Columns

Are we at a turning point in resolving the economic crisis?

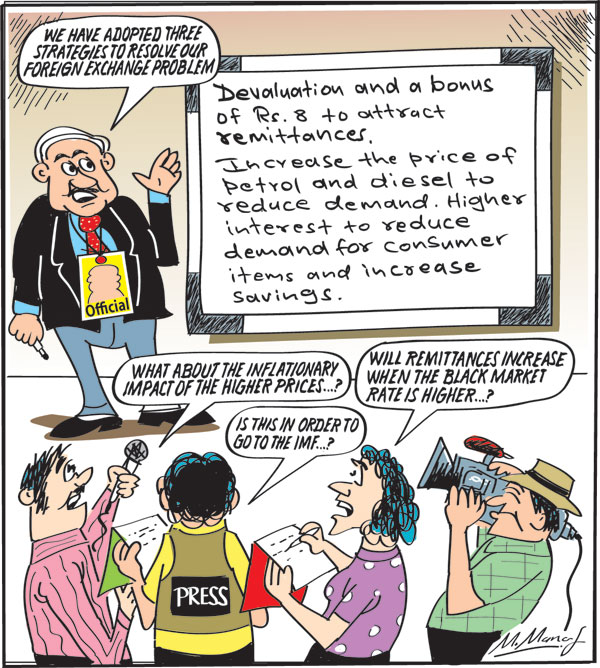

View(s): Recent changes in policy raise the question whether these would resolve or even mitigate the deepening economic crisis. A related issue is whether there is a new resolve to mitigate the economic crisis?

Recent changes in policy raise the question whether these would resolve or even mitigate the deepening economic crisis. A related issue is whether there is a new resolve to mitigate the economic crisis?

Are we at a turning point in policies to resolve the growing economic crisis?

Changes in policy

Two recent statements by the Central Bank of Sri Lanka are of vital significance for the economy. The Central Bank Governor’s policy statement on interest rates, monetary policy, and pricing policy and the devaluation of the Rupee were indications of a reversal in hitherto pursued policies.

IMF

There was also speculation whether the Central Bank’s change in policies was a sequel to the International Monetary Fund (IMF) statement just preceding it. Had the IMF influenced it?

There was even speculation as to whether the government was considering seeking IMF assistance to resolve the financial crisis as advocated by many.

The Governor himself answered that question when he said, as he had said and reiterated before, that there was no need to turn to the IMF for assistance as we had the expertise and homegrown solution to resolve the problem.

Meanwhile, the unofficial or black market rate for the US$ is reported to have risen to Rs.260 for a US$.

Meanwhile, the unofficial or black market rate for the US$ is reported to have risen to Rs.260 for a US$.

Deepening crisis

The course of events will unfold the answer to this question. What may be said however is that the crisis is reaching proportions when there would be no other way of economic salvation.

Indian aid

The severity of the crisis is demonstrated by the cancellation of the Finance Minister’s visit to New Delhi to ink the agreement for a US$ 1000 million line of credit from India.

Apart from some difficult political conditions that may have been insisted on, the Indian government being fully aware of the precarious state of the Sri Lankan economy, is likely to have insisted on the country adopting credible policies for economic recovery, including the need to go to the IMF.

Hyperinflation

The severity of the problem, and the severe hardships people are undergoing would increase soon. They would have to face hyperinflation.

Policy changes

Nevertheless, the change in policies announced by the Central Bank contained elements of an IMF restructuring programme. These include a higher interest rate policy and a pricing policy for fuel that reflects costs. The devaluation of the Rupee would increase fuel prices.

Interest rates

The Central Bank has increased its lending rate to banks known as the Bank Rate and advised banks to increase their lending rates, especially for consumption, such as for credit card lending.

By raising the Central Bank’s SDR to 8.5 percent. It expects several on lending interest rates and fixed and savings interest rates to rise. The intention of the higher interest rate policy is to contain inflation by reducing demand.

Fuel prices

The policy of increasing the price of fuel to reflect rising costs of fuel imports has three objectives.

Reduce demand for fuel to decrease import expenditure, reduce government expenditure due to the subsidy and promote less costly public transport.

Since fuel consumption is inelastic, these objectives would not be easily achieved. They may have been better achieved by a scheme of fuel rationing. However, this would have been difficult to administer and likely to be abused.

Remittances

The most urgent need is to boost the reserves by increasing inward remittances to over US$ eight billion which was achieved in 2020. Remittances are about half that now and In January it was the lowest for a month.

Right direction

Most economists would agree that the changes in policies were in the right direction, but perhaps too little and too late. Yet they indicated a reversal in thinking. Implicitly they recognised the failure of the so called “home-grown” solutions and the need for market-oriented policies.

Repercussions

Nevertheless, they have severe repercussions on the livelihoods of people, on the one hand, and are inadequate to resolve the crisis in internal currency shortages.

At present the economy is at the highest rate of inflation in recent decades. The official inflation estimate reached 14 percent in January this year.This is known to be an underestimate of actual increases in prices. Alternate indicators point to a much higher level of price increases.

More important is the prospect of much higher prices consequent on the new policies, especially the devaluation and the hike in international prices due to the ongoing war in Europe and the economic sanctions on Russia. The increasing fuel and grain prices are especially of dire consequence to the economy.

At mid-week a barrel of crude oil had sky rocketed to US$ 180 per barrel and expected to rise further. This price hike and the devaluation will increase the cost of petrol, diesel, gas and kerosene to unprecedented levels.

The expectation that the devaluation of the rupee and an extra eight rupees for remittances would increase remittances is unrealistic. There may be a small increase owing to the decreased margin but it is unlikely to achieve the earlier amount of US$ eight billion.

This is due to the restrictions in releasing foreign exchange that has created a demand for foreign currency for education, travel and other requirements of foreign currency that are not permitted.

Concluding reflection

Although the thrust of the policy changes is a movement in the right direction, they are unlikely to make a dent in the country’s foreign reserves. Furthermore, the inflationary pressures unleashed by them would be unbearable. The devaluation of the currency is not likely to increase remittances by much as there is an increasing demand for foreign currency owing to the stringent control on foreign exchange.

Since Sri Lankan’s going abroad, students in foreign countries and a large number of Sri Lankans need foreign exchange for a variety of reasons, they will access the informal and organised black market to obtain foreign exchange. Consequently, these needs will be met by those wanting to remit money to Sri Lanka.

Paradoxically, it is the liberalisation of foreign exchange that is likely to increase remittances. However, the current economic instability makes it a risky proposition.

An important determinant of the country’s state of finances is the end of the war in Europe.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment