|

14th June 1998 |

Front Page| |

Contents

|

||

|

Dealers impatient as CB drags feetBy Mel GunasekeraThe Central Bank's decision to seek foreign expertise for a Central Depository System (CDS) to trade Treasury Bills (TBs) has evoked a chilling response from primary dealers. The Central Bank has invited bids from foreign experts together with local experts to carry out a study, a top CB official told The Sunday Times Business. The Central Bank is also receiving World Bank assistance for the project. Semi-scripless bidding for TBs began last week, with bids being made both electronically and manually. At present nearly all dealers are linked to the Central Bank, and officials are confident that manual bidding would cease within a month. "The electronic bidding system would push back the closing time to 12 noon and would give more time to the dealers to study the market prior to submitting bids," he said. However, the Colombo Stock Exchange (CSE) and the Primary Dealers Association (PDA) say they want to establish the depository system within the CSE, using the existing CDS. They allege that the CB has been dragging its feet over this issue for over three years. The decision to procure foreign expertise for the setting up of a CDS will only delay things further, they said. But CB has been insisting it wants to set up a separate system to transact TB's. Primary dealers say it is an unnecessary expense to create a similar system when the existing CDS could be adapted to transact TBs. CB officials defended their decision saying the government is keen to establish Colombo as a financial hub within the SAARC region. "In the future we may even have the provincial governments dealing with TBs, so a more comprehensive CDS system is required," Central Bank officials said. Primary Dealers retort that Sri Lanka has to overcome two main factors for the regional financial hub to become a reality. The different regulators (CSE, SEC and CB) have to agree on a common clearing and settlement system, which can be a magnet for foreign companies to come here. Secondly, a separate organisation dedicated to marketing Sri Lanka overseas as a financial hub is needed. The government could also throw in some incentives to lure foreign companies, they added. Sri Lanka needs a central operation not a fragmented one, a top Primary Dealer said. Countries like Singapore, which previously had separate CDS, are now moving towards one system. "This is the trend worldwide, and Sri Lanka should take note of it", he said. The existing CSE can be developed into a model like SIMEX (Singapore International Monetary Exchange). For instance, Japan didn't permit the trading of derivatives. So the Japanese government created a system in Singapore where Japanese companies could trade in Singapore. Sri Lanka should be aiming at this end of the market to attract companies in the SAARC region, he said.

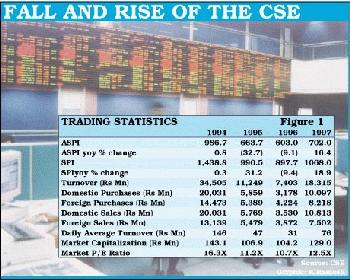

Fall and rise CSE

"The performance of a stock market is sometimes judged solely on the growth of the price index and turnover. However, from a national perspective the dynamism of the stock market has to be gauged by measuring how effective it has been in harnessing and channelling savings to the productive sectors of the economy," CSE Director General, Hiran Mendis has said in a review of the CSE's annual report for 1997. The table above tells the story of the performance of the Colombo Stock Exchange in the past four years. After two years of lack lustre performance the market revived in 1997, the Director's review says. This turnaround is no doubt attributed to the improved economic performance in 1997 and its reflection on improved corporate profits. The performance of the market in 1997 has to be viewed in the context of the East Asian crisis and the intensification of the conflict in the North and East. During the first half of 1997, the ASPI appreciated by 31 per cent and the SPI by 41 per cent. The ASPI peaked at 869.7 points and the SPI at 1411.2 points on July 31, 1997 reflecting a growth of 44 per cent and 57 per cent respectively. This scenario changed with the onset of the crisis in the East Asian region in August 1997. The ASPI and the SPI closed the year at 702.2 points and 1068 points respectively, declining by 19 per cent and 24 per cent since August 1997. Foreign investors were net sellers in the market and there was a net outflow of Rs. 768 mn in foreign portfolio investments in the second half of 1997, the review said. The effect of the East Asian crisis was relatively less than that experienced during the Mexican crisis. During the Mexican crisis the ASPI fell by 36 per cent between December 1994 and May 1995. In comparison, during the East Asian crisis the ASPI fell by only 13 per cent. Average net foreign sales during the Mexican crisis amounted to Rs. 8.7 mn per day, in comparison to Rs. 5.2 mn during the height of the East Asian crisis, the review says. One factor for the above could be the improved profits and stronger fundamentals during the period under review. The Mexican crisis occurred immediately after the change in government in 1994. The uncertainties associated with such a change may have been another factor, which contributed to the decline in the market during the first half of 1995, the review adds.

Companies to rush for listing?Companies with an eye on state tenders and BOO/BOT projects may rush for a quick listing after last week's government announcement limiting bids for government tenders on major infrastructure projects to listed companies. An Information department release says that international bidders for state tenders on major infrastructure projects and BOO/BOT projects must declare their local agent and the local agent should be listed in the stock exchange. The listed company should have a market capitalisation of not less than Rs. 500 million. The regulation will apply with immediate effect for all projects over Rs.250 mn in the ports, road and power sectors of the relevant ministries, the release says. The regulation will come into effect within four months in the case of agreements signed with Defence Ministry and Transport Ministry (excluding roads) the release adds. Foreign investors bidding for any tender or project should enter into a valid agency agreement with the listed company, the release says. Listed companies by their very nature are considered more transparent than non-listed companies. With a greater degree of accountability to its shareholders, listed companies are also required to comply with the continuing listing requirements which include corporate disclosures, release adds. The minimum market capitalisation for a company to be listed on the main board is Rs. 75 million and Rs. 5 million for the second board Over 50% of the companies' listed on the CSE have a market capitalisation of more than Rs. 500 million. Stock Exchange Director General Hiran Mendis told The Sunday Times Business that the new regulation is a positive step in promoting accountability and transparency in major infrastructural projects. From the CSE's point of view it could also improve market capitalisation at the Colombo bourse. He added that even if a small portion of the capital for a big infrastructure project could be raised in Colombo debt market by a listed company, it would boost the development of the debt market and promote raising funds in the capital market.

London tea shop up for private managementSri Lanka's London tea shop/bar run by the Tea Board may be handed over to private sector management, industry officials said. The shop/bar is in financial difficulties due to mismanagement, compelling the Tea Board to invite private sector management bids, sources said. The Board may face difficulties in handing over management to the private sector, due to the present lease agreement, sources said. The leasing agreement stipulates that the premises or part thereof cannot be sub-leased. Unless the Board enters into a fresh agreement with the landlords, it may not be possible to hand over management to a private company, sources said. Considering these factors, the Board has decided to appoint a commercial oriented private sector manager to run the two units. He will be totally responsible for managing the organisation on a profitable basis and would report to the Board in all respects. Sources say, it is unlikely that the Tea Board would call for tenders from the private sector to manage the outfit. Instead the Board hopes to write to reputable private sector tea firms asking them to submit suitable proposals. Meanwhile, the Tea Board has decided to issue quit notice to Air Lanka Ltd., London office (now occupying the Tea Bureau premises) for failing to pay their rent.

Nuke tit-for-tat shakes CSE?By Feizal SamathThe tit-for-tat nuclear tests by India and Pakistan last month still reverberate through stock markets in the two countries filtering into Sri Lanka while Colombo is having additional headaches at home,analysts said. Although still to impact on the economy, the recent blast of a tea factory in central Sri Lanka and a string of bomb attacks on transformers and telecommunication facilities have caused some anxiety in business circles, they said. For example, John Keells Holdings said last month that the bulk of its profits for the fiscal year ending March 1998 came from plantations. While security forces and the police are investigating the string of attacks on economic targets, so far no one has been blamed for the incidents though the Liberation Tigers of Tamil Eelam (LTTE) is the prime suspect. While conceding that the LTTE had in the past threatened to attack economic targets, some analysts noted that the rebels were trying to seek the support of plantation workers to re-activate their campaign in those areas, and hence it was unlikely that the group would try to disrupt the workers' livelihood. Apart from these disturbing developments, the Sri Lanka rupee appears to be taking a beating due to the South Asian political crisis and has fallen by more than 1.3 percent against the US dollar since last month's nuclear test blasts. SocGen-Crosby officials said that the rupee had depreciated by 3.6 percent in the period from January to May 11, this year when the tests were conducted. After that period up to now, a further depreciation of 1.3 percent has taken place. The Indian rupee has lost five percent in value, against the US dollar, after the tests and is seen sliding further. "The authorities have so far maintained a slow decline in the Sri Lanka rupee against the US dollar but there could be pressure for a sharper fall as India is Sri Lanka's largest trading partner, accounting for 13.5 percent of imports and 9.0 percent of total trade. Thus far, the Sri Lanka rupee has fallen 3.5 percent to 63.50 rupees per dollar, in line with our full-year target of a 10 percent devaluation. However a rapid fall in the Indian rupee could trigger a 12-15 percent slide in the Sri Lanka rupee in 1998," SocGen-Crosby said in its June report. The June report was prepared after the Indian nuclear blasts but just before the Pakistan nuclear response, and SocGen-Crosby officials said that the uncertain environment that follows could be much severe than the concerns expressed in the report. SocGen-Crosby's Amarasinghe said that there was a perception in India that the stock markets there may take off in three months if recent Indian budgetary allocations for capital investment in the agriculture sector woos large scale foreign investment. "If that happens, the markets are expected to respond positively to investment in this sector, and reciprocally our markets too would see some gains," he said. Traditionally, international fund managers take a cue from India when investing in South Asia with Sri Lanka "merely picking up the crumbs". The Indian scenario remains the key to the quantum of foreign investment in the region. The short-term view of the Colombo bourse by broker Jardine Fleming - arising out of developments in South Asia - is that foreign investors will take a back seat for at least a month, says Panduka Ambanpola, head of research: "The reversal would be due to sentiment (political developments) not fundamentals which are sound in Sri Lanka. The second point is that Asia's situation is still not sound for investors smarting from the East Asian financial debacle." He said that these two developments, taken together with domestic financial problems in Japan, would result in less investment inflows to the region. Ambanpola said that Sri Lanka was not in a position to attract big funds and investors would first look at India or Pakistan, both of which are in difficulty due to the tit-for-tat nuclear battle, and then Colombo. "The investor mood will change only if things improve in India," he said.

Exports: picture far from rosyAnother leading research house has warned of the long-term adverse effects from the Asian crisis on Sri Lankan exports. In its initial issue of insights, an extension of Indian Insights to the subcontinent - Jardine Fleming Research says that garments, rubber and coconut based products in particular will be hit by heightened competition from the ASEAN. According to March 1998 export data, garments together with tea continued to report a solid growth. These two items constitute 65% of total exports. While 1998 first quarter results have grown 8.4% garments have grown 14.9% Exports in March have grown 16.8% YoY, garments have grown 27% YoY, while non-garment industrial exports have grown 9.4% YoY. Tea exports also grew 28% YoY. While the March figures are an improvement on the earlier months the research house remains cautious, as the figures come on a low base for industrial exports. The worsening economic crisis in Asia has compelled the research house to downgrade growth prospects for 1998 and 1999. JF research has revised down GDP growth projections for 1998 and 1999 to 5.4% from 5.7% and 5.6% from 6.1% respectively. Projections were based on the launch of infrastructure projects like highways, industrial parks and the port whichzq are temporarily shelved as the foreign component for these projects largely from Hong Kong, Korea and Malaysia are now on hold. The regional crisis could also nail prospects for a GDP growth of over 6%. This would require an improvement of the current 25% investment-to-GDP ratio to 30%. With the domestic savings rate stagnant at 19%, foreign savings fill the gap, the report says. Given the depressed regional outlook, and prospects for global economic slowdown, combined with growing demands in limited pools of concessionery finance, raising investment ratio above current levels will remain an uphill task, they say. While the export sector, particularly garments, has still not felt the serious loss of competitiveness, pressure could build up in the following months as battered ASEAN economies recover and currencies stabilize, the report says. Non-garment, non-quota related manufactured exports like rubber, leather, ceramic and wood based manufactured exports in particular could face competitive problems, JF research says.

Delays in power projects could cripple economyIf some meaningful action is not taken to increase the country's power supply significantly, there is little doubt that the country would face a power crisis in the next few years. The need for augmenting our power supply hardly requires to be argued. The country's demand for power is increasing at a rate of about 10 per cent per year. This means that by the year 2005 our power generation capacity would have to be doubled. Such an increase in power supplies can only be effected by large thermal or coal based power plants being established. Such plants do take a fair gestation period and unless they are in place shortly, the country would have inadequate power supplies soon. The smaller plants which are being installed, however useful, cannot solve the problem of increasing demand for power significantly. Despite the overwhelming evidence and recognition that large power plants should be installed quickly, there has been little evidence of such installation. The monopolistic power, which the Ceylon Electricity Board (CEB) wields, has been one of the stumbling blocks to enhance power generation. The CEB has behaved in a 'dog in a manger' attitude by blocking and preventing others installing power plants which they themselves have failed to establish. Tenders were called for several power plants like the barge-mounted power plants, the Kelanitissa combined cycle power project and the coal based power plant, among others, but nothing came of these. True there have been other hindrances as well, but CEB's attitude has been the major factor in the dismal experience of tenders being called for these projects and nothing happening. There is some evidence that the government's keenness to enhance the power supply has made the CEB less of a stumbling block. This has given a new sense of expectation among private investors to bid for power plant projects. Yet there appears to be other disputes and rivalries among the decision-making bodies, which are postponing, if not crippling, the prospect of investments in large power plants. These delays are once again causing anxieties. If current efforts to install new power generating plants are stalled, they may have a long-term impact of investors not taking the governments's requirement of energy seriously. This could be a major setback requiring quite some years to redress. It is therefore vital that new power plants are established soon. The tender procedures must be completed quickly and the most reliable and cost effective suppliers given the go-ahead to implement their projects. Otherwise the prospects of economic growth are indeed bleak.

Group of Eight focus on Asian co-operationMeeting in Birming ham, England, on May 15-17 for their annual summit, the leaders of the world's major industrial economies emphasized the importance of multilateral co-operation to enable all countries - particularly those at the low end of the economic and development scale - to benefit from the increasing globalization of the international economy. The key challenge, according to a communiqué issued on May 17 was "To ensure that the benefits of globalization are spread more widely to improve the quality of life of people everywhere". The 1998 meeting of the heads of state and government - renamed the Group of Eight to reflect Russia's first full participation in these annual summit meetings - was preceded by a meeting of the Group of Seven (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States) and the President of the European Commission on May 15. The topic of a new financial architecture in a globalized world was also addressed in London on May 8 by IMF Managing Director Michel Camdessus. In his speech Camdessus outlined two organizational avenues that might be explored to enable the IMF's governors to become more actively involved in the decision making aspects of its work. The Group of Eight leaders re-affirmed the key role of the IMF and other international financial institutions in helping to resolve and prevent future crises. Their communique stressed the need for the economies most severely affected by the crisis to implement IMF supported reform packages fully. A key lesson from the Asian crisis, the statement noted, was the importance of sound economic policy, as well as transparency and good governance. The communique also called on Asian countries undertaking economic reforms to ensure that the private sector plays a timely and appropriate role in crisis resolution and that steps be taken to prevent hardship for the poorest segments of their population. Calling for a "speedy and determined" extension of debt relief for the world's poorest countries, the communique strongly endorsed the Heavily Indebted Poor Countries (HIPC) Initiative, launched two years ago, aimed at providing debt relief to countries pursuing economic reforms prescribed by the IMF. All eligible countries were encouraged to take the necessary policy measures to enable them to participate in the HIPC Initiative by the year 2000. The Group of Eight communique addressed several other issues, including: * Economic and Monetary Union (EMU):-The communique welcomed the European Union's decision to launch the Euro, noting that the commitment of European Union countries to sound fiscal policies and continuing structural reform was key to improving a growth and employment prospects. Trade liberalization:-The leaders re-affirmed their strong commitment to continued trade and investment liberalization with- in the multilateral framework of the World Trade Organization and called on all countries to open their markets further and resist protectionism. * Aid to poorer developing countries:- The Group of Eight pledged themselves to a "real and effective partnership" to help the poorer developing countries, especially in Africa, develop their capacities and integrate more fully into the world economy. They agreed to provide support for the efforts of these countries to build democracy and good governance and to mobilize resources for development in support of reform programs. Group of Seven Immediately preceding the Group of Eight meeting, the leaders of the seven major industrial countries and the president of the European Commission met on May 15 to discuss the world economic financial situation and the challenges they face in strengthening the global financial system. Following the meeting, a statement issued by its Chair, UK Prime Minster Tony Blair, said that in the wake of the Asian crisis there was an urgent need to take steps to strengthen the global financial architecture to reduce the risk of such crisis recurring and to produce a system more resistant to shocks when such crises do occur. The Group of Seven also hailed Japan's new pump-priming package, but urged the country to resolve its bad debt problem, strengthen its financial system,and implement structural reform. The multilateral institutions have a key role to play in the new financial architecture, the statement said, adding that the leaders attached particular importance to the following. * Increasing transparency by encouraging IMF members to provide more accurate and accessible financial data - for example, by subscribing to the Special Data Dissemination Standard and identifying publicly those that fail to meet the standard; welcoming the IMF's adoption of a code of good practice on transparency in fiscal policy and encouraging its promotion and encouraging the IMF to publish more information about its members and their policies, as well as about its own decision making. * Helping countries prepare for global capital flows by providing advice on how best to manage orderly capital account liberalization and assisting them with the required strengthening of domestic policies and institutions and urging the IMF to examine how to effectively monitor capital flows - particularly short-term flows - to provide information and promote market stability; * Strengthening national financial systems by encouraging all countries to adopt and implement the basic core principles of effective banking supervision; developing international codes and guidelines for corporate governance and accounting principles; and establishing a system of multilateral surveillance of national financial supervisory and regulatory systems; and ensuring that the private sector takes full responsibility for its decisions by developing a framework to ensure that the private sector plays a timely and appropriate role in the resolution of financial crises; and asking the IMF to signal that in the event of a crisis, it will be prepared to consider lending to countries that are in arrears, including in situations where debt standstills have arisen, if the debtor country adopts appropriate

