Columns

No prospects or policies for resolving the economic and financial crisis

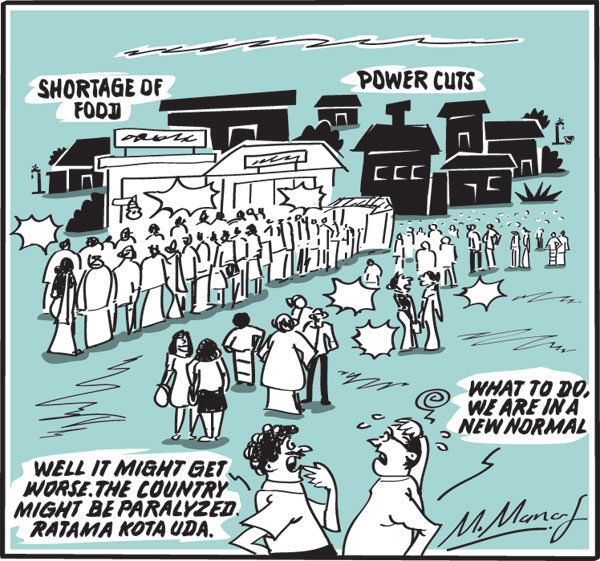

View(s): Much like the COVID pandemic, the economic and financial crisis has come to stay with no resolution of the problem in sight.

Much like the COVID pandemic, the economic and financial crisis has come to stay with no resolution of the problem in sight.

New normal?

Is the new normal one of severe shortages of essential food, medicines, petrol, diesel, power cuts and water shortages?

Currency crisis

The root of the problem lies in the lack of foreign currency for even essential imports. Foreign currency reserves have reached rock bottom.

Useable reserves

Although foreign reserves at the end of January were reported to be US$ 2.3 billion, the useable reserves are minimal. The official reserves appear to include currency swaps that are not available for imports.

Assistance

Lifelines have been given by India to import essential foods, medicines and fuel. China has given a Yuan loan to purchase raw materials for industry. Both India and China have also given currency swaps to boost reserves.

Food from Pakistan

The government has even obtained a US$ 250 million credit line to purchase food from Pakistan that is in serious economic difficulties and has turned to the IMF to resolve the country’s financial difficulties.

This assistance is mutually beneficial: Sri Lanka obtains much-needed food, Pakistan sells her surplus of food for a deferred payment.

Inadequate

These lines of credit are indispensable. They meet essential needs. However, they are inadequate to meet the foreign exchange requirements of the country. Furthermore, they add to the country’s already high debt burden and debt repayment obligations as these credit facilities have to be repaid in due course.

Request to China

There is no word yet as to whether China will accede to the request to reschedule our loan repayments. Such a rescheduling would ease the strain on repayment obligations. Perhaps the delayed response to this request is due to conditions insisted by China.

Financial predicament

What is the current financial predicament? Financial analysts estimate the usable reserves to be less than US$ 500 million. Perhaps as low as US$ 200 million that is not even enough for a month of required imports.

Desperate

Such is the desperate situation the country is in, unable to import basic needs. The inability of the Petroleum Corporation (CPC) to import fuel is leading to severe consequences. The economy could come to a standstill.

Dependence

In this dire shortage of foreign currency, we have to depend on the credit lines provided by friendly countries. These too may run out soon. Fresh infusions of credit may soon be needed. Will they be forthcoming?

Debt repayment

In addition to the basic import requirements of the country, the debt repayment obligations are about US$ five billion this year. How will these be met?

Reserves

The balance of payments deficit is increasing owing to the widening trade deficit, inadequate earnings from services and net capital outflows. The widening balance of payments deficit is depleting the reserves.

Bleak future

Despite this desperate predicament, there are no policies to resolve the crisis. The only ‘remedy’ is further controls on releasing foreign exchange for essential imports.

We are told that we will not seek assistance of the IMF as there are ‘home grown’ solutions. What are these? Are they aggravating the crisis?

Consequences

The consequences of the inaction are shortages of essential foods, soaring prices, lack of medicines, uncertainty in electricity supplies and water cuts. A petrol shortage is imminent.

Other shortages could bring the life of the nation to lesser economic activity and closure of businesses and services. Industries are experiencing delays and shortages of essential raw materials for production.

The motor spares traders are warning of a lack of spares that will affect transport or as expressed by them, bring the country‘s transport and economy to a grinding halt: “Rata kotauda.”

No policies

Despite this grave situation, there are no significant policy measures to resolve the crisis. In fact, current policies are aggravating the situation.

Exchange rate

The artificially low exchange rate is denying the country of foreign exchange. The increasing trend in remittances till mid last year has been reversed owing to the official rate being about fifty rupees less than the market rate and a large demand for foreign currency due to stringent exchange controls.

Remittances

Remittances fell from an anticipated US$ 8.5 billion to only US$ six billion. This decrease of about US$ 2.5 billion would have made a significant contribution to reducing the balance of payments deficit and would have reduced the depletion of the foreign reserves. Indications are that the country would lose around US$ four billion in remittances this year.

Plight

The trade deficit is widening in spite of Import restrictions and growth of exports. There is little prospect of a balance of payments surplus owing to the administered exchange rate of the Central Bank.

There is a massive foreign debt repayment this year.

Conclusion

At the end of the second month of the year no light is visible at the end of the tunnel. In fact, the tunnel is getting darker and longer. And there are no silver linings in the dark clouds.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment