Columns

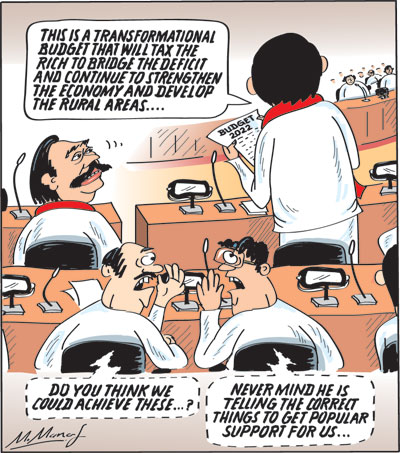

Is the 2022 budget a step towards fiscal consolidation?

View(s): Reducing the fiscal deficit to five percent of GDP by 2025 is of utmost importance for economic stability and growth. Will the 2022 Budget usher in a process of reducing the fiscal deficit towards that goal?

Reducing the fiscal deficit to five percent of GDP by 2025 is of utmost importance for economic stability and growth. Will the 2022 Budget usher in a process of reducing the fiscal deficit towards that goal?

Budget deficit

Although, prior to the 2022 Budget, key officials indicated that the fiscal deficit would be brought down to five percent of GDP, the budget expectation of the deficit is 8.5 percent of GDP.

Even this fiscal deficit would be an achievement owing to the prevailing economic conditions, and the state of public finances, especially the committed expenditures and political compulsions in expenditure.

Targets

Budgetary targets are rarely achieved. Expenditure overruns and revenue shortfalls widen the deficit significantly. As in the past, the fiscal deficit is likely to be double digit owing to government expenditures being much higher than budgeted and revenue shortfalls.

Only recognition

The need for reducing the fiscal deficit has been recognised by the Government and a few measures taken to reduce expenditure and increase revenue. However, there has not been substantial curtailment of expenditure nor comprehensive tax reforms to increase the woefully inadequate revenue to GDP ratio.

Expectation

The 2022 budget expects the fiscal deficit to be reduced to 8.5 percent of GDP from 11.4 percent in 2021.There is however many reasons to doubt that this could be achieved without an adequate reduction in expenditure, on the one hand, and insufficient revenue measures, on the other hand.

Progressive reductions

Progressive reductions in subsequent years to contain the deficit to around five percent of GDP by 2025 could stabilise the economy and be conducive for economic growth. However, such expectations are rather unrealistic in the current state of public finances and incapacity to curtail expenditure.

Reduction

In reality the reduction of the budget deficit is almost entirely dependent on increased taxation. The reduction of expenditure is mostly cosmetic. For example, the reduction in the petrol allowance of ministers and officials is such an instance. Other measures too like extending the number of years and Parliamentarian should be in parliament to receive a pension from five to ten years will hardly reduce expenditure.

State enterprises

State enterprises

The Finance Minister identified two areas where expenditure could be reduced. These were the huge losses of state owned enterprises (SOEs) and expenditure on Samurdhi.

SOEs

The huge losses of SOEs are a severe burden. However the Budget did not indicate how these would be reformed. Will they be privatised? Will they be made private sector state partnerships? Will they be privatised? Without any indication of what the reforms would be, the reduction of losses in SOEs is unlikely.

Samurdhi

Similarly, studies have shown that most Samurdhi beneficiaries are not the needy and the needy are not beneficiaries. In addition, the administrative costs are disproportionate and benefit supporters. Reducing Samurdhi expenditure is unlikely for these reasons.

Politics

Both these policies cannot be reformed owing to the political disadvantages of such reforms. They are severe hindrances to reducing the fiscal deficit.

Taxation

Prior to the budget there were expectations of comprehensive changes in taxation such as an imposition of a wealth tax. There were no such radical changes to increase revenue, only a few “once and for all” taxation measures.

Tax measures

A significant change in taxation was the imposition of a 12 percent surcharge on companies that had made profits of above Rs. two billion in 2020.This was to some extent a reversal of the tax benefit granted to the corporate sector in the 2021 Budget when the tax threshold was increased significantly. The estimated revenue is likely to be achieved as it is a retrospective tax.

Retrospective taxation

However, such retrospect taxes are considered bad taxation measures as they render the country’s tax system uncertain and unpredictable. It is another disincentive to foreign investment.

Banking and finance

The tax of 12 percent on profits of banks and finance companies on their 2020 profits should yield the expected revenue. Although they are not expected to pass on this cost to customers, they are likely to adjust their interest rate policies to garner profits. There is also an issue as to whether this would have an adverse impact on their capital adequacy ratios requirement by the Basle requirements.

Conspicuous omission

The Budget was conspicuous in its omission of any reference to the external finances of the country. It was no doubt a contrived omission as there could have been no good news for the Government members to thump on the benches.

Nevertheless, the perilous state of the country’s external reserves at only US$ 2.3 billion at the end of October is the most serious economic problem.

This omission in the budget is a clear indication of a lack of a strategy to resolve the problem. The Finance Minister wisely left the external finances in the hands of the Central Bank, whose optimistic expectations of international assistance are yet to materialise.

Summary

The “strategy” adopted in the Budget to reduce the deficit has been one of increasing revenue rather than reducing expenditure. There is a good rationale for this. Much of government expenditure is committed expenditure and there is no scope for their reduction. For instance, the expenditure on salaries, pensions and debt repayment absorbs the entirety of government revenue.

Summing up

Once again next year’s Budget has demonstrated the inbuilt rigidities and difficulties of reducing government expenditure, as well as the lack of a political motivation to reduce unproductive and wasteful expenditure. The increase in defence expenditure and funds for provincial councils are clear items of such expenditure.

The budget has also made cosmetic and insubstantial expenditure cuts such as on the Government’s petrol allowances to ministers and officials that would not make any significant dent on government expenditure.

Some of the revenue proposals to tax super profit making companies, banks and finance companies may yield increased revenue. However, there has not been a significant tax reform to ensure a more progressive taxation of the rich who evade and avoid taxation. Higher indirect taxes on the consumption of the rich, such as taxes on luxury vehicles and property are missing.

Conclusion

There is a conspicuous absence of substantial measures to reduce government expenditure or increase government revenue. The Budget for 2022 is hardly a step in the right direction. Fiscal stability for economic growth remains a mirage.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment