Sunday Times 2

Impact of COVID-19 on the illicit tobacco market

View(s):As part of ongoing research into the economic impact of illicit markets, the Research Intelligence Unit (RIU) shared some of the key findings from its latest report that covers the economic impact of untaxed tobacco consumption in Sri Lanka.

The report has been grounded on preliminary results of an ongoing island-wide survey. Given the current sovereign debt challenges that the Government is facing, taking a closer look at the revenue loss to the Treasury is both timely and useful. Herein discussed are the sources of illicit tobacco and the impact of recent COVID-19 and lockdowns on the illicit tobacco market which accounts for a significant fraction of the overall tobacco industry.

Source: RIU survey 2021 - illicit tobacco sources

The illicit tobacco market has grown in Sri Lanka over the past decade, particularly since 2016. According to the World Health Organisation (WHO), the high price of cigarettes in Sri Lanka makes it the most expensive in the world, based on Purchasing Power Parity (PPP). The price of the most consumed cigarette brand in Sri Lanka, John Player Gold Leaf, has increased considerably over the past decade from Rs. 20 in 2010 to Rs. 70 in 2021. A significant component of this increase in price occurred in 2016 where the excise on cigarettes was increased by nearly 50%. Concurrent to this has been the rise of illicit cigarette trade which has skyrocketed from 10% in 2012 to 21% in 2021. Whilst raising prices to deter people from consuming cigarettes is prudent, a more holistic approach is needed to keep the illicit market under control.

The RIU’s consumer survey, conducted from September to December 2021, revealed that a substantial number of illicit cigarettes were sold through family/friends/work colleagues, street sellers and known re-sellers. Illicit cigarette smokers have also reported illicit cigarette purchases through hotels, restaurants, and cafes (HoReCa). Alarmingly, a significant amount of these illicit cigarettes was also reported to have been purchased through small retail shops, supermarkets and grocery stores.

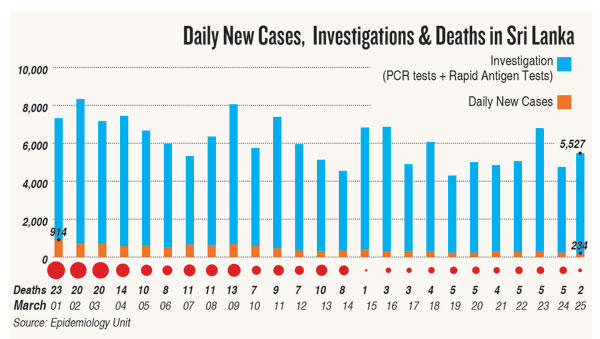

Impact of COVID-19

Based on the RIU primary research, the size of the Sri Lankan illicit tobacco market was estimated to be 21% of the total cigarettes consumed in Sri Lanka in 2021. The research was conducted during a period that witnessed unusual economic and social conditions due to the pandemic. This was evidenced by the inconsistent and sporadic nature of illicit distribution across the provinces as revealed in the surveys. Perhaps the silver lining of this narrative is the commendable efforts made by the Government in 2021 to tackle the issue of smuggling. In May 2021, Sri Lanka Customs made the largest ever detection of illicit cigarettes of over 200 million sticks with a street value of more than Rs. 9 billion. There have also been Government-driven public awareness campaigns on the threat to the national economy stemming from smuggling and widespread media coverage on detections made by the Customs, Excise, Police, STF and alike. These measures have somewhat served as deterrents, yet the 21% estimation is still significant. The number could further increase with travel normalising, illicit product access and availability increasing, and local cigarette prices rising.

To tackle the menace in a more sustainable and permanent manner, greater investments must be made in strengthening border control via increased scrutiny at points of entry. To this end, the current scanners installed at the Port of Colombo could be better utilised to scan containers that enter the country from known illicit hotspots such as the Jebel Ali Port in Dubai. The Government could also utilise intelligence services to identify and track big players in the smuggled cigarette industry.

The surveys also revealed that 56% of people island-wide have admitted to consuming illicit cigarette products over a wider period that includes pre-covid years, indicating that there is a potentially strong demand for illicit products. Irrespective of the pandemic, it should also be considered that a certain percentage of survey respondents may not be willing to share or may under-report real illicit cigarette consumption due to the fear of law enforcement. This should prompt serious concerns among policymakers that illicit tobacco consumption is a long-term challenge which, if unaddressed, will continue to rob the Government of much needed revenue. Consequently, it is imperative that the Government adopts a more comprehensive, but pragmatic tobacco policy to achieve national health objectives, maximise revenue and curb the growth of the illicit tobacco market. The RIU report highlights policies that the Sri Lankan Government can take on board to address the growing illicit tobacco market more directly.

Over the past 20 years, the RIU has remained an organisation that has addressed issues of national interest, advocating the pursuance of prudent and pragmatic policies that avoid spurring the growth of illicit markets. In addition to tobacco, Sri Lanka is affected by illicit markets that exist in other sectors such as agriculture, alcohol and pharmaceutical products, which result in fiscal revenue leakage for the country.

(For more information on RIU’s research and to access freely accessible research reports,

visit www.riunit.com/info@riunit.com)