that's Stassens Group and 20% for promoters that's the Browns Group.

Mr. Jayawardene's shareholding is around 30% at the moment under the different companies. Mr. Jayawardene and Mr. Cooray said at the Board meeting that they cannot put in any more money. But at the same time they are going to give an undertaking in the prospectus that if by some chance the share devolves on the shareholders, both of them are going to make some arrangement within their parameters to take up the shares which were not taken up.

Wherever possible they will take up the non voting rights but they are not decided.

The public must realise that they are the persons most concerned with the issue. They have assured me that some how or other they are going to find a way to buy the rights but at the same time we have to make some available to the public as well. We want to make an announcement saying they are renouncing because they want to make them available to the public. We have also gone up to the next 50 major shareholders who have assured me that they will take up the rights issue.

STB: Your provisioning for non-performing loans is not on par with your rival Commercial Bank?

RW: Our loan advances are very much higher than Commercial Bank.

STB: Is it because you are over exposed to certain sectors?

RW: No we have a very well spread exposure. But the question is our portfolio has been very steady and has good quality for the last several years. I don't want to be critical but I know that Commercial Bank's portfolio up to about three years ago had been very weak. Their are provisioning is much higher than us on a smaller portfolio.

Our portfolio is much larger and the provisioning is much lesser because of the quality. I am prepared to take responsibility for it. Certainly our country conditions have called for it to be increased. Last year we made a very conservative approach to our provisioning this year we have recalled some of those loans.

STB: What's your provisioning like this year?

RW: Well non-performing loans as a percentage of our portfolio is about nine percent, provisioning for that is about three percent. The balance is fully secured in property.

STB: What is your loan growth like?

RW: Last year it was 18% - 20%. This year we expect it to be 10% - 15% at least. Because of our large branch network we are having a continuous demand for credit on the small scale from our retail customers is very large.

STB: What about your deposit growth?

RW: Its very steady. We have been able to shift from high cost funds to low cost category very much this time. We have been able to shed a fair amount of high cost funds of fixed deposits and term loans. And we have increased our savings deposit at a very satisfactory level. So overall growth may be little less than last year but our deposit mix is much more favourable this year.

STB: How do you propose monitoring your ROE's in the face of intense competition in the future?

RW: With the technology we are going to introduce we hope to contain our overheads. Also with our branch network which we have expanded about 10-12 a year over the last few years, all those branches are going to be productive over the next few years. So we certainly hope to reduce our overheads, our net income ratio to the level of our competitors or even better.

STB: What sort of gross margins do you hope to achieve over the next 2-3 years?

RW: It will certainly be much less than what it is. Our margins have been 5%-6%, it will not be more than 3% - 4% in the future.

It's because of competition and we also have a duty by the country and by the government to reduce our lending rates. But the deposit rates, we cannot reduce beyond this level. Its not humanly possible. With less economic activity taking place its difficult to work with higher margins.

STB: What sort of new areas do you hope to venture into?

RW: We are encouraging our managers to increase their fee based income by various services like issuing of foreign exchange, drafts, guarantees etc. we are encouraging the branches without funding to increase their income on these areas.

Wheels of the nation

A recently released Central Bank report tells us that self employment is steadily moving up. But they fail to say specifically what forms of self-employment individuals are engaging themselves in. The Sunday Times Business Desk learns one of the most popular methods is, if you don't know by now, driving trishaws, three wheelers, auto or whatever you may call it.

The Minister of Transport and Highways A. H. M. Fowzie told the Business Desk that an increasing number of youth are taking up the profession as an easy means of employment.

Though self-employment is encouraged by the government they say that the proliferation of three wheelers in the country will be responsible for the industry's down- turn.

Already three wheel drivers are complaining of loss of revenue and business due to too many three wheelers commuting in the same area. The Minister said steps are being taken to regulate over-crowding in urban areas in an effort to keep the industry running.

The Minister also said that 20 percent of the estimated 80,000 three wheelers did not have a licence. He said measures were being taken to rectify the situation.

In addition to these matters the Minister said the number of passengers travelling in three wheelers would be restricted to four and all-possible measures would be taken to stop three wheelers from being used to peddle prostitutes and in the use of petty thefts.

These regulations will come into effect from January next year.

He said many other regulations would also be imposed on the three wheel drivers to guarantee decent standards.

Japan gives Rs. 2.37m to grassroots bodies

Two grant contracts under the Japanese "Grant Assistance for Grassroots Projects" (GGP) scheme, totalling US $ 33.935 (nearly Rs. 2.37M), were signed by Ambassador of Japan, Yoji Sugiyama and the heads of two organizations on October 14 at the Japanese Embassy.

The Government of Japan introduced "Grant Assistance for Grassroots Projects" (GGP) on 1989 to supplement its official development assistance yen loans, grant aid and technical assitance programmes. The GGP scheme provides financial assistance mainly to NGOs, primary schools, hospitals and other non-profit organizations for grassroots projects related to primary healthcare, education, public welfare, the environment and poverty alleviation an embassy release said.

So far, the Japanese Government has implemented 77 projects under GGP totalling US $2.1 million (approximately Rs. 144 million) in Sri Lanka.

The National Council for Mental Health established the "Sahanaya" Community Mental Health Centre in 1983. During the past 16 years, "Sahanaya" has provided educational, training, rehabilitation, clinical and out-reach programmes to those who need professional help.

However, there is an urgent need for the "Sahanaya" to improve its mental health expertise and information.

Therefore, it is important to update publications and provide better treatment and better environment in keeping with new methds. This grant of about Rs. 936,000 (US $13,200) will provide the "Sahanaya" with mental health literary publications and personal computers with access to the latest knowledge and information through other cyber media. It will also provide educational equipment and materials to assist in dissemination of knowledge, which will help strengthen its functions.

Out of a total of 15 villages in the divisional area of Beliatta, only half are fortunate to have safe drinking water. At Siripura, there is a very old well which was donated by JOYCEP decades ago. The Japanese Government has decided to support this project, proposed by the Divisional Secretary of Beliatta, with the intention of providing better health care and sanitation to the village.

Commercial Bank offers high interest rates

Commercial Bank of Ceylon Limited has launched a long-term Fixed Deposit Scheme offering a high rate of interest plus several other unique features a bank release said.

Called "Full Option", this scheme is the only three-year fixed deposit product with so many additional benefits, provided by a Bank in Sri Lanka. It carries an attractive 13 percent rate of interest per annum at maturity.

The bank's Senior Manager Deposit Mobilisation, Nugennt Kapuwatte said that while the minimum amount that could be deposited is Rs. 100,000, investors in "Full Option" are provided with free Life Insurance cover as well.

Describing some of the features, the release said he said a depositor has the option of receiving interest monthly, quarterly, half yearly, annually or at maturity.

An investor also has the option of withdrawing the money before maturity, at the end of the first or second year. The interest one would earn upto the time of withdrawal in such an event is known at the time the deposit is made, which is a distinct advantage over the other long-term investments in the market.

Among the other facilities offered through the "Full Option" scheme are Overdraft and Loan facilities upto 90 percent of the value of the Fixed Deposit approved immediately on application, Current Accounts without the usual minimum deposit requirements as well as instant approval of Credit Card facilities.

"Full Option" is available from any of the 66 Commercial Bank branches across the island, and is expected to be an attractive investment to persons who do not wish to be exposed to volatile market conditions, Mr. Kapuwatte added.

Deutsche Bank names regional head

Deutsche Bank has announced that Kersi Patel has been appointed to the new position of Head of Trade Services for India, Pakistan and Sri Lanka a bank release said.

Before joining the Bank, Mr. Patel was with the HSBC Group in India as head of their Trade business. He will be based in Mumbai.

Mr. Patel joins the Bank with over seven years of in-depth experience in Trade Services and was responsible for launching various Trade-related new products, initiatives and promotions for HSBC.

In his thirteen-year career at HSBC he also worked in the Personal Banking, Foreign Exchange and Support Services areas.

Mr. Patel is a Mechanical Engineering graduated and has a Masters in Financial Management.

"Kersi has a very valuable career experience in the area of International Trade," said a Javad Shirazi, Regional Country Head India, Pakistan and Sri Lanka. "This is a key Trade appointment for Deutsche in Asia and we look forward to him contributing significantly to the growth of the Trade business in the region."

Mr. Patel is actively involved with the Foreign Exchange Dealer's Association of India and is on the Executive Committee of the International Chamber of Commerce (ICC), India.

He had been appointed by ICC Paris as a DOCDEX (Documentary Credit Dispute Resolution Expertise) expert and was recently involved in resolving an international trade dispute.

He co-chairs the International Trade Committee of the Bombay Chamber of Commerce & Industry and heads the Chamber's Committee on E-Commerce. Deutsche Bank is a provider of Trade Services in the subcontinent, with clients ranging from Multinational Corporates to Large and Emerging Local Corporates and Public Sector entities.

In addition to providing a full range of conventional Trade products, Deutsche Bank has built up a specialised product expertise in the Russian Counter Trade business and non-recourse Forfeiting for exporters, and aims to be a leader in the Trade e-commerce segment.

