Adjusting to a “high-priced” economy

View(s):

A ‘natami’ waits for work. Like everyone else, he is also struggling with rising food costs.

Asheni was standing near the cashier of a supermarket to pay for her purchases – groceries, meat, fruits and vegetables that she had collected in a trolly. Because Kamal, her husband likes fresh vegetable salads, she didn’t forget to collect few items for salads too.

Just like all others, she has also cut down her groceries by more than half, but still her grocery bill has more than doubled. She is from a middle-class family and used to buy some “good stuff” from this particular supermarket. Working as a professional in an organisation, she earns a few hundred thousands as her monthly salary.

The lady, serving at the cashier counter was recording the prices on a computer screen. She priced the bell pepper, just one fruit that Asheni had got for the salad. Before pressing the “okay” button, she asked Asheni: “Ma’am, this ‘chili pod’ costs 1,200 rupees; is that okay with you?”

Although it is quite unusual for a supermarket employee to ask such a question from a customer, during this unusual time this employee must have realised that its price is very exorbitant. Hearing the price of just one bell pepper, Asheni raised her eyebrows: “That much expensive?”

The lady answered: “Yes ma’am; one kilogramme costs 6,000 rupees!”

Heart-breaking news

While the middle-class people have fallen towards the national poverty line, the poor who remained around the poverty line were the most vulnerable to the sky-rocketing prices in Sri Lanka. It is the children – the future generation of the nation who have been the most affected by inflation. They need adequate food to grow well physically and mentally, without being subject to under-nourishment.

Even before the crisis began, Sri Lanka’s track record of underweight, acute under-nutrition (wasting) and, chronic malnutrition (stunting) maternal mortality, low birth weight ratios remained as high as those of a low-income country and, not a middle-income country. Some of these indicators reflect the mother’s nutritional standards more than that of the child.

Even before the crisis began, Sri Lanka’s track record of underweight, acute under-nutrition (wasting) and, chronic malnutrition (stunting) maternal mortality, low birth weight ratios remained as high as those of a low-income country and, not a middle-income country. Some of these indicators reflect the mother’s nutritional standards more than that of the child.

The indicators of poor nutritional standards of either the child or the mother are influenced by the lack of food security in the country. The concept of “food security” is not about cultivating food crops, but sustaining food availability, affordability and, quality.

Then, the situation now – after the country was hit by an unprecedented inflation – is much worse than it was a few years ago. The country has been suffering for more than two years now, first due to the health crisis and then the economic crisis, but we still don’t have national data to show the accurate situation of the people. The country has failed not only in looking after its 22 million people, but also understanding their real struggle in the midst of the crisis.

Almost every day, we hear the heart-breaking news on media about people’s struggle to deal with hunger; the children who fainted and collapsed in the schools; the schools which have stopped conducting their morning assembly, the children’s struggle to bring lunch; mothers who decided to commit suicide with the children; fathers who were caught up for stealing just bread or a coconut…; and the list goes on.

Highest in the region

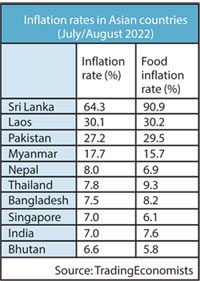

It was this week that the Department of Census and Statistics reported that the year-on-year inflation rate for the month of August was 70.2 per cent – the highest rate of inflation that Sri Lanka ever reported in its post-independent history. Cross-country comparisons, taken from a different source of information, show that Sri Lanka has also become the top country in Asia due to its highest rate of inflation among its Asian neighbours.

While Sri Lanka has reported the highest inflation rate among its Asian neighbours, the second highest rate of 30.1 per cent in Laos is still less than half of Sri Lanka’s. The rate of food inflation, which is 90.9 per cent in Sri Lanka, presents an even worst condition among its Asian neighbours. In Laos, the country with the second highest food inflation, the rate is about one-third of Sri Lanka’s.

Why is the country suffering so much from the sky-rocketing domestic price hikes? Much of the explanation points to the domestic factors on both demand and supply sides. The excessive money growth over the past two years and its impact on inflation, which may be seen after a time-lag is a well-known explanation. It may also be due to the excessive tax cuts introduced two years ago.

Why is the country suffering so much from the sky-rocketing domestic price hikes? Much of the explanation points to the domestic factors on both demand and supply sides. The excessive money growth over the past two years and its impact on inflation, which may be seen after a time-lag is a well-known explanation. It may also be due to the excessive tax cuts introduced two years ago.

However, there are a number of factors underlying the supply-side shocks. The sharp depreciation of the rupee exchange rate against the US dollar and the gradually tightening import controls continued to exert pressure on domestic supply shortages. The infamous fertiliser policy has also affected local food supply, causing higher prices.

The input costs and the breakdown in input supplies appear to be a major contributory factor causing a further deterioration of the domestic supply. The fuel shortages, power cuts and the import controls have effectively paralysed production leading to a further contraction in the economy. The issue got exacerbated due to the interest costs, fuel costs and utility costs that have increased recently in order to correct the structural issues. Contraction in economic activity means, a negative growth with reduction in incomes, livelihood and jobs, creating a “vicious cycle” of economic contraction.

In fact, for a number of reasons the global economy is in crisis too. However, as far as the Sri Lankan economy is concerned, local factors seem to be overwhelmingly affecting our lives much more than the global factors. The countries which have a better immune system have been coping with the challenges posed by the global economy while countries such as Sri Lanka with weak immune systems continued to remain vulnerable to the global issues.

Adjustment to normalcy

Many are concerned about returning to the “normalcy” we had before the COVID-19 pandemic, although it was not the ideal situation. Even though it wasn’t good enough, we were not under unprecedented inflationary pressure.

Well, if we are concerned about the somewhat manageable prices of basic needs that we enjoyed at that time, then there will be no reduction in prices! Inflation may slow down with a reduction in current hyper-inflation rates, but it does not mean at all a reduction in prices. The most likely situation under normal circumstances is the continuation of current price structures with a low-inflationary regime, perhaps at a single-digit inflation rate.

Then, the question is, how do we deal with these exorbitant prices, if these prices don’t come down? As a nation we may adjust ourselves to the “new normal” situation so that the best that we can achieve is to improve our income levels to match the prevailing prices; anyway, this may not happen overnight, because it is a long-term outcome. As a nation, we are poor again, so we have to start from lower levels where we were long ago.

Therefore, the expansion in production and improvement in productivity is the key. Until we start that process, we have to deal with adjustment confusions; producers and suppliers are confused how to maintain their profit margins under hyper-inflationary conditions, while customers and consumers have to deal with exorbitant prices that they encounter in the markets.

Producers and suppliers feel that they haven’t increased the prices enough, while the customers and consumers feel that they have increased the prices too high. And it’s a turbulent time for both parties trying to interact, while some may lose, and others may gain in this battle in the adjustment process.

(The writer is a Professor of Economics at the University of Colombo and can be reached at sirimal@econ.cmb.ac.lk

and follow on Twitter @SirimalAshoka).

Hitad.lk has you covered with quality used or brand new cars for sale that are budget friendly yet reliable! Now is the time to sell your old ride for something more attractive to today's modern automotive market demands. Browse through our selection of affordable options now on Hitad.lk before deciding on what will work best for you!