|

23rd May 1999 |

Front Page| |

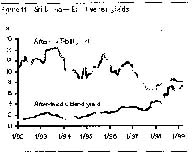

Jardine Fleming says SL stocks cheap but where is the market going?By Amal Sanderatne - Market StrategistSri Lankan stocks have become very, very cheap. Sri Lanka equities are very cheap, relative to those of regional peers, relative to historical Sri Lankan valuations and relative to fixed-income instruments. The market is trading at levels that would be more characteristic of an economy about to collapse, but Sri Lanka's corporate and macro fundamentals continue to be strong. But fundamentals are solid GDP growth hasn't been spectacular but is expected to be, the third-highest

in Asia. Corporate earnings have been strong. After falling 4% in 1996,

they grew at 41.1% in 1997. We expect growth of over 17% CAGR in the next

two years. Country risk from a balance of payments (BOP) crisis and forced

devaluation is minimal as the current account deficit has fallen from a

high of 7.4% of GDP in Furthermore, Sri Lanka's policy of a gradual depreciation over the years and a closed capital account have made it immune to attacks on the rupee, budget deficits have also been falling which together with a loosening of monetary policy in 1997, has brought interest rates down. For 12-month T-bills, they have fallen from an average of 20.46% in 1993 to the current 12.5%. Inflation remains subdued, which suggests that the lower interest-rate scenario can be sustained. Relative returns have improved to such an extent that just the dividends on many solid-growth stocks are offering higher returns than fixed-income instruments. The first boom'n'bust Sri Lanka opened up to foreign investors in 1991 and flourished during the emerging markets bull run with the all-share index reaching a peak of 1,379 on 1 March 1994. A change of government (from the right-wing UNP to the more people-friendly PA) in August 1994 led to a period of investor scepticism. In 1996, a severe drought coupled with power outages brought GDP growth down to 3.8% and corporate earnings down 4.1%. Sri Lanka's bust came earlier than for the rest of Asia. The market derated, closing 1996 at 603. 1997 recovery Yet Sri Lanka's economy proved its fundamental resilience and rebounded in 1997, with GDP growing 6.4%. Corporate earnings boomed by 41.1% and the market responded, rising over 40% till the end of July 1997. Then Thailand devalued and the Sri Lanka market was unable to withstand the flood of foreign selling that followed. Strong corporate performances and healthy financial fundamentals were ignored as the market tumbled. The only saving grace was that the market outperformed the MSCI. Still, it fell 23% between July and December 1997. For 1997, it rose 8% in US$ terms, the third-best figure for Asia. In 1998, ASPI fell on foreign sales Expectations of strong earnings growth led by exceptional profits reported by plantations fuelled a mini rebound in April-May 1998, that was snuffed out by a fresh flood of foreign selling in May following the nuclear testing in India and Pakistan. The sell-off in Sri Lanka, due to the sanctions imposed on India and Pakistan and the deteriorating external picture there, was actually unjustified, given Sri Lanka's own solid external picture. Finally, in July 1998, the collapse of the rouble, an external event that affected the market through its effect on plantation-sector earnings forced the market to fall further to a low of 461 on 3 September. Only the emerging recovery in Asia caused the local market to rebound to 597 at end-1998. But it still underperformed the rest of Asia. 1999 has proved disappointing as the CSE fell by 11% even though the rest of Asia has continued to recover. Since July 1997, the market has fallen along with other markets in Asia. This derating since the Asian crisis was largely unjustified as the crisis has slowed growth but not anywhere close to the extent implied in valuations. Corporate earnings growth continued to be strong in Sri Lanka, even though it suffered in most other markets. As the CSE has fallen mainly because of external concerns and corporate have performed well, the market has much accumulated value at present. Why not a continued fall? Cheapness and solid fundamentals in and of themselves don't set a floor for the market (at least in the short term), a fact that investors in 1998 learnt the hard way. In our Strategy 1997 report, we noted that Sri Lanka's stock market valuations were low by historical and regional standards, yet after that, the market fell further. The question on the minds of investors today is: What is different this time? And where how far down will the market go if external news flow turns negative. For instance, the latest missile testing by India and Pakistan has reminded investors of the May 1998 crisis, while the old bogeys of a renminbi devaluation and an emerging markets sell-off still lurk in the background. Fear of foreign selling dogs the local fund management community, and has prevented the realisation of the value in Colombo today. The bottom is 480 fundamentally The difference today is dividends. The attractive dividends reaped from many Colombo stocks have limited the downside in the market. Not surprisingly, the high dividend-yield stocks have outperformed. Equity returns in Colombo are now tax-free for domestic investors (see below), and just this tax-free real return on stock dividends is turning out to be as attractive as the after-tax return on debt instruments. At 480, the market would provide an after-tax return equal to that on debt instruments, and we see that as the bottom to the market. From the current index level of about 550, this would represent risk of just 13%. In contrast, we expect the index to rise to 750 by year-end (a 36% rise). We believe that any fall below 480 will be only temporary (which proved to be the case in September 1998) and the market will bounce back. Furthermore, the bottom is already here for high dividend-yield stocks such as Ceylon Tobacco. Should another sell-off occur, we believe that the high-yield stocks will continue to provide positive absolute returns even if the low-yield stocks derate further. Tax-free dividends in Sri Lanka: Capital gains on equities are tax-free for all investors, and since 1997, legislative changes have resulted in equity returns being tax-free for many domestic investors. This effect is crucial when returns on equities are compared with returns on fixed-income instruments. In 1997, a 100% Advance Company Tax (ACT) imputation was allowed for dividends declared by listed companies. This effectively meant that local shareholders would receive such dividends free of income tax. This is because the tax payable on the dividends would be equal to the tax credits available. For those shareholders not liable to pay income tax, the filing of a return could result in a refund of the tax credit. Furthermore, only resident shareholders can deduct ACT credits against income tax payable, so it was proposed under the November 1997 budget that companies need not pay ACTs on dividends paid to non-residents. This encourages higher payout ratios, especially by multinationals such as Ceylon Tobacco, Singer and Lanka Lubricants. Fair value is 800 Using very conservative estimates in our dividend discount model, our estimate of fair value is 800 for end-1999. We assumed 4% sustainable real growth in corporate earnings, a 9% after-tax risk premium and a 1.5% after-tax risk-free return. Using historical data for 1985-1998, real earnings growth worked out to be 7.7% pa and after tax risk-free return -0.8%. If we used this data in our assumptions, we would see the market's fair value shoot up to 3,666. Our more conservative assumptions suggest a value less than one-fourth of that. Our figure is 45% higher than current levels. At 800, the market's forward PER of 6.17x is still at a 50% discount to the Indian market. What will make the market move? Sparking the upsurge - What and when? The market has derated and it can't go down much more, but unless something triggers the market, we could be in for a period of lacklustre performance, with any gains coming mainly from dividends. Economic and corporate growth We don't see a boom year or GDP growth shooting past 6% any time soon, but neither do we see it falling below 4%. The worst of the slowdown resulting from export challenges and bad weather in 1997 is over. From now on, we will see a modest improvement. Our forecast is for 5.2% growth in GDP for full-year 1998, with stronger growth YoY in 1998. Corporate earnings are expected to grow by about 17% in 1999 (JF has yet to finalise some earnings downgrades). Thus, even without a rerating, the market will move 17% on earnings growth alone. Following the region The Sri Lanka market usually tracks other markets in the region. On its way down, it has been far from immune to the crises in other markets. On its way up, it has often seen its bull phases sparked off and aided by rallies in the region. The 1993-1994 bull run was a striking example. The MSCI began its assent at 218.48 at end-December 1992 and ended its run at 434 in December 1993. Colombo was a couple of months late: Our bull run began later, at end-April 1993, with the index at 541, and ended later, at end-February, with the index at 1,375. Sri Lanka not only caught up, but outperformed. A similar trend looks likely to occur again this year, with the market following movements in the MSCI with about a month's lag. Politics ends Sri Lanka has lagged the region, as politics took centre-stage during the run-up to the elections to five provincial councils. The elections to the Southern province in June are likely to dampen sentiment only slightly, given the peaceful conclusions to the earlier elections. What happens during the presidential and general elections, due in 2000, will have a strong effect on the market as the issue of who will be in control for the next six years will be settled. If speculations that these elections will be held prematurely are proved correct, the trigger that the market needs will come all the sooner. EPF and large funds Sri Lanka's lack of liquidity cuts both ways. A small allocation (by international standards) from an FII can push the market down, which we have already seen happen. Equally, an allocation of even US$20m to Sri Lanka can push the market in the opposite direction. That is all it needs. Once it gets that push, the valuations in the market will allow it to be sustained at this higher level. In this respect, reforming investments made under the Employees Provident Fund (EPF) system will provide a critical source for new funds into the market. EPF made its first investments in the share market in 1998, with the total reaching Rs 332m, as revealed in the 1998 November budget. In total, the fund holds an estimated Rs 160bn. The investments it has made to date amount to just 0.2% of that amount. If the fund increased its allocation for equities to 1%, the inflow would be Rs 1.2bn, Rs 130m more than the net foreign sales of 1998, which brought the market down. In his budget speech last year, the deputy minister of finance envisaged greater equity investment by the fund in 1999. EPF is known to be working with the World Bank to improve its investment decision-making process. Sri Lanka Telecom In 1997, 35% of Sri Lanka Telecom (SLT) was sold to NTT for US$225m, with NTT taking management control. An IPO is expected within the next 12 months. This will have spill-over benefits for both the market and the economy. In our macro projections, we have assumed a US$200m inflow from a further sell-down of SLT. One problem that could stand in the way of the IPO is the battle between SLT and the telecoms regulator over the company's interconnection agreement with private operators. However, a small number of shares could be sold to NTT before the main placement. The revenue from a placement would lead to a further fall in T-bill rates. Year to date, interest rates have remained subdued at about 12.5%. The revenue from SLT could well cause rates to fall below this level. Furthermore, there are the unquantifiable effects on local confidence if SLT is successfully placed. Sri Lanka's perennial problem has been one of liquidity. With market turnover now approaching less than US$1m a day, many foreign funds do not seem to find it worthwhile to devote time to making an assessment of Sri Lanka, given the very small actual returns that can be made in practice. SLT's IPO would give the market its first billion-dollar company with enough liquidity to create a new focus on Sri Lanka. The possible downside is that local funds would have probably have to allocate funds to SLT, which could put pressure on other stocks. 750 - Our year-end target for the ASPI Our year-end target for the ASPI is 750 (less than our conservative calculation of fair value). Much would depend on the actions of FIIs, who have continued to sell Sri Lanka despite the rally in the rest of Asia. As the main provincial elections have ended peacefully, we believe that further FII sales will be limited. However, the earlier sell-offs and the subsequent underperformance by stocks with large FII holdings still dominate the minds of domestic investors. Dividend rerating will lead initial push Given this fear, there has been increased interest in high dividend-yield stocks, which have limited downside because of the hedge provided by the yields. Investors have warmed to such stocks because the dividends are more real than the potential upside from capital gains. Furthermore, the income from these dividends has helped investors to ride out the downturn and match opportunity costs. This switch to stocks such as Ceylon Tobacco, Lanka Lubricants, Walkers Tours and Colombo Dockyard has led to their share prices posting positive gains despite the overall fall in the index. We feel that this phenomenon has not yet run its course, and we believe that high-yield stocks will rerate on dividends to the point where returns on dividend will equal after-tax returns on fixed-income instruments. Sentiment improvement after August As we have already witnessed, such stocks could appreciate in price even if the market overall turns negative and foreign sell-offs continue. However, our expectation is that, in the immediate term, net foreign activity is likely to be neutral rather than negative, given the rally in the rest of Asia. We expect stock prices to be driven initially by domestic investors, mainly because of dividends. Under this scenario in the immediate term, the market should rise by about 10% until around August, given dividends-based rerating and adjustments to corporate earnings growth. Then with the economy picking up steam in 1999, we should see an improvement in sentiment and an increase in multiples. The listing of SLT and its spill-over effects are likely to be factored into market prices, which will drive the market up to 750 by year-end. Watch the FIIs and EPF - Their actions could change outlook FIIs could change the entire scenario with a sudden return driven by the recent performance in the rest of Asia. If this happens, we will see FII favourites outperform the currently strong income stocks. Of course, there is always the risk of another emerging market crisis that could turn the current recovery in Asia into another dead cat bounce. If heavy foreign selling continues all year, only income stock will be rerated based on their dividends. The market would then end the year at about 600 rather than the 750 we expect now. Of course, EPF investments if made could easily overshadow foreign selling. What could go wrong Much of the risk of Sri Lankan equities is in the price. The only news that would bring the market down below a fundamental bottom (480) would be news affecting the ability of corporates to sustain current dividends or higher interest rates. We believe the main effect of negative news would be to reduce our index target rather than reduce the floor. Fiscal indiscipline Our chief worry is that, in a prelude to national elections, as mentioned in the previous sections on politics and economics, the government could move towards fiscal easing by announcing a voter-friendly package. We believe that there is a 30% risk of this happening, which could change our forecasts. If major voter concessions were announced, our year-end target would be reduced to 600 and the floor to 450. Terrorist attacks by LTTE The second risk we fear is that LTTE's terrorist attacks on Colombo could escalate into full-fledged economic warfare with regular large-scale attacks on the capital. A bomb or two a year is partly priced into the CSE's valuations as are the more small-scale attacks. Often the market seems to react positively after a bombing, which suggests it was expecting something worse. Here, what we are worried about is an escalation way beyond anything we have seen in the past. The probability is about 20%, and it would drag down our index targets as much as fiscal easing would. US crash Our third concern is Wall Street and the US economy. As the US is Sri Lanka's key export market, a slowdown in the US could have serious repercussions for the Sri Lankan economy. A return of Wall Street to pre-'New Economy' valuations could also dampen sentiment in Colombo in the short run, even though in the long run, it could lead to new money flowing to emerging markets and the CSE. Don't miss out Sri Lanka fundamentals remain strong. Corporate earnings grew strongly here even though they fell elsewhere in the region. Though other markets will show earnings growth this year, off low bases, Sri Lanka will see earnings growth of at least 17% in 1999, from already high bases: growth of 40% in 1997 and more than 20% in 1998. The budget and current account deficits have been falling. Interest rates are expected to remain subdued, and the currency is in no danger of a snap devaluation. Yet the PER multiple is the lowest in Asia. The only real problem is liquidity, but this will double with the expected listing of SLT within the next 12 months. Again, we stress: The risk of serious downside is limited compared with the potential upside. The risk-averse can buy high-yield stocks to further minimise the downside. Those who believe that FIIs will return have the option of buying blue chips at all-time low valuations.In the 1993-1994 bull run, Sri Lanka lagged initially but then caught up and outperformed. Don't miss out this time.

Low growns up, high growns margin widensLow growns category, which built on the previous auctions average price of Rs. 123.90 could increase further by Rs. 1 or Rs. 2 this week, officials said. While prices of low grown tea prices will continue to climb this week, the price gap between poor quality high growns and best quality high grown teas has widened to Rs. 50/- whereas before it was a mere few rupees. Industry officials said that this had led to increased production of high quality teas. The industry also witnessed, probably for the first time, online marketing of some of the world's finest teas at the Java Centrale Internet Cafe. Massimo Da Milano Incorporation (MDMI) announced an Internet marketing agreement with Millennia Tea Masters Incorporation, producer of Ceylon Teas. The project is a joint development with iChargeit.com and to MDMI's Web site. In addition, Massimo's will be distributing Millennia's products in America beginning with a marketing effort directed at MDMI's existing customer base. Meanwhile coming back to the real world, industry officials said that the COMESA trade agreement had affected Pakistan too. Pakistan exports rice to Kenya and in return imports tea, but with the COMESA trade agreement Egypt is now supplying Kenya with its rice requirements in exchange for tea. This has set the stage for more trade between Pakistan and Sri Lanka. Also in Pakistan tea officials held talks last week to decide if they were to host the inaugural Tea Association of South Asia (TASA) meeting in November this year. In Kenya tea production declined by 42% YoY to 50.2 million kilos in the first question of 1999, following adverse weather conditions. Bad weather conditions affected India's production which dropped by 24.22 million kilos in the first quarter.

Ad campaign to boost unit trustsIn a bid to bolster the Unit Trust industry, the Unit Trust Association launched a strong media campaign with the hope of tapping the fixed income securities market. The campaign which is mainly targeted at medium and long term investors; those who earn a minimum Rs. 50,000 per year and secondary those who earn Rs. 10,000 per month. The campaign which costs Rs. 7.5 mn is partly funded by the Securities Exchange Commission and the Unit Trust Association of Sri Lanka. This will become a historical step initiated by the Association to take capital market opportunities through unit trusts to the door step of the Sri Lankan saving public, Unit Trust Association President, S Jeyavarman said. The promotional campaign will target average Sri Lankan savers who have a few thousand rupees to save for the medium to long term, but who are generally not aware of the new investments available in the market to enhance their long term return. The promotional campaign will specifically emphasise the nature of long term investment, the opportunities for growth in initial capital available in unit trust product and the unique security feature present in a structure of unit trust investments. Unit trusts globally have produced lucrative opportunities, mainly to small savers to access the high return opporutnies offered in the capital market. Unit trusts therefore plays an important role of chanelling rural savings to meet the needs of economic developments by investing in innovative capacity market instruments. It has become a stabilising office in the depressed equity market during the last few years and the equity trading by the industry accounts for 9.3 per cent of the total trading volumes at the Colombo Stock Exchange from 1992-1998. With the downward trend in interest rates, in the long term, supported by reductions in inflation, the savers will find it more attractive to move their investments into unit trust compared to the single digit interest rate usually received from traditional savings products.

Record trading nets 32mWinds of change appear to be blowing across the Colombo stock market. Trading volumes increased tremendously over the last two weeks. Net foreign inflow during the period amounted to Rs 32 million. John Keells Holdings, DFCC, Colombo Dockyard and Sampath Bank stocks gained marginally. The trend in the indices and activity levels indicate sentiment has improved and the market is showing signs of recovery," head of research Jardine Fleming Stock Brokers Panduka Ambanpola said. There is an encouraging amount of foreign buying, foreigners are capitalising on the value available in the market," Head of Research John Keells Stock Brokers, Nanda Nair said. Stocks are 2-4 times cheaper in the local market compared to the regional market," researchers at Asia Securities said. They attributed the increase in foreign interest to the lagged impact of rallies in the regional market. If the market picks up 15 points, locals too would come in to the market, given the low interest rate scenario," they said. A lot of money that left the region during the East Asian crisis is returning to the region," Head of Research C T Smiths Stockbroker's, Rajiv Casie Chitty said. This has resulted in some foreign interest in the Sri Lankan market," he added. However the fundamentals of the market remain the same cautioned NDBS Stock Brokers. "Corporate earnings have declined, liquidity in the market is poor and macro economic trends are negative," they reiterated.

Private banking to keep things hush hushSeylan Bank has launched a new product, offering value added services to high net worth customers. A minimum deposit of Rs 5 million entitles customers to private banking where a bank officer is nominated for each customer to attend to his services to the extent of this officer even visiting the customer's residence.. The bank has dedicated the 16th floor of Ceylinco Seylan Towers for private banking. Customers privacy is closely guarded. "In todays context with kidnappings, people don't like to flaunt their money. Everything here is very hush hush." Seylan Bank Manager Private Banking, Rohan Wijesinghe said. A separate lift is allocated for private banking customers. Secluded rooms have been made available to the customer in which all diverse transactions can be enacted. A hotline to all chief managers facilitates this. The room is also equipped with phones, Reuter screens and internet facilities. Customers who prefer not to visit the bank can carry out transactions from their homes with the aid of a relationship officer who can be contacted 24 hours a day. Each relationship officer services ten customers. Customers can also carry out transactions on the phone using a personal identification number. The bank verifies the phone call by calling back and records the conversation to maintain security. Seylan has tied up with numerous hotels, and private banking customers using these hotels may sign a cheque instead of paying the bill. The bank will remit the funds to the hotel. Travellers cheques, visas and travel documents will also be provided to customers. The bank will host cocktail parties for members on a regular basis to enable members to meet and transact business among themselves. The bank maintains a research department to screen all prospective clients. "Our research department screens the clients to ensure funds deposited are not earned through nefarious means which conflict with the bank's moral responsibility and corporate culture," Mr Wijesinghe said.

Mind your Business By Business BugGST another nameOkay, Okay, so they have told us that they wouldn't increase the dreaded GST. They couldn't afford to do that with elections due at any moment, could they? But then there is that other question: where does the money for all the welfare schemes and non-income generating services such as health and education come from? Someone- a big boy in the Treasury, who else? - has suggested that another tax be introduced with another name at a lower rate for state employees and at a higher rate for the private sector. The matter is receiving due consideration at the highest levels, we hear but the big question is what will the tax be called? When time's rightFirst a sizeable share of the then monopoly was sold to the Japanese and now we are told that rates for their services will be raised again, from the first of June. The monopoly is no longer theirs and there is a bitter court dispute with their rivals as well but no one doubts that the public share issue of this venture will be the biggest in the Colombo market for some time to come. So, strict instructions have been given to get the timing right so that the market reacts with an upward trend, just in time for the hustings!

CommunicationThumbs up for telecom sectorBy Shafraz FarookSri Lankan telecommunications industry got an 'all clear' signal on Y2K compliance by a Y2K Telecom consultant recently. British Telecom consultant Graham Jenner gave a confident 'thumbs up' to the local telecom sector and said all systems are nearly in place ready for the millennium. The Telecommunication Regulatory Commission (TRC) flew in Mr. Jenner to review the telecom sector and ensure all systems are millennium compatible. He also conducted a three-day workshop for all operators and a few banking personnel. The Y2K audit was mainly conducted through documentation and on site supervision. While the three fixed access operators, were checked on site, random audits were carried out on a paging company and an Internet service provider. A lot of time was spent going through documentation, particularly contingency plans drawn up by individual operators. He said, the documentation prepared was very good and the operators had put tremendous work into this particular project. "I feel at the end of the day if something goes wrong for any operator, it's not for their lack of trying," he said. The operators have covered all possible angles and as far as I am concerned, they are very confident and everything thing is moving very positively, he said. "What was visible was very pleasing." A suggestion was made for the operators to study the external operators, "because at the end of the day I fell a greater threat might come from outside Sri Lanka." He was impressed by the thoroughness of the documentation. The general running of the company was good across the board and there were no instances where officials were fumbling through trying to find the proper documentation. "Everything was properly documented and this indicates that they are in control," he said. However, the TRC needs more power, he stressed. "They have got some very good people, but they lack sufficient powers. It's not their fault but that of the government," he said. As part of the recommendation made in the report he stressed that the TRC needed more power. "It is not something they can device themselves, it will come around, and I am sure it will happen. But, I think the Sri Lankan regulator needs to have to more power," he added.

Cellular boom in Sri LankaThe telecommunications sector is the fastest growing sector in the world

and here in Sri Lanka to it The mobile phone sector especially has grown phenomenally since the introduction of the first mobile phone back in 1989 by Celltel. Now, with the digital revolution, growth is taking to new heights. Handsets too are high tech, and chic. Certainly compared to the earlier models, the 'gadol bagee' also known as 4x4 model which weighed at least one pound, a must have then, to the more modern, compact and I mean compact cell phone. The gadol bagee surely left its mark on many of us both mentally and physically. Especially those who were given the pleasure of displeasing individuals possessing the gadol bagee. Even the fixed phones nowadays come in all colours, shapes and sizes. From wireless to wired, video and net phones, the telecom revolution has made waves in the end of the 20th century. Mankind cannot go back to an era without the phone. He is highly hooked to the concept of the phone. It is pretty astonishing when you look at it in terms of numbers, where a mere 1800 cell phone users were in the market in 1991 and in 1998, it grew to 174,202 users and still growing very rapidly. But one should understand that one of the reasons for low usage in the early 90's was the hyper price of cell phones. Nowadays cell phone prices have come down by at least 60% and it is no more considered a luxury. Authorities reported that cell phone growth had surpassed fixed access phones by a percentage or two, this does not come as a surprise since the cell phone has become a necessity. The only thing that is amazing is that cell phones becoming a necessity when a few years back even the fixed access phone was considered a luxury. Still, with all this growth Sri Lanka has a large untapped market which quite possibly will change soon.

Mayday, mayday from TelecomAn emergency disaster management plan will swing into action on January 1, 2000 if the millennium bug cripples all or parts of the telecom system, a report on the use of telecommunications in disaster and emergency situations has revealed. Since telecommunications play an important role in disaster relief situations, the report suggests the government bring in necessary equipment such as containerised switch, software, training personnel to prepare for such an event and more importantly reactive communication links. The Telecommunications Regulatory Commission (TRC) prepared the report on the basis of extensive feedback on a previously circulated interim report received during the National Workshop held in November 1998 and additional interviews. The pilot study was the first to be completed in the world and was partly funded by ICO Global Communications UK. The recommendations include keeping at least parts of the network operational in the aftermath of bomb blasts. An automatic trigger will cut the excess load of less prioritised numbers and leaving the priority numbers accessible. The telecom industry standards stipulate each operator maintain 20 per cent of the network to accommodate any extraordinary usage like in the event of a disaster situation where the traffic load builds up and results in networks getting jammed. In reality, most operators tap the reserved 20 per cent in the interest of profit and revenues. The report suggests strict adherence to the 20 per cent level which may be mandated by the TRC. An emergency call centre modelled on the 911 or 112 services found elsewhere in the world will also have to be established. Other recommendations include, the possible use of satellite or GMPCS (Global Mobile Personal Communication System) phones in disaster situations, and the need to ensure 'emergency telecommunications kits' are maintained by all operators. The report also highlighted the absence of emergency telecom equipment in the National Hospital ambulances. As an initial step towards solving this problem, the TRC donated emergency telecommunication equipment was to the Colombo National Hospitals last week to mark World Telecommunications Day. The equipment was partly funded by the TRC, Dynacom Networks (Pvt.) Ltd. and the voluntary contribution of the TRC staff. |

||

|

Front Page| News/Comment| Editorial/Opinion| Plus | Sports | Mirror Magazine |

|

|

Please send your comments and suggestions on this web site to |

|

1994

to an estimated 1.9% in 1998.

1994

to an estimated 1.9% in 1998. has

made its mark.

has

made its mark.