Pakistan puts pressure

The hot topic internationally today may heat up problems for the local tea industry. The Pakistani State Bank's decision to protect its foreign currency reserves through imposition of cash margin for operating letters of credit (LC) has resulted in the worlds third largest tea consuming country cutting down on imports. Importers now have to pay 35 percent of the total import cost in advance, compared to the 10 percent they paid previously.

As a result of this decision, Pakistan's absence was felt at Mombasa auctions and led to sharp price declines in recent auctions.

Pakistan not buying tea and the increase in tea production promises downward pressure on prices, brokers said.

Asia Siyaka officials said that Pakistan absorbs almost 27 percent of Kenya's total tea exports and this accounted for the impact on the market. They added that from Sri Lanka's point of view, the slacking of prices in Kenya could have an impact on the Colombo auction prices in the short term.

However, given that Ramazan and winter is close at hand it is very unlikely that authorities would allow supplies to decline sharply as tea is virtually an essential commodity.

Closer home, last week's auctions saw better teas enjoy a premium over poor and plainer liquoring teas and is expected to follow into this weeks sale, while most categories declined in value. Low growns on the other hand declined for the third consecutive week.

Forbes and Walker Tea Brokers reported that the overall weekly sale average which has been steadily moving up over the past six weeks declined by Rs. 3.12 last week from its preceding sale price of Rs. 133.66 per kilo. Industry officials say the trend too would follow into this week.

Market update By Dinali Goonewardene

Elections announced; market hangs in balance

Market turnover plunged to Rs 9mn on Friday, following President Chandrika Kumaratunga's announcement of snap elections. Presidential elections were due before November 2000 but the commissioner of elections will now call for nominations before November 11 th.

The All Share Price Index fell .95 per cent to close at 866.2 while the Milanka Price index dropped .83 per cent to register 540.4. The MBSL Midcap Index fell 1.63 per cent to close at 959.3. Average turnover for the week was Rs 24.9 mn. Net foreign outflows during the week were Rs 32.48 mn.

Lanka Walltile gained 16 per cent, Horana Plantations 9.09 per cent and Dipped Products 7.27 per cent. Losers included The Finance Company 17.65 per cent, Central Securities 14.29 per cent and Lion Brewery 13.04 per cent. The plantation sector index dropped 2.2 per cent to 256, reflecting prices at the tea auction.

"Since elections were announced the market will peter-out and wait for elections," Head of Research, NDBS Stock Brokers, Chanaka Wickramasuriya said. "Some local investors will take a speculative view of elections and buy or sell depending on their perceptions of the out come. But by and large interest will wane," he said. "Postponement of the budget is a disappointment to investors and analyst who were eagerly awaiting the budget as an indication of government policies and this will be factored into the market," Wickramasuriya said.

"The market will be sluggish in the lead up to the elections," Head of Research, Asia Securities, Dushyanth Wijaysingha said. "The decision to have elections early will reduce the period of election uncertainty in the market," he said.

"The key issue is that elections are coming sooner rather than later and until that is over the market will not see a revival," Head of Research, C T Smith's Stock Brokers, Rajiv Casie Chitty said. "The tourism sector was expecting a very good winter season but if the elections are held during this time and violence escalates the season will be affected,' he said.

"The early election is positive as it reduces the period of uncertainty and would reduce political overhang on the market much sooner," Strategist, Jardine Fleming HNB Securities, Amal Sanderatne said. "The fact that the election is being held does not necessitate a drop in the market, in 1994 Sri Lanka saw a strong rally in the run upto the general elections," he said.

Counterfeit phones on the rise

As more and more Sri Lankans are craving for mobile phones, the number of counterfeit handsets are on the rise, industry officials said.

There are certain spot markets mainly in Europe who want to replace their old stocks, pass on older units or sometimes faulty units at knock down prices.

Vendors often purchase these handsets, insert low quality batteries and sell it in the local market.

Leading telecom equipment supplier Ericsson says around 25 per cent of the Ericsson units sold in Sri Lanka are brought through irregular means.

"We call it the parallel market because sometimes they are not pirated equipment but almost the same thing," Ericsson Telecommunications Lanka Managing Director, Johan Adler told The Sunday Times Business.

"It is difficult to crackdown on the market because it is not illegal, so long as you comply with customs regulation."

Adler says they started a proper distribution channel by appointing four agents, but the company is facing an uphill task.

"We try to educate the customers through various marketing campaigns about what differences to look for, but sometimes its so subtle that its hard to pick the right one," he said.

All handsets sold in Sri Lanka through the dealer network carry a serial number to ensure it is genuine.

Adler also said, Sri Lanka has a substantial replacement market for handsets despite having a low market penetration levels of around 0.1%.

"The replacement market is about 20% of the total number of Ericsson units we sell here," he said. The first mobile phone units to hit the local market 10 years ago resembled a huge brick. This market segment is now moving into newer slicker phones.

Some units are no longer compliant with the network, or not fulfilling the purpose any longer or not working anymore. Meanwhile, people's requirements from a mobile phone has also gone up.

Adler also says Sri Lankans love vibrant colours. "When I first came here the so called experts said forget about colours you can't sell them here.

But surprisingly the two most selling ones are the 628 and the 768 which was a real hit in the market." He however said it was difficult to predict what newer models will be popular because nearly 80% of Ericsson phones are now sold to first time users.

"It is difficult to predict what people really want. I am curious to see what models will be popular here. But judging from previous experience, the teak colours, mustard yellows, the blues may be hits here."

Adler expects the mobile phone market to have an annual 15%-20% growth.

YA TV notches four years

Asia's pioneer youth focused Education & Information Television program, YOUNG ASIA TELEVISION is today watched every week by over 40 million people in 10 Asian countries a YA TV release claims. YA TV was first broadcast on 24th October 1995 in Sri Lanka on TNL TV, coinciding with the 50th anniversary of the United Nations. Since then, Worldview Global Media, the owning company of YA TV, has expanded their programs to 9 other Asian countries, reaching over 300 million Asians.

Now YA TV Programs are watched, 6 days a week in India on Doordharshan Metro channel and Vijay TV, 2 days a week in Nepal on Nepal TV , 7 days a week in Bangladesh on Ten Network, 2 days a week in Thailand & Laos on Channel 5 & Channel 11, also 4 days a week in Vietnam on VTV2, 2 days a week in Cambodia on TVK, 2 days a week in Malaysia on RTM. In Sri Lanka, YA TV programs are broadcast daily from 7.25 pm to 8.55 pm on TNL TV.

In Vietnam, YA TV has a weekly audience of 18 million people of which 60% are under 25 years. In Sri Lanka, the YA TV audience has grown to over 1 million a week. YA TV was created as a BOI company by Worldview International Foundation to produce and export alternative Television programs with a focus on Asian, cultural environmental and development issues..

YA TV Programs are endorsed by Dr. Federico Mayor, Director General of UNESCO, as an important initiative to bring alternative Televison programs for young Asians. YA TV also enjoys the support of united Nations, UNICEF, ADB, WHO and many other international Organizations.

In the new millennium, YA TV programs will be broadcast from January in China on National Education TV in Chinese reaching over 200 million people. From February, in South Africa on ETV reaching 30 million people and in Columbia on National Columbia TV in Spanish. The International marketing Division of YA TV envisages to increase the weekly viewership to 100 million by the end of year 2000 with the China, Africa and Latin America broadcasts.

The board of Directors of Worldview Global Media Limited, the owning company of YA TV consist of the President, Mr. Arne Fjortoft, Chairperson Mrs. Nina Kung Wang and Directors Mr. Francois Manset, Mr. Samuel Koo, Count Roland de Kergolay, Mr. Nawaz M. Faleel, Mr. Hilmy Ahamed, Ambassador Joseph Verner Reed, Mr. Hugues B d' Annoax, Mr. Joseph W.k.Leung and Mr. Jan Ommundsen, Ms. Mette Havrevold, Mr. Rune Hersvik and Mr. Erik Langaker.

CleaNet's aims to introduce cleaner production measures

The Ceylon Chamber of Commerce, in its project to provide information to the business sector on environment related issues including cleaner technology, will be re-issuing its Directory of Environmental Consultants.

The Directory contains information on leading Specialists/Consultants in the field of Environmental Technology, Pollution Control, Waste Minimization, Noise Pollution and Waste-water Treatment Methodologies. It will be a useful guide to industrialists and foreign collaborators who are conscious of protecting the Environment and will help companies to access local expertise a new release says.

The Directory is compiled by 'CleaNet', a project jointly implemented by the Ceylon Chamber of Commerce, Industrial Technology Institute (successor to CISIR) and the National Development Bank. CleaNet's aim is to introduce cost effective Cleaner Production measures and Pollution Control Techniques to the industrial sector. It provides information, creates awareness and promotes the concept of cleaner production among industrialists.

Environmental Consultancy Companies who would be interested in including their Company Profiles in the Directory of Environmental Consultants, could do so by contacting the 'CleaNet' project at the Ceylon Chamber of Commerce, 50, Navam Mawatha, Colombo 2. Tel . 452184, 421745-7

![]()

Front Page| News/Comment| Editorial/Opinion| Plus| Business| Sports| Sports Plus| Mirror Magazine

Please send your comments and suggestions on this web site to