Learning from the Asian crisisThe Committee dis cussed emerging les sons from the Asian crisis and steps required for strengthening the architecture of the international monetary system. Such a strengthening was regarded as needed, particularly in light of globalization, which has brought clear benefits, but at the same time has posed challenges. It has reinforced the importance of sound macro-economic policies and strong financial systems to guard against vulnerability to shifts in market sentiment and to contagion effects from policy weaknesses in other countries. The Committee considered that action to help prevent financial crises, and resolve them when they occur, should center on the following pillars. a. Strengthened international and domestic financial systems. (i) Sound and stable macro-economic policies are critical to financial stability. (ii) Action is also needed to strengthen domestic financial systems, by developing supervisory and regulatory frameworks consistent with internationally accepted practices and strengthened standards for bank and non-bank financial entities. Work in this area is already in progress in various fora, notably the Basle Committee's Core Principles for strengthening banking regulation and supervision. b. Strengthened fund surveillance and recommendations The Fund should intensify its surveillance of financial sector issues and capital flows, give particular attention to policy interdependence and risks of contagion, and ensure that it is fully aware of market views and perspectives. The Fund's enhanced surveillance should include a focus on the risks posed by potentially abrupt reversals of capital flows particularly those of a short-term nature. It requested the Executive Board to examine ways to strengthen the monitoring of capital flows. c. Greater availability and transparency of information regarding economic data and policies. (i) Noting that the effectiveness of surveillance depended critically on the timely availability of accurate information, the Committee underscored members' obligation to provide timely and accurate data to the Fund. If persistent deficiencies in disclosing relevant data to the Fund seriously impede surveillance conclusion of Article IV consultations should be delayed. (ii) The committee welcomed the progress made on implementation of the Special and General Data Dissemination Initiatives. It requested the Fund to expedite its efforts to broaden and strengthen the Special Data Dissemination Standard (SDDS) to cover additional financial data, including net reserves (reserve- related liabilities, central bank derivative transactions and positions); debt, particularly short-term debt; and indicators of the stability of the financial sector. The Committee recognized the importance of encouraging more members to subscribe to the SDDS. d. Central role of the Fund in crisis management (i) The Committee welcomed the timely response to the crisis by the international community, including from the Fund. It welcomed the establishment of the Supplemental Reserve Facility and the use of emergency procedures in the Fund's rapid response in support of the countries in crisis. (ii) The Fund's role in responding to members experiencing a large financing need should remain central, in particular because of the Fund's role, through its conditionalty, in supporting the necessary reforms. e. More effective procedures to involve the private sector in forestalling or resolving financial crises. (i) The Committee observed that, while many in the private sector had incurred substantial losses in the recent crises, it was important that all creditors, including short-term creditors, more fully bear the consequences of their actions. (ii) It noted that, in the first instance, measures to discourage excessive reliance on short-term financing and strengthen countries' capacity to withstand sudden shifts in market sentiment are essential preventive elements. (iii) Efforts should also be devoted to strengthening incentives for creditors and investors to better use information to analyze risks appropriately and avoid excessive risk-taking. Liberalization of Capital Movements Under an Amendment of the Articles The financial crisis in Asia has given heightened attention to the role of capital flows in economic development. The effects of the crisis have not negated the contribution that capital movements have made to economic progress in the Asian countries before the crisis erupted. Rather, the crisis has underscored the importance of orderly and properly sequenced liberalization of capital movements, the need for appropriate macro-economic and exchange rate policies, the critical role of sound financial sectors, and effective prudential and supervisory systems. The committee re-affirmed its view, expressed in the Hong Kong Communiqué last September, that it is now time to add a new chapter to the Bretton Woods Agreement by making the liberalization of capital movements one of the purposes of the Fund and extending, as needed, the Fund's jurisdiction for this purpose. The Committee noted the progress made thus far and the provisional agreement reached by the Executive Board on that part of the amendment dealing with the Fund's purposes.

More Business * ERM - promoting sustainable development * Demands of RRDB employees * India opens market for 106 more exports * Defence levy unraveled * World Bank on politics of poverty * United Motors aim to be market leader in automobile industry * Peace: main aim of new Chamber Chief * Emirates keep young in mind

Front Page| News/Comment| Editorial/Opinion| Plus | Sports | Mirror Magazine |

|

|

Please send your comments and suggestions on this web site to |

|