Eyeing ‘money talks’

View(s):

Inflation is high in Sri Lanka with vegetable prices soaring.

The world is now eyeing “money talks” in the rich countries to decide their own steps. I am returning to a topic that I discussed in this column many times last year. It was about the forthcoming inflationary pressure in the world, which is now quite visible. I thought of elaborating this issue from a global perspective and, the future outlook of the global economy.

Before that however, I must also explain why the world is now under inflationary pressure. It is the nature of the “business cycles” that during the boom periods the prices would rise and, during the recessions the prices would fall. In the past two years, the world economy was in a crisis – at the bottom of the business cycle. As a result, the economic activities contracted causing income losses and job losses, subdued consumption and investment demand and, discontinued trade connectivity. Inflationary pressure disappeared from the world, while some countries actually had a deflationary problem (negative rate of inflation) as well.

Now the world economy is on the recovery path. One of the major factors underlying the recovery of the world economy is related to the ease of the impact of the COVID-19 pandemic. After a year of vaccine administration, the world population has been given over 10 billion doses of vaccines. Approximately, about 70 – 80 per cent of the people in rich countries and 50 – 60 per cent of people in developing countries have received both vaccine doses. The new variants of the virus were identified as less harmful than its initial forms. People, who have become sick of lockdown practices have also gradually learnt to live with it.

World inflationary pressure

The result of all these factors is the relaxation of the economic machinery in every country in order to return to normalcy. Thus, economic activities get revived, production and transportation restored, incomes and jobs recover. As a result, consumer demand and investment demand rise and, international trade recovers. In addition, inflationary pressure has been mounting.

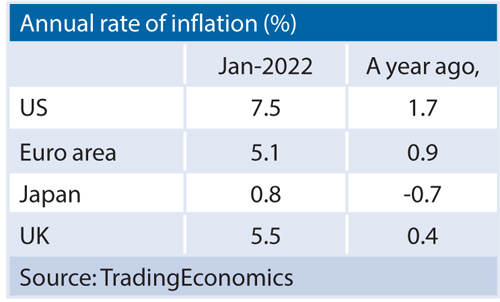

The US inflation hit its 40-year historical high rate of 7.5 per cent in January 2022, which was only 1.7 per cent a year ago. Energy, housing, food, motor cars and medical care have contributed to the large part of high inflation in the US. The Euro area experienced a gradual increase in its average inflation rate to 5.1 per cent in January, from less than 1 per cent a year ago; in fact, prior to that for some time the Euro area had deflation too.

Japan is a country which has been experiencing negative inflation from time to time over the past 25 years and, it was eagerly awaiting to achieve at least 2 per cent annual rate of inflation. During the period of the pandemic too, it had deflation rate even going below -1.0 per cent. However, even there the inflation rate turned to rise over zero per cent during the past four months reaching 0.8 per cent in January 2022. UK’s rate of inflation at 5.5 per cent in January 2022, was also reported to be the highest after 30 years. One year ago, it had 0.4 per cent inflation rate.

Although as a seasonal factor, the impact of cold winter had its price effects on energy while the rising costs of oil, gas, food and manufactured goods have contributed to the inflation rate. However, it is a difficult judgement to anticipate whether the inflationary pressure would ease after the winter period in the Northern Hemisphere is over by the end of this month. If it is the impact of renewed demand conditions of economic recovery after a long-standing recession, the winter-impact on inflation may not be a significant element.

Inflationary response

Generally, the developed and the developing countries both are now feeling the pinch of rising global inflation, although many of the developing countries have their own problems contributing to their higher inflation rates. Among them, Syria, Lebanon, Sudan and Venezuela have been experiencing over 100 percent rate inflation due to their own internal problems. Argentina, Zimbabwe and Cuba also experienced 60 – 80 per cent of high inflation due to their own internal issues.

The US, Euro area, Japan and UK are important in determining the directions of the world economy this year. They produce about half the world GDP, while the US alone contributes to a quarter of the world economy. Apart from that with greater integration with the world monetary system, their policy decisions are important guidelines for the entire world to shape their policy directions too.

The US, Euro area, Japan and UK are important in determining the directions of the world economy this year. They produce about half the world GDP, while the US alone contributes to a quarter of the world economy. Apart from that with greater integration with the world monetary system, their policy decisions are important guidelines for the entire world to shape their policy directions too.

What are the changes in economic policies that we can anticipate now? If inflation is running too far and too high, then obviously the central banks which have the mandate for price stability would choose to increase their “policy rates”. These are the interest rates affecting short-term lending and borrowing between the central bank and the commercial banks. In an inflationary situation, the central banks tend to increase the policy rates so that borrowing becomes costly. In effect, credit expansion slows down and aggregate demand falls, cooling down the heat in the face of rising interest rates. In a low-inflationary or deflationary situation, the central banks do the opposite (as they all did in the past two years).

But here is a policy dilemma: When countries are looking forward to an economic recovery aftermath of the pandemic, a choice of monetary policy to raise policy rates would undermine the recovery process. Facilitating the recovery through fiscal and monetary policy stimuli is important to ensure incomes and jobs for people. How can a monetary policy retard that outcome?

Federal fund rate

Since mid-2020, the average policy rate of the US – the so-called Fed fund rate – remained as low as 0.25 per cent. Even in the face of rising inflation rate, the US didn’t choose to increase it as it would hinder the recovery process affecting job creation and income growth. As inflation is still on the rise, many are anticipating an increase in the fund rate to 0.5 per cent in March!

For more than five years now, the average policy rate in the Euro area remained at zero per cent. The European Central Bank too has not yet decided to alter its policy rate allowing for economic recovery in the midst of some degree of inflation. As an exceptional case, Japan has been maintaining negative policy rates for long time, while the Bank of Japan will continue to adhere to its ultra-loose monetary policy stance even if its counterparts choose otherwise.

Bank of England adopted a different approach by increasing the policy rate twice – from 0.1 per cent to 0.25 per cent in December 2021 and to 0.5 per cent in February 2022. In fact, the UK also has faced a different issue – the Brexit issue, which happened a year ago, affecting the country’s general prices.

Forthcoming high rates

In the rest of the world, some of the countries have already started raising their policy rates much earlier. Now, the situation is different, as many of them are looking at the US decision over the fund rate to respond accordingly. This is because the US interest rate changes are big enough to create big currents in the world financial flows.

An increase in the US fund rate will result in world financial outflows from the rest of the world towards the US, exerting pressure on both the interest rates and the exchange rates. In order to counterbalance, many of the countries in the rest of the world are keeping an eye on what the US decision would be over its interest rate.

In fact, if the world economy is actually on a recovery path entering a boom period, then both the inflation rates as well as interest rates are on the rise. The irony is that countries which have weaker macroeconomic fundamentals will have a hard time because they would be hit by both – higher inflation rates and higher interest rates.

(The writer is a Professor of Economics at the University of Colombo and can be reached at sirimal@econ.cmb.ac.lk and

follow on Twitter @SirimalAshoka).

Hitad.lk has you covered with quality used or brand new cars for sale that are budget friendly yet reliable! Now is the time to sell your old ride for something more attractive to today's modern automotive market demands. Browse through our selection of affordable options now on Hitad.lk before deciding on what will work best for you!