Columns

Are we at a turning point in economic diplomacy and economic policies?

View(s): Recent events, diplomatic developments and foreign investments are indicative of a shift in the country’s foreign policy, foreign economic dependence and perhaps of economic policies. The unfolding of events in the next few months will reveal whether there have been changes in these pivotal issues.

Recent events, diplomatic developments and foreign investments are indicative of a shift in the country’s foreign policy, foreign economic dependence and perhaps of economic policies. The unfolding of events in the next few months will reveal whether there have been changes in these pivotal issues.

Important events

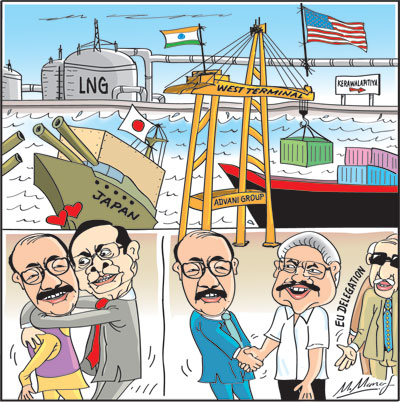

Several events that occurred last week were of significance for the country’s economy. Among these the visit of Shri HarshVardhanShringla, the Indian Foreign Secretary, was perhaps the most significant. The Japanese war ships in the Colombo port and the European Union (EU) team to review the country’s efforts to improve human rights in order to determine the continuation of the GSP plus concession were the other events of significance.

Foreign investments

As significant for the country’s international relations and economic development was the Advani group’s 51 percent stake in the Colombo Port’s West Terminal and the American company New Fortress investment of US$ 250 million in the Kerawalapitiya LGN gas project.

Shift in policies?

Are these developments indicative of a shift in foreign and economic policies towards India and the West? Has there been a tilt towards India and perhaps QUAD: The four-member alliance between Australia, US, Japan and India. Is the dependence on China diminishing?

Assurance to China

President Gotabaya Rajapaksa was quick to give China an assurance that these ties will not be a threat to the security of China. Nevertheless, these are important development in foreign policy of significance to the economy.

Indo-Sri Lankan economic cooperation

The Indian Foreign Secretary’s visit was not a courtesy call or a sightseeing visit of Colombo, Kandy, Trincomalee and Mannar, As Indian commentators have noted it has been to deepen Indo-Sri Lankan economic cooperation, revive Indian development projects in Sri Lanka that have made little progress, identify new economic opportunities and perhaps assist Sri Lanka’s foreign currency reserves that were discussed.

Foreign investments

Foreign investments

The two recent foreign investments in the Colombo Port and the LNG gas plant have important implications. The Government has apparently decided that the country is in dire need of foreign investments from whatever quarter it comes and will face trade union and other political pressures to implement these two projects that are Indian and American investments.

The two projects

The Indian Advani Group of companies will invest US$ 500 million in the joint venture to develop the Colombo Port West Terminal and an American company, New Fortress will invest another US$ 250 million investment in the Kerawalapitiya LNG gas power plant. The interesting question is whether these are signs of other Indian and American investments.

Despite opposition

The Government faces severe trade union and other opposition to these projects. However, they are fait accompli and the Government is determined to resolve the opposition in their own way.

The Government appears to have taken the view that these foreign investments are vital of the country’s development and cannot be blocked by opposition from even its constituent parties.

New approach

This new bold approach could result in many more foreign investments, especially from India. Has the Government’s bias towards Chinese investments changed or is it that the weakening of the Chinese economy restrains their foreign investments abroad?

World Bank

The Government has also signed an agreement with the World Bank for US$ 500 million to improve rural roads and infrastructure. Although these funds would not be dispersed at once and there would be an import component when work begins, they would offer temporary relief to the low external reserves.

Reflections on these developments

The developments discussed above when taken as a composite picture indicate several significant changes in policy. Perhaps,there has been a change from an ideological to a more pragmatic stance.

The Sino-Sri Lankan economic dependence appears to be weakening. Two factors are likely to have influenced this shift. First, China’s capacity to assist Sri Lanka, especially her foreign currency problem, is limited by her own developing financial crisis. Its currency swap in Yuan was useful to import essential items, but limited in its use as a foreign reserve and had to be repaid in US$.

Significant realisation

Even more significant was the realisation that Sri Lanka’s markets were in Europe and North America. Any restriction in these markets would be suicidal. Therefore, there is a need to placate these countries.

The earlier approach by this Government was to ask the UNHRC to not interfere in Sri Lanka’s internal affairs and that the country will ensure human rights by domestic instruments. The new approach was to assure UNHRC that weaknesses in human rights would be addressed in the near future. This was a reversal of the earlier haughty approach.

The reason for the change in approach was the belated realisation that the economy could not face the withdrawal of the GSP plus concession or trade sanctions by the EU or the US and North America that were the country’s main export markets.

The decision to sign agreements with Indian and American firms was based on the conviction that the country’s development was not possible without foreign investments and foreign technology. This implies that the Government would seek similar investments from India and western countries in the near future.

Final thought

Has the Government arrived at a turning point in its foreign investment policies that will shift its economic policies towards India and the West? Will the country drift away from her reliance on Chinese financial assistance and investments? Is there such a shift in economic policies? Only time will tell.

Leave a Reply

Post Comment