|

28th March 1999 |

Front Page| |

|

WTO accord on financial services52 states sign accordBy Mel GunasekeraSri Lanka together with 52 countries has signed a World Trade Organisation (WTO) agreement on financial services to liberalise the sector. The landmark agreement is part of the General Agreement on Trade in Services (GATS) which came into effect from March 1st 1999. The agreement brings trade in this sector - worth trillions of dollars - under the WTO's multilateral rules on a permanent and full most-favoured-nation basis. The combined commitments of the 52 governments cover more than an estimated 95% of the world's financial services and eliminate or relax current restrictions on commercial presence of foreign financial services suppliers. The commitments, which cover all three of the major financial services sectors - banking, securities and insurance - also reduce current limitations on service suppliers. Sri Lanka's policies in the area of financial services have been more liberal than many countries. At present, Sri Lanka is not a major exporter of financial services, but has great potential and expects to grow in the future. Thus it was felt that the submission of schedule of specific commitments by Sri Lanka based on existing policies would enhance international recognition of the liberal policies in place in Sri Lanka's financial sector. Regarding the banking and other financial sectors, the liberalised policies already in place were forwarded as commitments. However, there were two important measures, which deserve specific mention. Firstly, commercial banks incorporated outside Sri Lanka were permitted to open any number of branches in Sri Lanka. Second, in terms of the Banking Act, non-nationals are permitted to hold only up to 49 per cent of equity in any institution providing financial services. However, Sri Lanka retains the right to subject approval, registration and licencing relating to banks and other financial institutions to an economic needs test. In the insurance sector, offers were made in three sub sectors: Life Insurance, Non-Life Insurance; Re-insurance and Retrocession. In the case of both life and non-life insurance sub sectors, under market access, new establishments are subject to licences approved by the Sri Lankan government while there will be no limitations on national treatment. In both sub-sector, foreign equity participation is determined by the country's general laws relating to foreign investment.

Kotelawala scotches rumoursThe sleepy Colombo bourse jolted awake last week with Ceylinco Group's sudden, surprise announcement of a major re-structuring operation with the Group's Deputy Chairman Daya Senanayake being retired from the board of several group companies. The Ceylinco Group which was re-named Ceylinco Consolidated prior to the restructurig announced last week, has Chief Executive Directors in charge of sectoral groups with a total of over 77 individual companies. "The decision appears sudden, though its really not a sudden decision," Ceylinco Consolidated Chairman, Deshamanya Lalith Kotelawala told The Sunday Times Business. The re-structuring process was a direct result of the 1996 Central Bank bomb in which Mr. Kotelawala was injured. "While convalescing I realised that the whole company was centered around me and decided to make 12 sectoral groups, with 12 dynamic people heading each group," he explained. With the millenium dawning and the new accounting year commencing next month, we took the decision two weeks ago to formalise the structure, delegate more responsibilities to the heads of 12 sectoral groups and make them Deputy Chairman of each group, he said. Ceylinco Consolidated is not a holding company nor will it seek a listing on the CSE. The company operates on a cellular structure, as opposed to a pyramid structure where each company operates independently. Since each company operates on a profit basis, when Blue Diamond Jewellery ran into difficulties, it had a minimum effect on the group. This is the safety of my organisation, he said. "It was a mutual agreement between Daya Senanayake and myself that he will step down and concentrate on the Blue Diamonds Group," he added. Dispelling rumours that Mr. Senanayake and he had fallen out, Mr. Kotelawala said, he had been friends with Daya Senanayake since kindergarten and they grew up together. "Ours is a unique relationship, not based on business but on personal relationships." Mr. Kotelawala and Mr. Senanayake are presently concentrating on re-structuring the Blue Diamonds Group. Mr. Senanayake is still directly involved with the Blue Diamonds Group and the Seylan banking group. The onset of the East Asian crisis was responsible for the collapse of the Blue Diamonds Group. The company's main buyers were Thailand, Hong Kong, Japan and Malaysia. Credit problems with buyers led to heavy provisioning in their annual accounts, resulting in the plunging of Blue Diamond share prices. However, the situation is reversing, with Mr. Senanayake securing orders from the USA, and the Asian economy recovering. The factory has been re-organised, the staff motivated with productivity bonus increasing productivity by 20 per cent. "We are looking forward to the free trade agreement to export jewellery to India. At present India imposes a 35 per cent duty on all diamond and jewellery imports," he said. The Group plans to sort out the continuity of share ownership as the next step. "We are thinking about Employee Share Option ownership". All I know is that the group must continue. For instance if a child has taken a life policy from us he must have an assurance that he can collect the money in a few years time, he added. One of the largest business houses in Sri Lanka, Ceylinco Group has eight listed companies. Chairman Kotelawala says that although his group will expand further he will not go into the areas of animal husbandry, arms, and liquor.

Factory owners trying to scrap price formulaThe Tea Factory Owners' Association is pushing for abolition of the time tested, 30- year old price formula for green leaf to tea smallholders, citing poor auction prices. Chairman, Sri Lanka Federation of Tea Small Holding Development Society, K. M. Upananda, told The Sunday Times Business that the real threat to the Factory Owners Association could be that the smallholders are quietly and steadily getting on their feet. A budgetary package of Rs. 200 million has led to the smallholders arranging their own transport of green tea to factories and in some instances setting up their own factories. "This may be the real threat. Or else why would a 30 year agreement suddenly become unfavourable to them even if the tea prices have fallen. This is not the first time tea prices have fallen at auctions", Mr. Upananda said. He added that factory owners sometimes resort to deliberately submit low grade teas for auction. The bone of contention is the price formula. The small holder gets 68 percent of the auction price of the made tea and the factory owner gets 32 percent . In countries like Kenya this ratio is 75% to 25%, as was in Sri Lanka when the Tea Reasearch Institute (TRI) first introduced the formula based on scientific study. President Upananda says that the Factory Owners Association conducted a hostile media campaign saying that the factory owners were subsidising the smallholder despite poor tea prices. While the information in the press was incorrect it was also injurious to the state of the smallholder, Upananda said. The small holders say that the regulatory authority, the Tea Commissioners Division, has not taken any action to stop these hostile moves by the factory owners by giving them a clear directive on the price formula. " We have tolerated them, but this is going too far," Upananda said. The current price of Rs.12 per kg of tea, has undergone a dramatic 50% drop from February to mid-March. Tea industry which enjoyed premium prices early last year is now in trouble following the rouble crisis(CIS countries being the major buyer) and Iraq(embargo) and Iran markets (devaluation). Small holders contribute nearly 70% of production. Made leaf prices which sky rocketed from Rs.62.78 to Rs. 134.35 in a period of five years from 1994 has dropped from January's Rs.132.30 per kg at Rs. 105.80 in February. In the face of opposition, smallholders are banding together and are on the threshhold of forming the Teashakthi Movement, the members said. With the proposals of building their own tea factories (with two factories at the moment) they want to be in part with the whole tea making process, to gain more financial benefits. Meanwhile, the Private Factory Tea Smallholders Association is to receive a Rs. 350 mn soft loan from the Treasury as a temporary measure to cushion the industry from the prevailing low price situation. Plantation Ministry officials were tight lipped about the details of the loan, as the proposal is awaiting Treasury approval. The government has also appointed the National Institute of Plantation Management to evaluate the prevailing problems of the tea industry. Factory owners have been asked to submit their accounts for the past three years, and for a detail assesement of their debt portfoilo.

Dip in growth endangers long term developmentForecasts that the economy would grow by less than 5 per cent this year is bad news. Given the global downturn and the lower rates of economic growth in many other countries, a 4. 5 per cent growth or even a 4 per cent growth appears quite acceptable. Yet it is bad news as the long term expectations that the country would achieve a much higher rate of growth needed to solve the country's economic and social problems appear to be diminishing. Economists have for sometime pointed out that the country requires to grow at around 8 per cent per year for about a decade to make a serious dent in the country's problems, particularly, the problem of unemployment. It is also an 8 per cent growth over a decade that would ensure a doubling of per capita income during the next ten years. Such a rate of growth would be needed to sustain social welfare expenditures and reduce poverty to acceptable levels. While we have been speaking of these kinds of growth rates, we have, in fact, achieved only a little above one half of the required rate.One can even be fatalistic and say that the country can in fact achieve only an average of around 5 per cent of growth. But that is another way of saying that we would not be able to solve our problems. Since we cannot take such a fatalistic view we must look to the reasons why we have been unable to grow faster. One easy answer is to blame the war. No doubt the war is an important factor inhibiting a faster rate of growth. It affects the economy in very many ways, both directly and indirectly. But we must look beyond the debilitating factors of the war to take remedial action. If the war ends tomorrow to expect the economy to automatically generate an 8 per cent growth sustained over a long period is a pipe dream. There are a number of other conditions which must be fulfilled to achieve the kind of rapid economic growth which the East Asian countries achieved. These include governmental actions besides, good policies, as well as a response by civil society to back up economic growth. But people's responses can only come in a situation where the government takes a leadership and makes it clear that it is seriously interested in policies and actions which are growth oriented. The government must play a proactive role. Recent governments have failed to play this role as there has been a lack of priority for the pursuance of economic policies. Instead government's prior concern has been to pursue policies which would bring short term political gains. Political concerns have dominated the country's scene not economic programs. Frequent elections have made this obsession with politics the greater. The economy has had to grow with very little positive actions by the government. It is true that the government has put in place a good framework of policies, but that alone would not do in an underdeveloped country like ours where the government must play a more supportive role for economic growth. When the country faces unfavourable global conditions, it is precisely the time when there must be support to those sectors which are facing problems. Besides this there have to be efforts to find alternate strategies to ensure growth. There is an urgent need to take the fall in economic growth seriously and find ways and means by which we can grow faster. The expected fall in growth must be a challenge to policy makers to find ways and means of putting the economy on a path of higher growth.

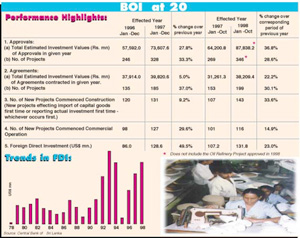

At 20 the public still does not know us properly - BOI chiefThe country's chief investment promotion establishment, the Board of Investment, originally the Greater Colombo Economic Cooperation has turned 20. The Sunday Times Business reviewed its performance over the recent past and its run up to a "diamond status" and spoke to its chief, Tilan Wijesinghe who says that there are many public misconceptions about the BOI which they are attempting to clear in an ongoing comprehensive advertising campaign. By Ruvini Jayasinghe

A: One is that BOI is only geared for foreign investment. This is not correct. Because under our law, any company incorporated under the Company's Act, regardless of whether it is foreign, local or a joint venture, can be approved. What is interesting is last year, of the 180 BOI ventures that commenced operations, exactly 50% were 100% Sri Lankan companies. Another is that every company that has the tag BOI approved has to have some incentive. Approval is granted for entry of foreign investment into areas, which do not necessarily qualify for incentives. Q: The strongest criticism of the BOI is that it has not attracted the right kind of investment so far. McDonalds, Kentucky, Pizza Hut and a crop of Chinese medical clinics can in no way be compared with a big manufacturer - a Fortune 500 company investing here? A: The BOI suffered its single largest setback in its investment drive in 1983. At that time there were investment applications from Motorola, Harris and big Japanese companies, all of which abandoned Sri Lanka as far back as 1983. We are attracting investment basically which.. Let me put it this way. The quantum of investment into Sri Lanka can be doubled or tripled if our international image changes. In my opinion the single largest drawback to attracting investment is an unfavourable international press. Recently Newsweek has reported Sri Lanka as a higher risk country than even Egypt where recently 60 or 70 tourists were brutally murdered. Thats just one example. Now given this framework, we still continue to attract investment. For example, last year 82 projects with foreign equity participation commenced construction. Previous year it was about 70. I am not even taking into consideration the restaurants, we do not sign agreements with them and keep statistics on them. The reason we keep attracting investment is because our economy continues to be resilient, our human resource potential and the regulatory environment governing investment, one of the best in Asia. Q: Why are you permitting all these Chinese medical clinics and other small time entertainment operations to come here? A: Well they are usually approved, as I told you, under the normal

laws. There is nothing in the laws of our country to prohibit them coming

here. Medical clinics are referred to the ministry of health. Once they

are set up they have to abide by the laws of the country. If the laws of

the country are Q: Are there any such companies that have been sent away? A: Not that I can think of. But at the end of the day they are taking all the investment and market risks. Q: Well if they are not given any particular incentives and operate in a competitive business environment there is no argument with that. But do these establishments boost your investment figures? A: It doesn't. I don't include them. We include only those that qualify for incentives under section 17 of the law. You can go through my annual report you will not see any restaurant or medical center or Q: BOI seems to have attracted more investment into infrastructure than into large-scale industry. Do you agree? A: Even if it has, what is wrong with it? Q; Nothing wrong with it except that, why aren't there any big industries setting up here alongside infrastructure projects because industry would generate more employment also. A: In the last 12 months alone, investment above Rs. 100 million is . If you read the advertisement today you could have got an idea. In fact today I had confirmation from Courtalds Clothing of UK on constructing yet another plant for Rs. 1700 million. Construction commenced on a US$ 40 million cement plant in the south. We have also got confirmation that YKK who is the largest zip manufacturer is coming here. Then we had Holderbank of Switzerland subsequently investing a further Rs. 1.2 billion on expansion. The issue here is the number of blue chip companies of international stature that we have attracted. Q: Are you satisfied with the performance of the BOI after you took over? A: Investment plunged dramatically in 1995. Foremost reason is the fact that in November 1993, the policy makers at that time decided to abolish all tax concessions. Even though I am totally opposed to having a plethora of tax holidays, which are not targeted to priority sectors, abolishing all tax holidays was a shortsighted measure because, virtually every developing country attracting foreign investment has offered tax incentives. So therefore the 1993 decision had an impact in 1995. Secondly, we had a change in the government, and there was uncertainty, delays in the policy framework. But then we put in collectively several initiatives firstly, a revised incentive package was introduced. The second issue we corrected was that since the construction of the Biyagama zone in 1987, no new modern industrial parks were constructed within 50 kilometers from Colombo. In fact Koggala and Pallekele were constructed for not entirely economic reasons. And with the declaration of the whole country as a free trade zone we found that the rate at which project were implemented was slow. We took a decision to recommence setting up of industrial parks, and through that initiative we have now completed Mirigama, Malwatta and Wathupitiwela is under construction. The Seethawaka zone will be opened by the President in a few days. We are also planning on launching a large industrial township in Horana. Thirdly, the overall policy environment governing investment became quite stable. We have seen the results immediately. FDI has grown in every year since 1995. Q: What sort of investment do these industrial parks generate? Is it the investment that is important or the employment aspect? A: Both are important. In my opinion without investment there cannot be employment. And in a situation of globalization what is most important is that investment is competitive. So as a result of it, we have resisted from the practice of insisting on minimum employment level, which is as high as 400 or 500. We no longer have the luxury of doing that because today garment factories are highly automated. We have taken a decision that considering our unemployment rate today is 9.6% compared to 13% - 14% six to seven years ago, what is important is encouraging capital formation, ensuring that investment takes place, because consequent to investment employment will also takes place. Q: There is discrepancy between the projects approved and actually implemented. Why is this? A: We approve anywhere from 30 - 40 projects a month. Total for last year would have been over 300. And we have had a success ratio of about 45% to 50% and that is commendable, because in countries like Vietnam and India the success ratio is below 35%. The reasons for non-implementation are several fold. One is that Investors put in applications to several countries, secondly market conditions etc. What is important is the number of agreements. Frankly in the last. since I took over I have not gone on approvals. What is important is agreements and in my time a 70% success rate is achieved after agreements were signed. A greater degree of commitment is involved when a company has signed an agreement. Q: Doesn't the granting of BOI status to local companies result in erosion of government revenue? A: Majority of companies are paying taxes at 15% or the normal rates. Q: Isn't the reduced tax rate a loss of revenue to the government? A: You can argue that. I'm willing to demonstrate that there are more incentives under the Inland Revenue Law than under the BOI law. An investment conditions are more stringent under the BOI law. For example, you have to export 90%, your investments have to be over Rs. 500 million. Why give tax holidays to those investing Rs. 500 million because these are less than 2% of all projects. Why did we give a 15 year tax holiday to flagship project, because in the entire history of liberalisation there have been only six flagship projects. There is a degree of revenue erosion but look at the indirect benefits of these projects. These projects pay indirect taxes, they pay the national security levy. Sixty per cent of the projects are in the 15% income bracket. They are liable to GST across the board. And these investments result in indirect employment and indirect businesses, suppliers. And the employees pay taxes. The primary responsibility of the BOI is to have an optimal balance. Now it is arguable as to what the balance is. I think the simplest way to rationalize this is that to overall move into a lower tax regime. But then again eliminating investment incentive is again not the answer, because a tax holiday is a compensation for risk.

Basle Committee to revise capital accordThe Basle Committee is about to publish draft proposals for a revision of its capital accord. This is stated in an article by George Graham, in the "London Financial Times". The Committee brings together banking supervisors from the leading industrialised countries. The capital accord sets out minimum levels of capital for banks active in the international financial markets. Graham says the banks are "up in arms" over the inclusion of a capital cushion for operational risks in the draft proposals. The revision of the present capital accord is to be published as a consultative paper and it will propose refinements to the present formula which requires banks to hold capital equivalent to 8 per cent of their risk weighted assets. The rules at present, says the writer, concentrate on credit risk - the danger that borrowers might default on their debts. The new paper is expected to introduce a much wider spectrum of risk weightings. Some bankers, says Graham, estimate a modified formula could reduce the average minimum capital requirement from 8 per cent to around 6.25 per cent. But supervisors want to offset that requirement by requiring banks to hold extra capital to cover risks not included in the present credit risk formula, principally operational risks. Commercial banks say, according to the writer, this attempt to cast the capital rules more widely is fundamentally flawed. Graham goes on to say that "operational risk can cover anything from a hurricane knocking out computer systems to staff fraud or sickness, and notoriously difficult to quantify". The writer goes on to say that "although a handful of banks, such as Bankers Trust, have internal measures, many say operational risk should be addressed by internal systems and controls, not by setting aside capital against it". According to Graham, Tom de Swaan, the chief financial officer of ABN Amro Bank says that the new formula is not workable. He is reported as saying "Clearly operational risk is a risk you have to manage, but to set a specific percentage on it is the wrong approach". One method considered by the Basle Committee, says Graham, for calculating a capital charge on operational risk is simply to take a percentage of a bank's operating costs, as a broad gauge of the extent of its business. This has angered even those bankers who believe operational risk is measurable. They say, according to Graham, it would have perverse consequences, because, for example, any bank wanting to invest in a new computer system to improve risk management, would find its supervisors requiring it to set aside more capital, not less. The writer concludes by saying that supervisors acknowledge the original Basle ratios were far from scientific but seemed about right at the time and have had the effect of increasing the amount of capital in the international banking system adding that after last year's financial market shocks, the last thing they want to do is to reduce that capital cushion.

British firm clinches SEC Y2K auditThe British based Arthur Andersen Company has secured the contract to carry out a millennium compliance audit on the institutions regulated by the Securities and Exchange Commission (SEC). The consultancy assignment would cost the SEC approx. Rs. 5.4 mn and the report will be out within 3 months, SEC Director General, Kumar Paul said. The audit will cover 15 stockbroking firms, 4 Unit Trusts Management Companies, the Colombo Stock Exchange (CSE) and the settlement bank of the Central Depository System (CDS). Arthur Andersen is represented in Sri Lanka by Someswaran Jayawickreme and Company (SJC). SJC in association with Arthur Andersen Year 2000 Competency Centre will commence work on the audit next month. The consultants hope to follow a fast path methodology by a series of questionnaires and onsite reviews. The SEC issued a directive last year on Y2K compliance to all institutions, with the threat of withdrawing licences for failure of compliance. The 15 stockbrokers have been given time till March 31st while the 4 unit trusts have time till April 30th, 1999. The CSE's CDS was implemented in 1991 on a Unisys mainframe and re-developed in 1994 on a 'open systems' platform. The exchange anticipated the Y2K problem at the time of re-development and instructed the vendor to accommodate 4 digits to represent the year. The Automatic Trading System (ATS) was implemented in June 1997. The ATS and the CDS use one database and CSE has ensured that the date format of the ATS conforms to be millenium compliant. At the time of development of both systems, the vendors that provided other components for the two systems were in the process of certifying their products to be Y2K compliant. However, the Consultants will carry out a detailed audit of all components of the ATS and CDS which includes application software, database, hardware and operating systems to ascertain if they are fully millenium compliant, SEC Senior Manager Research, Mahinda Ambahera said. The systems of 15 stockbrokers would be checked on the application, database, operating system and hardware. The four unit trust management companies operate ten unit trusts. The unit trust management companies are dependent upon computer systems to manage their portfolios, calculate net asset values, keep accurate records, process unit holder purchases and redemption and timely preparation of financial statements. The software used by these management companies have been primarily developed in-house. Some of the operating systems used are NetWare, Windows NT, Windows 95 and MS DOS. In addition, the hardware includes a range of computer of different makes and models. The management companies are at various stages of upgrading their systems and acquiring suitable software packages which are Y2K compliant. The consultants would advice the SEC on further steps that each institution needs to take to achieve full Y2K compliance. A contingency plan would also be developed for all institutions regulated by the SEC, irrespective the degree of compliance. (MG)

