Bitter truth in bitter times

View(s):

A tuk-tuk driver sells vegetables, which are likely to rise in prices with increased taxation.

The editorial of the Sunday Times last week noted that “…the Inland Revenue Department has only 292,305 active income tax files when the number should be in the millions for a population of over 22 million”. In other words, this means that there are millions of people who should pay income taxes but who have become the “free riders” enjoying the benefits of income taxes paid by a few; anybody would ask the question, how fair is it!

Some of the public sector employees have got their office to pay their income taxes, which is the “pay-as-you-earn” (PAYE) tax. This means that such institutions use money that already belongs to the government in order to pay income taxes on behalf of some of the public sector employees; how fair is that!

15 million new taxpayers?

Although there are much more to talk about taxation problems, including its related corruption and bribery problems, my purpose today is different. When the Sri Lankan economy is in a deep economic crisis, we must know that its main causes are rooted in our taxation and spending issue as well; over spending due to less revenue and more spending has a prolonged contribution to it. If it is the case, then we must correct the problem as part of the recovery plan.

President Ranil Wickremesinghe’s message, televised on October 18, regarding the new tax hikes, must have shocked many, who are not familiar with Sri Lanka’s tax problems. At a time that the “real value” of our incomes has fallen within past 12 months by about two-thirds against the skyrocketing prices, “tax hikes” as such would likely push people from the pan to the fire.

While the tax rates have been revised, taxable income threshold has been brought down from Rs. 300,000 a month to Rs. 100,000; this means that anyone who earns over Rs. 100,000 a month is now obliged to pay income tax at the rates from 6 per cent to 36 per cent of income slabs.

While the tax rates have been revised, taxable income threshold has been brought down from Rs. 300,000 a month to Rs. 100,000; this means that anyone who earns over Rs. 100,000 a month is now obliged to pay income tax at the rates from 6 per cent to 36 per cent of income slabs.

It was already announced in the Interim Budget that everyone who is above 18 years of age should register with the Inland Revenue Department (IRD) in order to be taxed; accordingly, we must expect over 15 million individual registrations of people over 18 years of age or, at least about eight million working people’s registrations. Whether the IRD has the capacity to handle that number of registrations is a question; whether all eligible people would register or not is another question.

IMF conditionality

Some might be able to interpret the new tax hikes as IMF conditionality; of course, it is. As the President himself specified, Sri Lanka wouldn’t be able to obtain IMF assistance, or any other lending agencies, or countries, if a tough new tax system is not implemented. If we don’t get IMF certification, we will not get the support of those international institutions such as the World Bank and Asian Development Bank, and the countries that provide support. In spite of all that, however, we may have to face tougher times ahead.

What’s wrong with our tax regime? How does it relate to the current economic crisis? Or have we been trapped by the IMF conditionalities? Or have we been trapped by our own systems? These are new issues that we must focus on today as we continue to hear bitter truths in bitter times.

Budgetary disarray

Sri Lankan government’s total revenue has already been on a long-term declining path, when it fell down sharply from 12.6 per cent of GDP in 2019 to just 8.7 per cent of GDP in 2021; it should be compared to our expenditure requirement of 21 per cent of GDP, which needs to be covered with more borrowings – of course, there won’t be anybody to lend us anymore.

Sri Lankan government’s total revenue has already been on a long-term declining path, when it fell down sharply from 12.6 per cent of GDP in 2019 to just 8.7 per cent of GDP in 2021; it should be compared to our expenditure requirement of 21 per cent of GDP, which needs to be covered with more borrowings – of course, there won’t be anybody to lend us anymore.

A long-standing worrying problem has been the deficit in primary balance – the expenses that we require for our day-to-day living without “interest payments”. It is an indicator of “how well we manage our public money”. For long years it was already in deficit, while the deficit increased to more than two-thirds of government’s total revenue in 2021.

Tax revenue is only about half of the government’s recurrent expenditure requirement, including interest payments. Salaries, pensions and subsidies alone require about 90 per cent of the government’s tax income. As per the information sources of the Treasury, the government is having accumulated unpaid bills amounting to Rs. 190 billion.

Apart from all the above, the government expenditure should have two more components: Public investment expenditure and the capital component of the debt payment, all which virtually depend on further borrowings. Thus, Sri Lanka’s internal finance is in a critical disarray, which apparently needs to be corrected with painful adjustments.

Equity and development costs

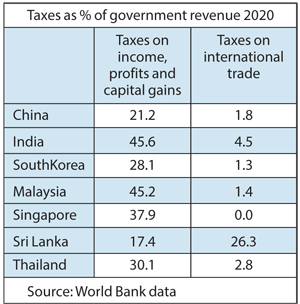

Sri Lanka is among the countries with the lowest direct tax ratio, which is only 17.4 per cent of revenue compared to 46 per cent in India, 45 per cent in Malaysia, 38 per cent in Singapore and 30 per cent in Thailand. Even with a huge non-tax revenue, China’s direct tax ratio too still accounts for over 21 per cent.

When the income tax ratio is lower, apparently indirect tax ratio is greater as the government collects more of its tax revenue through indirect taxes such as VAT, import duties, excise duties and various other taxes. Accordingly, Sri Lanka’s indirect tax ratio is around 80 per cent. This is unfair not only because many people avoid paying income tax, but also because its equity implications is in favour of the rich and against the poor. For instance, a person who earns Rs. 1 million a month should pay, according to the new tax schedule, Rs. 286,500 as income tax. A person earning Rs. 50,000 a month doesn’t pay tax because such income is below the taxable income threshold of Rs. 100,000. But they both pay indirect taxes at the same rate for their purchases so that the tax burden on the poor is greater than that on the rich who don’t pay income taxes.

In a situation where there is no proper income tax system, the government must depend more on indirect taxes sabotaging the country’s economic progress. For instance, Sri Lanka has also become one of the few countries in Asia with the highest taxes on international trade, collecting 26 per cent of the total tax revenue. For India it is 4.5 per cent, while China, South Korea and Malaysia collect less than 2 per cent. It’s not surprising that Singapore has zero per cent of its tax revenue from trade taxes. It is, indeed, strange that we want to grow fast and become richer like these countries, but we keep doing the opposite.

“All hands on deck”

There is no dispute that Sri Lanka’s entire tax system should be reformed – not in an ad hoc and piecemeal manner, but its entire system. As far as “income tax” is concerned, the main issue in question is that there is no proper, technology-based information system to report and record “income and wealth” of people. Until and unless the government establishes a system as such, Sri Lanka’s income tax administration is not expected to widen the tax base and improve its fairness.

Further, although there is a grave need for improving the income tax system, it should be based on an “international benchmarks” and it should be “competitive” among the countries. Otherwise, it may be counter-productive; if people and businesses find favourable tax systems out there, just because of “unpleasant tax hikes” the country might be losing rather than gaining from tax revisions.

By the way, the problem is not only taxing the people, but also spending unproductively and wastefully. It’s quite strange that the government is yet to address the expenditure side issues too in order to reduce and regulate spending.

(The writer is a Professor of Economics at the University of Colombo and can be reached at sirimal@econ.cmb.ac.lk and follow on Twitter @SirimalAshoka).

Hitad.lk has you covered with quality used or brand new cars for sale that are budget friendly yet reliable! Now is the time to sell your old ride for something more attractive to today's modern automotive market demands. Browse through our selection of affordable options now on Hitad.lk before deciding on what will work best for you!