Columns

Dwindling foreign reserves, widening trade deficit and deteriorating balance of payments

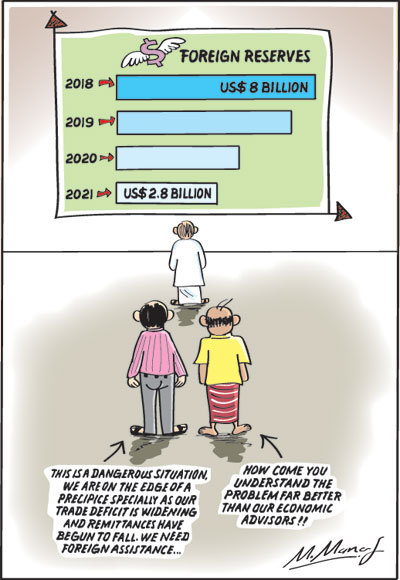

View(s): The nation’s external finances are in a perilous state. At the end of the first seven months, foreign reserves had fallen to US$ 2.8 billion, the trade deficit has expanded to US$ 4.9 billion and the balance of payments deficit widened owing to net capital outflows and lower remittances in recently.

The nation’s external finances are in a perilous state. At the end of the first seven months, foreign reserves had fallen to US$ 2.8 billion, the trade deficit has expanded to US$ 4.9 billion and the balance of payments deficit widened owing to net capital outflows and lower remittances in recently.

Downgraded

This state of external finances has made international rating agencies downgrade the country risk to ccc- status. The implication of this is that Sri Lanka’s borrowing rate for International Sovereign Bonds (ISBs) has sky rocketed, like the erstwhile Greek Bonds. They are at exorbitant interest rates of nearly 50 percent.

Solution

How do we resolve the problem of inadequate foreign reserves to meet essential import expenditure when the trade deficit is widening and the balance of payments is deteriorating? How will the country escape the impending external financial catastrophe?

Economic facts

First let us look at the facts. The foreign reserves have been depleting from about US$ six billion at the end of 2018 to US$ four billion at end 2020. After the repayment of foreign debt obligations in March this year, reserves fell to US$ three billion at the end of April 2021. It has been declining since then to US$ 2.8 billion in July. Foreign reserves are estimated to be about US$ 2.3 billion at present.

Trade balance

The balance of trade is a key factor determining the external reserves. Despite stringent import controls, the trade deficit has been expanding from March to July 2021. At the end of July the trade deficit had widened to US$ 4.7 billion. This is a serious drain on the low foreign reserves.

Increased imports

What is surprising is that despite severe import controls, the trade deficit widened entirely due to increased imports. Increased expenditure on fuel, due to higher international oil prices, expenditure on COVID related medical imports and essential raw materials for industry explain increased import expenditure.

This trend in import expenditure is likely to continue as there is a large pent-up demand for imports of essential food and intermediate goods that will impact adversely on the trade balance.

Reduction in food and tea production due to the ban on chemical fertiliser, weedicides, fungicides and insecticides could increase food imports and reduce tea export earnings later this year. Organic fertiliser imports would add to the import bill.

Increased exports

Increased exports

In contrast, the country’s exports have expanded this year from US$ 5.5 billion in the first seven months of last year to US$ 5.8 billion during the same period this year. This increase in export earnings of 24 percent was due to both agricultural and industrial exports increasing.

Trade deficit

Regrettably, increased exports have not been adequate to offset the increase in imports. Although earnings from exports increased during the first seven months, expenditure on imports increased at a faster pace, causing the trade deficit to widen to US$ 4.9 billion by end July 2021. While export earnings increased by 23.7 percent,import expenditure increased by as much as 30.7 percent.

Import expenditure

The increase in import expenditure was in consumer goods, intermediate goods and investment goods. Despite import controls in place, import expenditure from January to July 2021 amounted to US$ 11.73 billion, compared to US$ 8.97 billion in the first seven months of 2020.

Import controls

Further, import controls are not the appropriate policies. They may affect export production adversely by the unavailability of raw materials. They will of course affect basic living requirements, as has already happened. An increased in exports is the long term solution.The immediate need is a solution to the country’s depletion of foreign currency.

Solution

The weaknesses in the external finances reflect the weak economic performance and defective economic policies. The persistent balance of payments difficulties are a fundamental economic and structural problem that can be resolved only by economic reforms.

These were discussed in last Sunday’s column on resolving the country’s external reserves and balance of payments problem.

Urgent solution

What is the means of resolving the current crisis in foreign reserves that is urgent and imperative? The country is at the edge of a precipice when an immediate solution must be found to resolve the inadequacy of foreign currency.

Three options

The three options to prevent a disaster are, borrowing in the international capital market by issuing fresh ISBs, financial assistance from friendly countries by various currency and loan arrangements and seeking assistance from the IMF to restructure the debt and obtain balance of payments support.

International borrowing

The first option of borrowing in the international capital market is not feasible owing to the country’s high risk rating. Sri Lankan ISBs would be marketable at exorbitant interest rates. Apart from the impracticality of such borrowing, the crushing burden of debt escalation would be unbearable.

International assistance

The second option of seeking finances from friendly countries has been tried, been partially successful, but inadequate. We have obtained currency swaps from India and Bangladesh and a Yuan loan that could be used for Chinese imports. These have been useful to tide over difficulties, but inadequate to meet the critical shortage of foreign currency.

Prospects

The prospect of obtaining adequate foreign assistance is bleak. Much financial help was expected from China. The growing financial crisis in China that might trigger off a global financial crisis makes such assistance highly unlikely.

A third option

This leaves us with the third option of obtaining balance of payments support and an extended facility from the International Monetary Fund (IMF). This is the only realistic and feasible solution.

The gravity of the situation and the unavailability of an alternate means of resolving the crisis will compel the government to turn to the IMF, as it has done on about 15 previous occasions.

IMF facility

An IMF facility has several advantages for the country. The funds are at a low rate of interest and repayable over a long period of time. Entering into an arrangement with the IMF builds international confidence in the Sri Lankan economy that would upgrade the country by rating agencies. This and renewed confidence in the Sri Lankan economy would enable the Government to sell ISB’s at a lesser premium, if needed.

Reluctance

The Government has repeatedly said it would not go to the IMF for assistance. This reluctance is owing to the conditions that the IMF would impose on the country. These conditions are well-known. They are principles of good economic management and structural reforms vital for the country’s economic stability and growth.

Finally

However much the advisors of the government say they will not go to the IMF, It will. If not, the consequences are too bleak to contemplate.

Leave a Reply

Post Comment