Central Bank proposes measures to counter economic headwinds

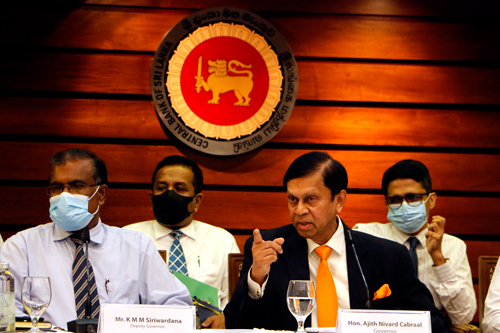

The Central Bank governor stresses a point at the briefing. Pic by Priyanka Samaraweera.

In move to counter economic headwinds in the country, the Central Bank proposed urgent policy measures towards economic stability by managing inflation, attracting non debt creating foreign capital to build foreign reserves while honouring foreign debt payment obligations.

This was disclosed by Central Bank Governor Ajith Nivard Cabral when he addressed a media conference on Friday convened to review the latest monetary policy, announcing the increase of the standing deposit facility rate and the standing lending facility rate by 100 basis points (bps) each to each, to 6.50 per cent and 7.50 per cent, respectively for the first time in 11 years.

He noted that it is the responsibility to make suggestions to the government to maintain economic stability carefully considering the current and expected macroeconomic developments both globally and domestically.

Under the present economic set up, a comprehensive policy package containing both traditional and non-traditional measures, along with other initiatives that have an impact on the overall economy is essential to handle economic head winds although its immediate impact is unbearable for the people.

Answering questions raised by journalists, he said that they are ready to discuss with the IMF but most of their suggestions have already been implanted by the Central Bank.

The Monetary Board has not taken a decision on the flexible exchange rate and therefore it will remain as it is he said adding that up coming debt repayments will be made accordingly and it was never faulted by the Central Bank, he said.

However he noted that Central Bank will hold talks with donor countries and international lending agencies including China and on the government’s stance of encouraging non debt creating financial facilities.

He specifically mentioned issues faced by banks and non- banking institutions with regard to moratorium given to borrowers which would expire on March 31 this year.

The unwinding moratorium and issues faced by banks and finance companies will be discussed with the representatives of this sector and arrive at a feasible solution, he revealed.

It has transpired that several banks are showing exorbitant profits in their balance sheets due to the moratorium offered to creditors as they were unable to make provisions for non-performing facilities.

As such they have to consider these facilities as performing loans and are absorbing the interest into their profits even though they have not been actually recovered.

The effects and repercussions of these will be felt only after the moratorium is lifted and the banks are compelled to make provisions for these non-performing facilities. This matter will be rectified during talks on unwinding the moratorium, he said.

Hitad.lk has you covered with quality used or brand new cars for sale that are budget friendly yet reliable! Now is the time to sell your old ride for something more attractive to today's modern automotive market demands. Browse through our selection of affordable options now on Hitad.lk before deciding on what will work best for you!