Another cellular satellite operator to come hereAsia Cellular Satellite (ACeS), a regional global mobile personal communications service, will commercially launch its operations in 23 countries including Sri Lanka by end 1999, senior company officials said last week. ACeS uses a dual mode telephone handset that allows users to select between satellite or cellular (either GSM or AMPS) modes of operations with identical voice quality in either one. The company would initially concentrate on the Asian region, and intend to cover Middle East and Europe eventually. ACeS is a part of the GSM MoU Group, enables ACeS subscribers to roam to any GSM network throughout the world. Conversely, GSM users worldwide will be able to use the ACeS dual mode handsets while travelling in Asia. The US$ 700 mn project, will launch its first satellite by July and commercial services would commence by end 1999, ACeS CEO, Adi R Adiwoso told The Sunday Times Business. The company has signed a Memorandum of Understanding (MoU) with Sri Lanka's sole GSM operator, Dialog GSM to provide the service to Sri Lankan cellular subscribers, he said. The handsets are produced by Sweden's Ericsson Mobile Communications AB and will have similar characteristics: size, weight and feature set as contemporary cellular handsets, ACeS Senior VP, Ashutosh Garg said. The handsets are priced at US$ 1000 each, while call charges are US$ 1 per minute, he said. The ACeS system includes two satellites on a Lockheed Martin A2100AX spacecraft bus. With two 12 metre antennas, on board digital signal processing and up to 140 spot beams covering the whole of Asia. Each of the two L-band satellites is capable of supporting 11,000 simultaneous telephone channels and up to two million subscribers in an area extending from Guam and Papua New Guinea in the east to Pakistan in the west, and from Japan in the north to Indonesia in the South. ACeS will have 5 gateways in Indonesia, Philippine, Taiwan, India and Thailand. Sri Lanka would use the Indian gateway. "We may decide to put a gateway in Sri Lanka if the market grows," Mr. Garg said. The Bermuda based ACeS, is jointly owned by Indonesia's' PT Pasifik Satelit Nusantara, Lockheed Martin Global Telecommunications USA, the Philippine Long Distance Telephone Company and Thailand's Jasmine International Public Company Ltd. Lockheed will hold 30 per cent of the company with the founding ACeS partners retaining the balance 70 per cent. At present, there are three satellite cellular services: Iridium, Globalstar and ICO. Iridium, which commenced operations last year, is already servicing Sri Lanka. Globalstar is scheduled to launch commercial operations by end 1999, while ICO will follow suit in year 2000. (MG) See also Innovations inside - Innovations

Front Page| News/Comment| Editorial/Opinion| Plus | Sports | Mirror Magazine |

|

|

Please send your comments and suggestions on this web site to |

|

violated

there are other institutions that have come into play. Now wherever we

have found that these companies are not practicing proper business ethics

we have cancelled their visa.

violated

there are other institutions that have come into play. Now wherever we

have found that these companies are not practicing proper business ethics

we have cancelled their visa.