Columns

Interim budget’s reforms, reliefs and reduction of budget deficit

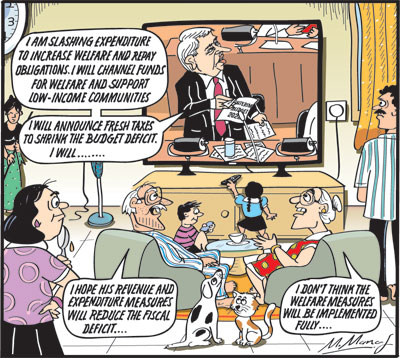

View(s):The Interim Budget presented last Tuesday was a step towards achieving fiscal consolidation. It was also replete with welfare measures and safety nets to relieve the increasing hardships of the poor and make the proposed reforms more palatable.

Budget deficit

The Interim Budget expects the fiscal deficit for 2022 to be reduced from 12.6 percent of GDP to 9.6 percent of GDP. It projects the reduction of the budget deficit to 6.8 percent of GDP next year. President Ranil Wickremesinghe expects the fiscal deficit to progressively reduce to five percent of GDP by 2025.

Welfare measures

Despite this objective of fiscal consolidation, the main thrust of the President’s budget speech was the disclosure of several programmes of relief to alleviate the increased poverty, malnourishment and hunger of people.

Diversion

Focusing on these relief measures would no doubt divert criticism from both within the Government’s own members and the opposition on higher taxation, increasing prices and privatisation of state enterprises.Politics is the art of the possible and a little sugar makes the medicine go down.

Central issue

Nevertheless, the central task of the Interim Budget presented by Finance Minister President Ranil Wickremesinghe on August 30 and the forthcoming budget for 2023, scheduled to be presented in November, are to decrease the budget deficit drastically.

Budget deficit

Budget deficit

The official expectation is that the fiscal deficit would be reduced to 9.6 percent of GDP this year from the earlier 12.6 percent of GDP.This is expected to be achieved mainly by an increase in revenue, while expenditure cuts are also expected.

Increasing revenue

The Interim Budget presented last Tuesday increased revenue that had fallen precipitously due to the taxation measures of the Budget for 2022. The new tax measures are expected to raise the revenue to GDP ratio from about 8 to 12.6 percent of GDP and bring down the fiscal deficit from an estimated 12.6 percent to less than ten percent of GDP. This requires an increase in revenue of 107 percent. This may be difficult to achieve as the economy is not functioning at full capacity.

Reversal

The Interim Budget reversed the previous taxation proposals that had reduced revenue to a record low of eight percent of GDP, one of the lowest proportions of revenue to GDP in the world.Hopefully, the revenue proposals would bring in the expected revenue in the last four months of the year to 9.6 of GDP.

Fiscal consolidation

These fiscal improvements, though inadequate, are moves in the right direction. They perhaps indicate the Government’s commitment to fiscal consolidation to the International Monetary Fund (IMF) from whom bridging finance and an Extended Fund Facility (EFF) is being sought.

Budget 2023

The Budget for 2023 to be presented in November would have to introduce further measures to increase revenue and cut expenditure to achieve the announced reductions in the fiscal deficit.

Welfare measures

A key feature of the Interim Budget was the expansion of safety nets for those adversely affected by the economic crisis and the soaring prices of essentials.

In fact, President Wickremesinghe devoted much of the one hour presentation to the welfare measures.

The expanded welfare measures included; the provision of an additional monthly allowance of Rs. 2,500 for pregnant mothers in addition to Rs. 20,000 already provided for them, the provision of Rs. 10,000 per family for four months to about 61,000 food insecure families and the increase of the monthly Samurdhi allowance by between Rs. 5,000 to Rs. 7,500 per month for approximately 1.7 million current Samurdhi receiving families and Rs. 5,000 per month temporarily to around 726,000 families in the waiting list for Samurdhi benefits.

Other benefits

Furthermore, the allowance paid for the elderly, disabled, and kidney patients was increased to between Rs. 5,000 to Rs. 7,500 and a temporary assistance of Rs. 5,000 is to be given for people who are on waiting lists in anticipation of receiving this assistance.

Rs. 46,600 million has been allocated for these programmes for four months. Rs. 133 billion has been allocated under World Bank loan assistance for the implementation of programmes with the view of reducing the impact of the current economic crisis on the poor.

Important

Undoubtedly, there is a need to expand the safety nets for the poor and the people left behind. However, Government welfare measures, including Samurdhi, is known to not reach the deserving poor and a high proportion of beneficiaries are not the intended and deserving.

Targeting

A well-targeted programmes has to be devised on the lines suggested by several think tanks. The main obstacle to such reform is that Government programmes are highly politicised and serve the interests of those in power.

Political significance

The announcement of the welfare programmes and the time devoted to them was a strategic move of the President. It shifted the focus from the unpopular measures of increased taxation and privatisation to the popular issue of doling out benefits to people.

Unacceptable

The revenue measures and reforms are not even acceptable to the Sri Lanka Podujana Peramuna (SLPP) that is the political support base of President Wickremesinghe. The welfare measures provide them with reasons to support the Interim Budget. Those opposing the Budget too would find their opposition weakened by these welfare proposals.

Concluding reflections

Fiscal consolidation is the most important, difficult and challenging task of the Interim Budget and the 2023 Budget that will be presented in November. The immediate reduction in the fiscal deficit and its progressive decrease in the next few years are vital for economic stabilisation.

Hopefully the fiscal deficit for 2022 will be brought down to 9.6 percent of GDP by the revisions in expenditure and the increased revenue from the proposed tax measures.

Although the progressive reduction in budget deficits is imperative for the economy’s revival, recovery and development, it is also the most difficult and politically challenging task.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment